Infrastructure | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Bouncing Back, BHGE U.S. Rig Count Climbs by Four

Drilling activity in the United States rebounded on Friday modestly from a steep drop one week earlier, picking up four rigs to finish at 1,048, according to data from Baker Hughes, a GE Company (BHGE).

After adding two gas-directed rigs and two oil-directed rigs for the week, the United States is outpacing its year-ago tally by a little more than 100 units.

Three directional rigs and three vertical rigs returned to action for the week, while two horizontal units packed up. Three rigs were added on land, along with one in inland waters. The Gulf of Mexico finished flat for the week at 16 rigs, according to BHGE.

Canada saw a net loss of one rig for the week as two oil units departed, offsetting the addition of one gas-directed. Canada finished the week at 228 rigs, up from 201 a year ago. The combined North American rig count finished at 1,276, versus 1,144 at this time last year.

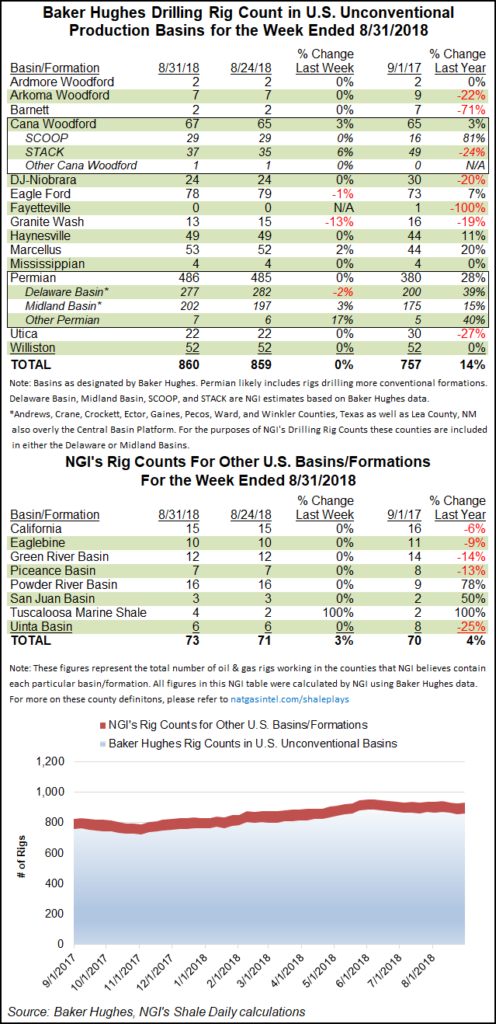

Among plays, the Cana Woodford posted the largest net gain for the week at two, finishing at 67, just ahead of its year-ago tally of 65. A more detailed breakdown of BHGE data by NGI’s Shale Daily indicates the two rigs added went to work in the STACK (aka, the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties), with the the SCOOP (South Central Oklahoma Oil Province) finishing flat week/week.

Meanwhile, the Marcellus Shale and Permian Basin each picked up one rig for the week to end at 53 and 486 active units, respectively. The Granite Wash saw two rigs pack up shop, while one exited the Eagle Ford Shale.

Among states, Louisiana and Pennsylvania each added one rig for the week, while New Mexico and Oklahoma each saw a net decrease of one rig. Kansas saw one rig go to work, the only active rig in the state as of Friday, according to BHGE.

The Lone Star State, home to a large portion of the U.S. onshore’s most active play, the Permian, saw its oil and natural gas output in June retreat from a year ago and month/month, with production at the lowest level in 16 months, according to preliminary data by Texas regulators.

The Railroad Commission of Texas production report for June, issued late Thursday, said combined crude oil and condensate output fell to 98.8 million bbl from 101.32 million bbl in June 2017 and from May 2018’s total of 106.48 million bbl.

Combined, natural gas well and casinghead gas also fell from a year ago to 615.21 MMcf from 661.54 MMcf, and output declined from 663.88 MMcf reported in May. Crude oil/condensate production in June was the lowest reported since February 2017, when output totaled almost 92.01 million bbl. Gas well/casinghead gas also hit a low not seen since February 2017, when production was 603.97 MMcf.

Meanwhile, Ohio unconventional oil production bounced back in the second quarter, reaching 4.5 million bbl, an 11% increase from the year-ago period, according to data released by the Ohio Department of Natural Resources (ODNR). Oil volumes were also up from 1Q2018, when they came in at 3.9 million bbl.

Oil production has fluctuated over the last several quarters, reflecting a broad shift to dry gas production that occured about two years ago across much of the Appalachian Basin when oil prices were lower. But operators have returned to wetter areas in Ohio and elsewhere in the basin, stoked by higher oil prices.

Unconventional natural gas production, meanwhile, continued to climb, setting a new record. ODNR said. Driven by the Utica Shale, gas production was 554.3 Bcf in the second quarter, up from 389.7 Bcf in the year-ago period and 531.3 Bcf in 1Q2018.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |