Infrastructure | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Four Natural Gas Rigs Depart as BHGE’s U.S. Count Tumbles

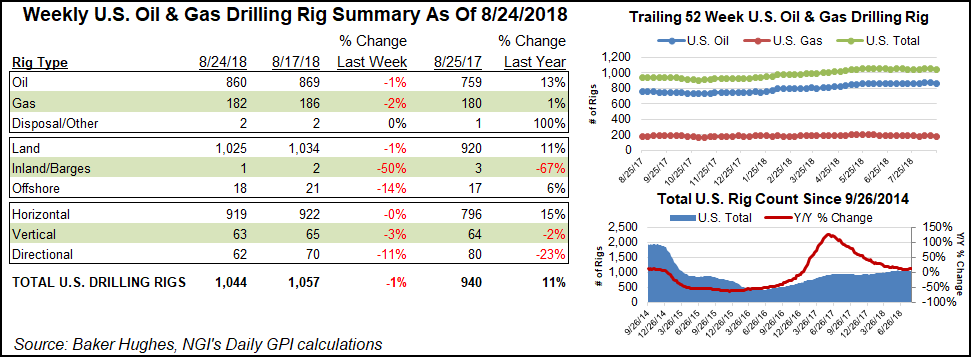

In what drillers may hope is not a sign that their luck has run out, the United States saw 13 rigs exit the patch during the week ended Friday, including four natural gas-directed, according to data from Baker Hughes, a GE Company (BHGE).

The declines also included nine oil-directed rigs, leaving the domestic tally at 1,044 for the week, versus 940 a year ago.

Nine rigs packed up on land, while three departed in the offshore, along with one operating in inland waters. Eight directional units were dropped, along with three horizontal and two vertical, according to BHGE.

Canada upped its tally by 17 to end at 229 for the week (217 a year ago), including the addition of 12 oil units and five gas. That left the combined North American count at 1,273 rigs, up from 1,157 in the year-ago period.

Among states, Louisiana posted the biggest loss for the week at seven rigs, dropping its total to 54 from 66 a year ago. North Dakota followed suit, dropping four units to fall to 52 (flat year/year). Alaska, California, New Mexico, Ohio and Pennsylvania each dropped one rig on the week.

Texas was the lone gainer among states for the week, adding three rigs to hit 528 from 456 a year ago.

Among plays, the Williston Basin dropped four units, corresponding to the declines in North Dakota. In the Northeast, the Marcellus and Utica shales each saw a rig pack up shop to finish at 52 and 22 units, respectively. The Permian Basin also dropped a rig to end at 485.

The decline in Louisiana drilling activity didn’t affect the Haynesville Shale. The gassy play, which underlies Louisiana and East Texas, added one rig for the week to end at 49 from 46 in the year-ago period.

According to North Dakota’s director of the Department of Mineral Resources (DMR), Bakken Shale operators have been “tapping the brakes” on their output on a combination of gas capture issues, weather and a shortage of hydraulic fracturing (fracking) crews.

North Dakota’s most recent production reports indicated that more than half of the 21,000 b/d decrease in crude oil production between May and June was on Fort Berthold Reservation lands, which account for roughly 25% of the Bakken’s production in any given month.

As operators tried to de-emphasize operations where they have the most problems with gas capture, they scaled back production on Fort Berthold, resulting in an 11,000 b/d production reduction in June, according to the DMR.

Meanwhile, no “easy beach days” are ahead in the U.S. onshore proppant sand market, as fierce competition among suppliers, and a slowdown in Permian completions, likely will continue into 2019, according to analysts.

For frack sand suppliers, “fears of the past six-to-12 months appear to be starting,” as volatility remains extreme, said Evercore ISI’s analyst team led by Samantha Hoh. The call for northern white 100-mesh sand in the Permian “has faded quickly and the frack sand market is now oversupplied, with increased competition likely to compress pricing into early 2019.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |