Markets | E&P | Infrastructure | NGI All News Access

U.S. Adds Two Natural Gas Rigs as BHGE’s Overall Count Steady

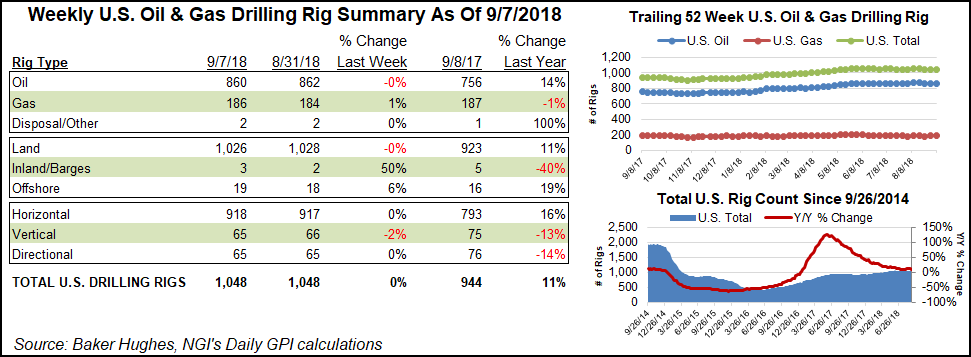

The United States added two natural gas rigs for the week ended Friday (Sept. 7) as the departure of two oil units held the overall domestic count flat at 1,048, according to data from Baker Hughes, a GE Company (BHGE).

The domestic drilling tally saw a net gain of one horizontal unit, offsetting a net loss of one vertical. Two land units packed up, while one returned to the Gulf of Mexico and one came back to inland waters, according to BHGE.

The U.S. rig count finished the week 104 rigs above its year-ago tally of 944.

In Canada, 24 rigs exited the patch for the week, including 18 oil-directed units and six gas-directed. That left the combined North American rig count down on the week to 1,252 but still higher than the 1,146 rigs running at this time last year.

Among plays, the Permian Basin dropped two rigs from its total to end at 484 (382 a year ago). The Cana Woodford dropped one rig to fall to 66 (67 a year ago), with a breakout of BHGE data by NGI’s Shale Daily showing the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties (aka, the STACK) losing one unit for the week to fall to 36 from 49 in the year-ago period.

The Haynesville Shale and Mississippian Lime each dropped a rig for the week, while the Denver Julesburg-Niobrara formation and Williston Basin each added one rig, BHGE data show.

Among states, Louisiana picked up three rigs on the week to grow its tally to 58 (65 a year ago), while Wyoming added two rigs to reach 31, improving on its year-ago tally of 25.

New Mexico and Oklahoma each saw two rigs exit the patch. Alaska added one rig for the week, while Kansas and Utah each fell by one.

Management for both U.S. onshore well completions expert Keane Group Inc. and Halliburton Co. acknowledged during the recent Barclays CEO Energy-Power Brokers Conference in New York City that activity has been lower than predicted in 3Q2018.

Halliburton CEO Jeff Miller repeated what he said during a second quarter conference call about near-term issues impacting North America, which include a shortage of pipeline takeaway capacity, particularly in the Permian, along with rising inflation, labor shortages and logistics issues to get equipment where it needs to be.

“For example, regarding pipeline takeaway in the Permian Basin, some operators will reallocate capital to other basins, some will slow down, others will build DUCs,” aka drilled but uncompleted wells, Miller said. “In Appalachia, producers exhausted their 2018 budgets early, “followed by a reevaluation…Some customers are choosing to do more work while others decided to stop or slow down.”

During the same conference, EOG Resources Inc. CEO Bill Thomas said he believes takeaway issues in the Permian will cause growth to slow temporarily, and the slower pace of development should help ensure that commodity prices don’t collapse.

“Our view as an industry for the Permian is probably a little bit more subdued on growth than most people would have it,” Thomas said. “It will grow certainly for the next few years, but it will grow at a slower pace every year. And it won’t be the thing that’s going to destroy oil prices again because it’s going to grow so fast and grow oil.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |