EIA Shocks With 70 Bcf Injection; Natural Gas Futures Too Stunned to React

The Energy Information Administration (EIA) reported a 70 Bcf injection into storage inventories for the week ending Aug. 24, well above market consensus of a mid-60 Bcf build.

The Nymex October gas futures contract, which took over the prompt-month position on Thursday, had a fairly muted reaction to the surprisingly bearish injection, slipping only nine-tenths of a cent to $2.854 just after the EIA print hit the screen. By 11 a.m. ET, the prompt month had moved back up to $2.863, flat with Wednesday’s settle. The rest of the futures curve through the March 2019 contract had a similar response to the inventory report.

The net of the last two weeks yields a better reading of balance, according to Bespoke Weather Services, which had projected a 66 Bcf build. Given the miss, however, this indicates “weekly noise” in EIA data may be playing a role in these misses.

“This print confirms much of the demand-side loosening we observed last week that appears to have carried into this week, and also reflects the recent surge in production,” Bespoke chief meteorologist Jacob Meisel said.

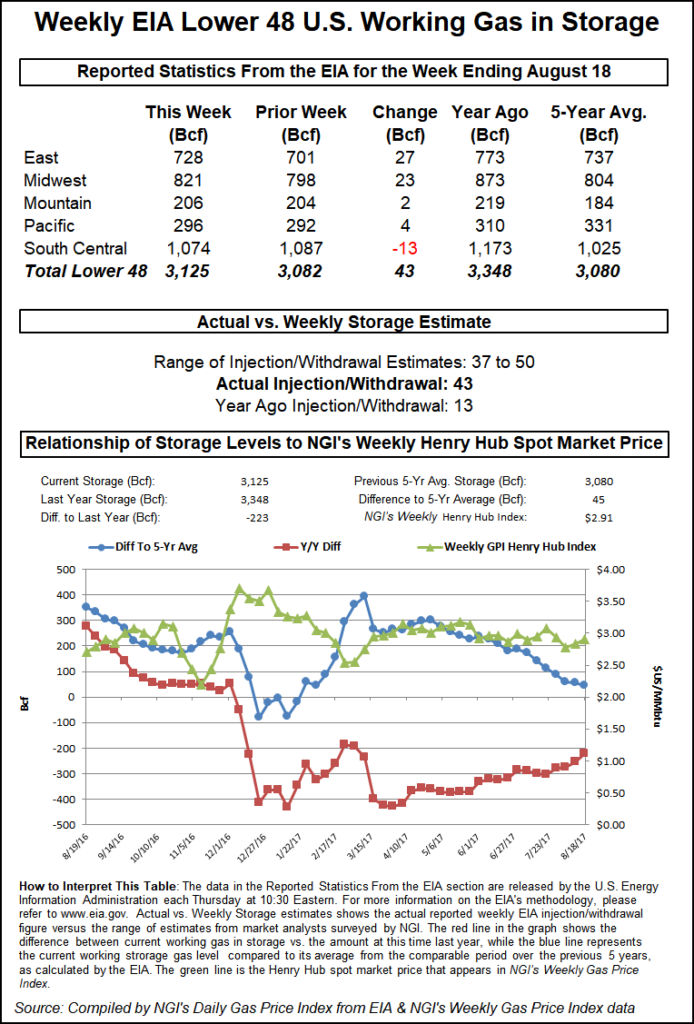

The 70 Bcf build was significantly larger than both last year’s 32 Bcf build for the week, and the five-year average injection of 59 Bcf.

Traders scoured the EIA data to find the missing link that caused the discrepancy between the estimated storage injection and the actual print. The Midwest region appeared to be culprit as mild temperatures and low humidity led to a 6 Bcf increase in injections week/week.

Broken down by region, the EIA reported a build of 35 Bcf in the Midwest, 27 Bcf in the East, 4 Bcf in the Mountain, and 2 Bcf each in the Pacific and South Central regions. Inventories as of Aug. 24 stood at 2,505 Bcf, 646 Bcf below last year and 588 Bcf below the five-year average.

As for price action for the rest of Thursday trading, Meisel said hotter weather forecasts should firm up $2.80-2.82, but “this print should increase $2.88-2.90 resistance as well and keep risk lower into the weekend.”

Looking ahead to next week’s EIA report (for the week ending Friday), Meisel said that power burns tightened slightly, but Canadian imports returned as well, indicating another loose print is likely.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |