Markets | NGI All News Access | NGI The Weekly Gas Market Report

Barclays Raises Henry Hub Natural Gas Prices on Low Storage, Accelerating Exports

Barclays Capital analysts on Tuesday raised their Henry Hub natural gas price forecasts for the final six months on lower-than-expected storage back-up and the accelerated startup of two Gulf Coast gas export projects by Cheniere Energy Inc.

Gas storage injections and stock levels have been below normal this injection season even with record production, noted analysts Samuel Phillips and Michael Cohen in Barclays’ Gas and Power Kaleidoscope. In addition, Cheniere is eyeing earlier-than-expected liquefied natural gas (LNG) exports from Train 5 at the Sabine Pass export facility in Louisiana, and it could start up the Corpus Christi Liquefaction LLC project in South Texas before year’s end.

Third quarter gas price forecasts were increased to $2.95/MMBtu from $2.91, while fourth quarter prices are expected to average $2.83 from a previous estimate of $2.58.

“The increase in our forecast is related directly to our lowered end-October storage expectations and resultant smaller safety margin at the end of the year, as well an accelerated timeline for start up at Corpus Christi and Sabine Pass,” Phillips and Cohen wrote.

Next year’s Henry Hub gas prices are forecast to average $2.67 on another year of solid production growth.

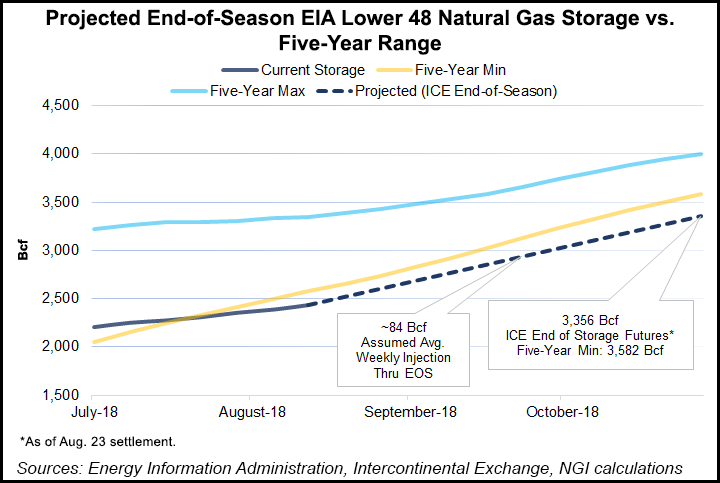

“The market seems largely unconcerned about running short of gas this winter,” said the Barclays analysts. “After ending last winter with the least amount of gas in storage since the 2013/2014 polar vortex, storage injections have been below normal all summer, and show no sign of accelerating.”

Barclays expects storage at the end of October to to about 3.38 Tcf, “as the market appears

content to bank on further production gains to meet demand this winter.”

There’s been a “remarkably nonvolatile market,” said Phillips and Cohen, with prompt New York Mercantile Exchange (Nymex) futures trading averaging in a 40-cent band since February.

“Our end-October carryout would be slightly lower than that of October 2008, and could rival that of October 2005, when twin hurricanes decimated offshore Gulf production and prompt Nymex futures reached about $14,” said Barclays analysts.

The tight storage picture has been countered by a sharp ramp up in Lower 48 gas production this year. Earlier in August pipeline flow estimates showed production levels peaked at more than 82 Bcf/d, which would be a new unofficial record high. The gains in output are from the usual suspects: the Marcellus and Utica shales, and from the Permian Basin’s associated gas.

“Our models indicated that output from these plays is up about 5.5 Bcf/d since last year, or

about 70% of the total Lower 48 increase,” according to the Barclays team.

“Though we think Permian gains will slow into 4Q2018 due to infrastructure constraints, Appalachia is set for further expansion as new takeaway capacity comes online,” including from the 1.7 Bcf/d Atlantic Sunrise, which is slated to begin in early September.

Meanwhile, U.S. LNG exports by Cheniere could expand before the end of the year. Officially, Sabine Pass Train 5 and Corpus Christi aren’t scheduled to ramp before early 2019, but they could begin in 4Q2018, adding upwards of 500 MMcf/d. In addition, Kinder Morgan Inc.’s Elba Liquefaction Project near Savannah, GA, is also slated to start up by year’s end.

Combined, Sabine Pass Train 5, Corpus Christi and Elba Island are slated to boost export demand by about 1.5 Bcf/d when running at capacity, Phillips and Cohen said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |