Natural Gas Bears Tighten Grip as Storage Matches Expectations; Waha Cash Up Again

Natural gas futures couldn’t break from a recent run lower Thursday as weekly government storage data confirmed expectations and allowed the bears to tighten their grip on the market. Spot prices fell across the East Coast with recent heat waning, while West Texas basis continued to strengthen; the NGI National Spot Gas Average dropped 11 cents to $2.67/MMBtu.

The October Nymex futures contract settled 2.3 cents lower at $2.772 Thursday after trading within a narrow band from $2.765 to $2.797. November settled 2.2 cents lower at $2.791, while January stayed on the wrong side of $3 from the bulls’ perspective, giving up 2.1 cents to $2.974.

The Energy Information Administration (EIA) reported a 63 Bcf build into Lower 48 gas stocks for the week ended Aug. 31, a number that fell in line with estimates.

Nymex natural gas futures, which were coming off a steep decline over the previous two sessions, registered a muted reaction to the news, trading either side of $2.780/MMBtu.

The 63 Bcf injection compares to a five-year average 65 Bcf build and a 60 Bcf build recorded in the year-ago period. The EIA figure came in just above major surveys that had pointed to a build in the low 60s Bcf; Intercontinental Exchange EIA Financial Weekly Index futures settled at 64 Bcf a day earlier.

“It was a slow natural gas trading day after more activity earlier in the holiday-shortened week, as EIA data came in right in line with expectations and we have begun to see just enough tightening at these lower price levels to firm up support without seeing many bullish catalysts at all,” said Bespoke Weather Services. “In the end, the October natural gas contract traded in just a 3.2 cent range” Thursday, “getting a touch of support from elevated cash prices” in the morning before falling on EIA data that “confirmed the loosening we observed last week” as expected.

Bespoke said there’s still a good chance that support around $2.75 gets tested before the weekend, given the potential for spot prices to weaken “as much cooler weather moves across much of the country and a strip that is still quite weak.”

Total working gas in underground storage as of Aug. 31 stood at 2,568 Bcf, 590 Bcf below the five-year average and 643 Bcf lower than year-ago levels, according to EIA.

By region, the South Central posted a net withdrawal for the week, thanks to 5 Bcf pulled from salt, offsetting 4 Bcf injected into nonsalt. The Midwest posted the largest net injection at 32 Bcf, followed by the East, which saw a build of 22 Bcf. The Mountain and Pacific regions each injected 5 Bcf, according to EIA.

With summer heat evaporating, bulls will likely have to turn to storage deficits for inspiration as they await the first blast of winter. But production growth seems to have erased any market fears associated with the prospect of lean end-of-season stockpiles.

In fact, based on recent production levels, the market can just shrink the yawning storage deficits during the winter, according to analysts with Jefferies LLC. The firm said August U.S. natural gas production averaged 81.9 Bcf/d by its count, 1.3 Bcf/d higher sequentially and up 9.5 Bcf/d from a year ago.

“Growth has continued into September, with production averaging just over 83 Bcf/d for the first six days of the month,” the Jefferies analysts said. “Production has increased significantly this summer, driven by gas-focused plays, with the Marcellus up 1.8 Bcf/d since May and the Haynesville up 0.7 Bcf/d.

“…With only eight weeks remaining in the refill season, we expect to enter November at around 3.4 Tcf (about 330 Bcf, or 9%, below average),” the analysts said. “Given the rapid supply growth that has occurred this summer, we believe that the storage deficit can easily be reduced further in the winter. Assuming five-year average withdrawals, we estimate that production would need to average around 7.0 Bcf/d higher year/year for storage to reach the five-year average of around 1.7 Tcf by the end of March. This level of production would imply a winter average of just 83.3 Bcf/d, 1.4 Bcf/d higher than the August average and roughly in line with the new recent daily high.”

Turning to the spot market, prices tumbled across the East as forecasts called for recent heat to dissipate heading into the weekend.

After one more day of highs in the 90s along the East Coast Thursday, temperatures were expected to drop into the 70s and 80s Friday “as a cool front arrives after pushing across the Ohio Valley,” NatGasWeather said in its one- to seven-day outlook. “It will be warm and wet over the Plains and east-central U.S. as moisture and remnants from” Tropical Storm Gordon contribute to “widespread showers and thunderstorms.

“Numerous weather systems will impact the country this weekend with highs in the 70s and 80s besides the far southern U.S. and portions of the West for lighter demand,” the firm said. “However, high pressure will re-strengthen next week with 80s to lower 90s gaining ground back.”

In the Northeast, Transco Zone 6 New York dropped 22 cents to $2.81, while further south Transco Zone 5 gave up 18 cents to $2.92. Appalachian prices followed suit, with Dominion South sliding 12 cents to $2.46.

Locations in the takeaway-constrained Permian Basin region continued to rebound Thursday from depressed prices a week earlier. Waha added 27 cents to average $2.29 Thursday, trading within 60 cents of Henry Hub, which fell 7 cents on the day to $2.87.

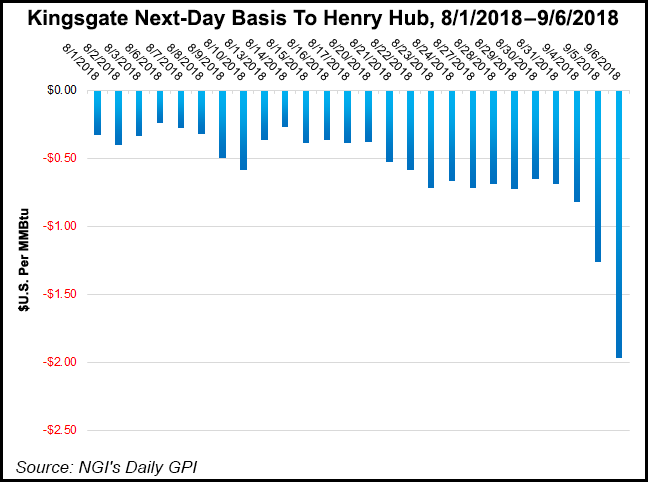

That’s a far cry from last week, when Waha cash basis on average widened to as much as minus $1.69. Waha spot gas is also trading at a substantial premium to its September bidweek average of $1.29.

The gains this week have coincided with some maintenance events in the region impacting the El Paso Natural Gas (EPNG) system, including a force majeure at the Puckett Compressor Station in West Texas affecting intra-Permian flows.

EPNG also issued an operational flow order Wednesday related to scheduled maintenance on the Washington Ranch storage facility in New Mexico. The operator lifted that order Thursday morning.

NGI’s Patrick Rau, director of strategy and research, has pointed to slower drilling and completions activity in the Permian and a regional storage deficit going into the shoulder season as possible factors contributing to improved pricing in West Texas this week.

As of Aug. 31, South Central storage stockpiles totaled 799 Bcf, well below the 1,065 Bcf in the ground a year ago and five-year average inventories of 1,036 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |