Markets | NGI All News Access | NGI Data

Break from Scorching Heat Sends Weekly Natural Gas Prices Lower

Natural gas prices for the Aug. 21-27 period moved lower as much of the United States enjoyed mild temperatures ahead of a warm-up expected later this weekend. Most regions saw prices decline less than a dime, although steeper losses were seen in the Rocky Mountains and along the West Coast, which is finally seeing signs of cooler weather ahead. The NGI National Weekly Gas Avg.dropped 12 cents to $2.79.

At the heart of this week’s sell-off was a return to more seasonal weather after repeated bouts of heat, particularly in the Midwest and East. This was thanks to a series of weather systems that brought rain and lower temperatures to those densely populated regions. The West, South and Southeast remained hot during the week, however, a cooler pattern was expected to develop over the West beginning late this weekend, while heat returns to the East.

Hot high pressure was forecast to begin building over the eastern half of the country, with temperatures expected to return to the mid-80s to 100s and setting the stage for strong national demand once again. This same weather pattern, however, was forecast to send cooler weather with spotty rain, high-elevation snow and gusty winds into the West.

“We expect a major shift in the jet stream to develop,” AccuWeather lead long-range meteorologist Paul Pastelok said. The jet stream is forecast to dip southward in the western United States, which would allow cooler air to drain from northwestern Canada and the northern Pacific Ocean.

The most substantial change in the weather is forecast to be across the Northwest, although some cooler and less humid air is also likely to reach parts of California and the Southwest, he said. While temperatures soared into the 90s and even low 100s in parts of the West earlier this month, outlooks showed highs would be slashed by 30-40 degrees in the Northwest. Highs are expected in the 60s and 70s in many of the low elevations and the 40s and 50s over the high country, Pastelok said.

Accompanying the cooler air may be a round or two of cool showers and even some wet snowflakes over the high country of the northern Rockies and perhaps the Washington Cascades, according to AccuWeather.

As for pricing, SoCal Citygate weekly prices plunged $2.46 to $4.84. Malin tumbled 22 cents to $2.55, and Northwest Sumas fell nearly 20 cents to $2.47.

Other Rockies pricing hubs also put up steep decreases. Cheyenne Hub was down 23 cents to $2.38, and Kingsgate was down 22 cents to $2.40.

Outside of the West, prices in the Northeast also posted sharp declines. Algonquin Citygate dropped 48 cents to $2.93, while Tennessee zone 5 200L slid 37 cents to $2.86.

Losses across Louisiana were limited to about a nickel, while Texas prices were mixed due to ongoing heat in the state. Still, most pricing hubs shifted only a few cents on the week. In West Texas/southeastern New Mexico, however, Waha dropped a dime to $1.85.

September Natural Gas Softens Despite Growing Storage Deficit

As for futures action, the Nymex ended the week on a soft note as traders continue to put all their eggs in the production basket. The Nymex September gas futures contract slid 2.3 cents from Monday to settle Friday at $2.917.

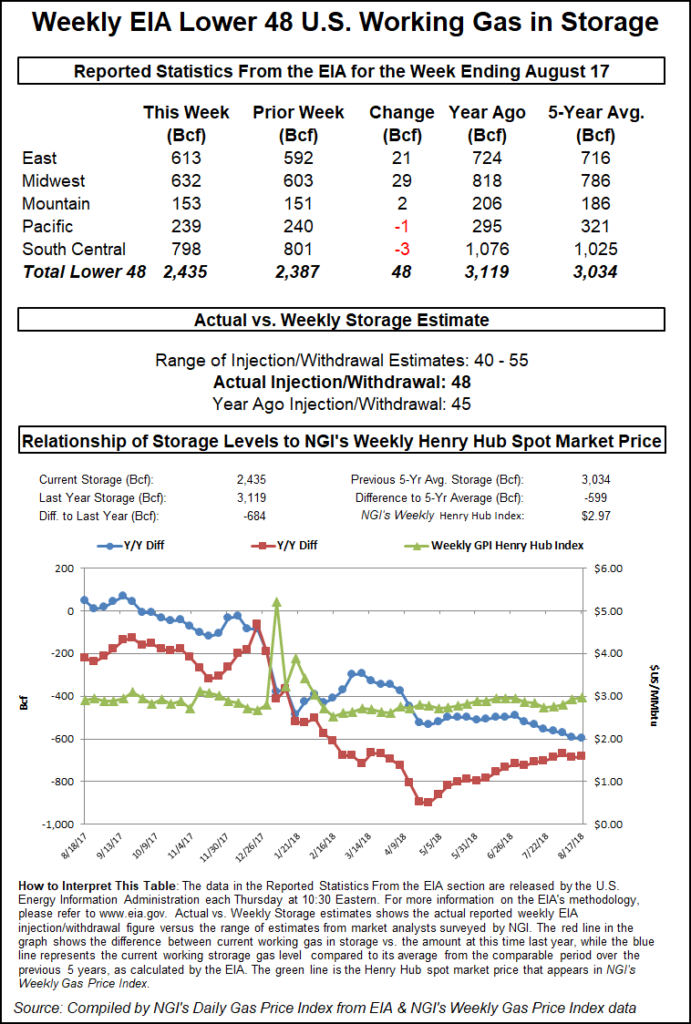

There were signs of bullish momentum during the week. On the storage front, the Energy Information Administration reported a 48 Bcf injection into storage inventories for the week ending Aug. 17. The build lifted gas stocks to 2,435 Bcf, 684 Bcf below year-ago levels and 599 Bcf below the five-year average of 3,034 Bcf, EIA said. The deficit to year-ago storage levels shrank by 3 Bcf, while the deficit to the five-year average grew by 4 Bcf.

Meanwhile, long-range weather forecasts showed hot weather returning to the eastern United States for the end of August/early September, and the expected boost in demand should keep storage deficits in place for a bit longer.

“Weather-adjusted, the market returned to being undersupplied (1.0 Bcf/d) despite U.S. production ramping 600 MMcf/d week/week,” analysts with Tudor, Pickering, Holt & Co. (TPH) said of the latest storage report. “Undersupply is set to persist as warmer-than-normal temperatures remain in the forecast.” Liquefied natural gas exports “remain volatile and the outlook is unclear as U.S.-Chinatrade warchatter continues.

“The storage trajectory implies exiting injection season near five-year minimums,” but approval Thursday by the Federal Energy Regulatory Commission for “in-service of theRover supply lateralsraises the potential for a ramp in U.S. production that “may somewhat mitigate thoughts of a winter pricing spike,” TPH analysts said.

But as the market continues to shrug at large inventory deficits, it could be setting itself up for volatility during cold weather events this winter, Genscape Inc. senior natural gas analyst Rick Margolin said.

“Around mid-July, current-year inventories began setting the low mark for the five-year range, and now stand at their lowest levels for this date since at least 2009,” Margolin said. “Yet, despite the series of small injections reports and persistently low inventories, forward curves for the winter continue to struggle to print even a $3 handle as the market is placing higher confidence on supply growth picking up the slack.”

With 11 weeks remaining in the traditional injection season, it would take a weekly build of 88 Bcf in order to break the 3.4 Tcf barrier, a level which was considered the lower bound of market expectations a few months back, according to Mobius Risk Group. Intercontinental Exchange futures showed end-of-season storage inventories sitting at 3,356 Bcf, more than 200 Bcf below the five-year minimum of 3,582 Bcf. To achieve even this level, weekly injections would need to average 84 Bcf through the end of October.

Average injections during the peak summer months (June to thus far in August) have been about 7 Bcf larger than the corresponding weeks last year. Using that same trend through the end of October would lead to a pre-winter inventory level of less than 3.2 Tcf, Mobius said.

Weather will certainly have a great deal to do with pre-winter inventory levels. Heat intensity through Sept. 6 is forecast to be centered on a Southwest to Northeast path from the Texas Panhandle through the Great lakes region, Mobius analysts said. Although this geographic area historically has been dominated by coal-fired power generation, this summer has seen “parabolic gains” in natural gas consumption when temperatures have verified significantly warmer than normal.

“Over the next six to seven weeks, above-normal temperatures will drive bullish natural gas demand and for the final four to five weeks of injection season, colder-than-normal temperatures will begin to carry the torch for market bulls,” Mobius said.

Still, on Friday, the Nymex September contract lost steam, ending the day nearly a nickel lower as other factors like production and perhaps position squaring ahead of the weekend weighed on prices.

To be sure, Genscape’s SpringRock production forecast is calling for production this winter to add more than 3 Bcf/d above summer’s levels, and more than 6.2 Bcf/d above last winter, Margolin said. “But individual region and field inventories running deficits increases volatility exposure during cold weather events that spike demand and/or trigger upstream supply disruptions like freeze-offs.”

Inventories in the East and Midwest, two of the coldest regions during the winter season, are tracking well below historical levels. As of Aug. 17, stocks were more than 100 Bcf below the five-year average in the East and more than 150 Bcf below the five-year average in the Midwest, EIA data show. The hefty deficits set the stage for increased injection activity in the coming weeks as local distribution companies work to assure adequate supplies ahead of the winter, according to EBW Analytics. This “may help support spot market prices, helping to limit the extent of likely declines in Nymex natural gas futures over the next six to 10 weeks,” CEO Andy Weissman said.

Furthermore, early projections for October suggest warmer-than-normal weather may dent the early-season heating outlook, dampening natural gas demand. It remains possible, however, that early-season warm anomalies may give way to cooler anomalies in latter October, strengthening weather-driven gas demand yet again, he said.

“Still, market confidence with both low storage levels and sub-$3.00/MMBtu gas has been and will continue to be dependent on the narrative of production growth. In our view, the market may target close to 1,350 Bcf in end-of-March storage at the beginning of the injection season, slightly higher than the 2018 low of 1,299 Bcf,” Weissman said.

Although production growth has moved higher in the past two weeks — gaining more than 1.0 Bcf/d in the past two weeks alone according to some pipeline scrapes — “further gains will be necessary this fall to enable Nymex futures to move lower,” he added.

Spot Gas Bleeds Red Ahead of Weekend

Spot gas prices across most of the country continued to lose ground Friday even as hotter weather was in store for parts of the United States in the days ahead. Strong high pressure remained on track to rapidly expand across the eastern half of the country beginning late in the weekend as high temperatures in the mid-80s to 90s were forecast to combine with humidity to return national demand to stronger-than-normal levels, according to NatGasWeather.

Where the data has been cooler is late in the Aug. 27-31 week, in particular across the northern United States, as the forecaster sees the ridge weaken on weather systems tracking across with showers and cooling. The hot ridge is then favored to spring back across most of the country except the West for the first several days of September; this is where the data has reverted back hotter Thursday night and so far Friday.

“We continue to expect the hot upper ridge should rapidly shrink in coverage Sept. 5-10 as shorter days make a more obvious impact,” NatGasWeather said.

While most pricing locations across the United States saw a retreat in prices before the weekend, some Northeast markets posted solid increases due to the incoming heat. Algonquin Citygatejumped 23 cents to $3.12, whileIroquois zone 2moved up 12 cents to $3.09.Tennessee zone 5 200Lwas up 5 cents to $2.94, andTennessee zone 6 200Lwas up 15 cents to $3.03. On the flip side, Transco zone NY and non-NY prices fell more than a nickel.

Meanwhile, Millennium Pipeline updated its maintenance scheduled yet again, pushing back the start date of its planned Wagoner East work to Wednesday (Aug. 29), one day later than its previously revised schedule. All flow estimates remain the same.

Also on Friday, Transcontinental Gas Pipe Line (aka Transco) told shippers that based on its schedule and forecasted progress, it is targeting full in-service for the 1.7 Bcf/d Atlantic Sunrise project to begin as early as Sept. 10. “The in-service date is based upon current contractor schedules and may further be affected by potential weather,” Transco said in a website posting. It plans to provide an additional update on Sept. 5.

Spot gas prices in Appalachia were generally lower, with the largest day/day losses seen atColumbia Gas, which fell 13 cents to $2.66.Dominion Southslid 8 cents to $2.56, andTransco-Leidy Linedropped 7 cents to $2.54.

Regarding FERC’s authorization for Rover to place into service the Burgettstown and Majorsville laterals, it added no additional date requirements to the approvals, which means that the laterals can be expected to come online at Rover’s convenience, which may be as early as Friday (Aug. 24) or rolled out to a convenient contract start date of Sept. 1, according to Genscape natural gas analyst Collette Breshears.

The Burgettstown Lateral begins in southwestern Pennsylvania, where the 400 MMcf/d Energy Transfer Partners LP Revolution (ready for operation) and 200 MMcf/d MPLX Harmon Creek (due in 4Q2018) processing plants are located, “and runs almost due west to a connection with the beginning of the dual Rover mainline,” Breshears said.

Initial expectations for gas volumes on this line are low because of the startup of new processing systems, Genscape said. “While production in the area may improve, our regional production forecast accounts for this growth along with the less-constrained areas to the south and west, and doesn’t predict a sudden increase to overall regional production levels,” Breshears said.

The Majorsville Lateral will connect the 1 Bcf/d Majorsville processing plant in West Virginia to Rover just north of Clarington, Ohio, providing a competing route to Majorsville gas currently delivered to Texas Eastern Transmission and Columbia Gas Transmission. The proposed Iron Bank receipt point would potentially add incremental production onto the line later this year, Breshears said.

In the country’s midsection, Midwestern Gas Transmission (MGT) was scheduled Monday-Thursday (Aug. 27-30) to replace pipe on the mainline north of Carlisle in Sullivan County, IN, that would fully restrict southbound flow through Compressor Station (CS) 2113.

Average flow through CS 2113 has been around 235 MMcf/d for the past 30 days, however, more recently has averaged just 161 MMcf/d, Genscape natural gas analyst Vanessa Witte said. Total demand south of the outage area has averaged 294 MMcf/d during the past 30 days, excluding nominations beginning on Aug. 20 when the outage atSimpsonbegan.

MGT has minimal receipt points south of Carlisle with the exception of Tennessee Gas Pipeline at Portland, which could increase deliveries to MGT to fulfill demand south of the outage area, according to Witte.

This event could also cause nomination reductions at the Scotland Rockies Express Pipeline (REX) interconnect farther north on the mainline, “as this is where MGT sources the majority of its gas,” Witte said.

The REX interconnect experienced a drop of roughly 171 MMcf/d on average during the Simpson outage from Aug. 20-23, according to Genscape.

Midwest and Midcontinent spot gas prices were a sea of red Friday, with losses of less than a nickel at most points in the Midwest and then steeper, double-digit declines in some areas of the Midcontinent.NGPL-Midcontinentwas down 25 cents to $1.98.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |