Traders Shrug Off Growing Storage Deficit as September Holds Steady

September natural gas prices ended Thursday in the black (barely) as the latest storage inventory data suggested a less loose supply/demand balance than what some in the market had expected. The Nymex September futures contract settled at $2.964, up eight-tenths of a cent. Spot gas prices, meanwhile, softened once again as cooler weather was expected to linger for a few more days before the next round of heat moves into parts of the country late in the weekend. The NGI National Spot Gas Avg. slipped 6 cents to $2.73.

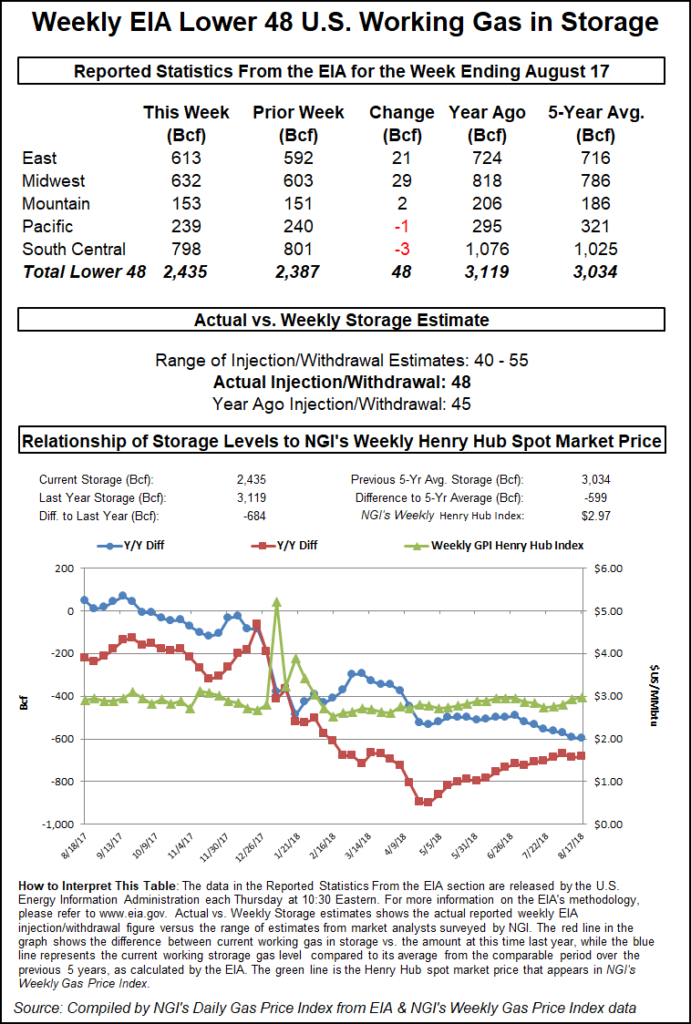

On the futures front, the Nymex September contract opened the session at $2.958, two-tenths of a cent higher than Wednesday’s settle. The market lost a little ground just before the Energy Information Administration’s weekly storage inventory report, which showed a 48 Bcf injection into gas stocks for the week ending Aug. 17.

The reported build was right on target with some market participant surveys, although several estimates clustered around a build in the 50 Bcf range as well.

Broken down by region, the East injected 21 Bcf into gas stocks, the Midwest injected 29 Bcf and the Mountain injected 2 Bcf, according to EIA. The South Central and Pacific regions continued to post withdrawals, pulling 3 Bcf and 1 Bcf, respectively, out of inventories.

As of Aug. 17, stocks sat at 2,435 Bcf, 684 Bcf below year-ago levels and 599 Bcf below the five-year average of 3,034 Bcf, EIA said. The deficit to year-ago storage levels shrank by 3 Bcf, while the deficit to the five-year average grew by 4 Bcf.

Despite a muted initial reaction to the EIA report, the September contract eventually climbed as high as $2.982 before easing again into the close. October was up nine-tenths of a cent at $2.95, and the winter 2018-2019 strip was up slightly more than penny at $3.078.

“There is more and more evidence of very solid structural demand. If there are not multiple 100-plus Bcf injections beginning mid-September, that confirms high demand,” said ION Energy consultant Kyle Cooper.

Indeed, traders agreed that demand was the elephant in the room that much of the market is refusing to talk about, likening it to “fake news.” And with the high-demand winter season around the corner, it remains a mystery why $3 gas remains elusive.

“The print was not quite as loose as expected with a solid draw across the South still, even with less impressive heat,” Bespoke Weather Services said. However, it has seen “marked loosening” so far this week with increased production, liquefied natural gas demand off slightly and weather-adjusted power burns loosening as wind generation has increased.

“This could explain why cash prices finally were able to dip below prompt prices this morning, and lead us to still see resistance as likely firm into next week as we see more bearish risks with next week’s EIA print,” Bespoke chief meteorologist Jacob Meisel said.

Also limiting the momentum for Nymex futures were cooler trends for the Aug. 27-31 week that began showing up in Wednesday’s weather models and remained intact on Thursday. The latest weather data showed a weather system weakening the ridge over the Midwest to allow showers and minor cooling for the loss of a few national cooling degree days, according to NatGasWeather. One weather model was then hotter for Sept. 1-5 with a little stronger ridge covering a vast majority of the country and making for above-normal temperatures. “The hot upper ridge is likely to gradually weaken Sept. 5-10 toward what we would view as a neutral set-up,” the weather forecaster said.

Still, the May-September cooling season is now projected to be the hottest in history, according to EBW Analytics. This follows the coldest April since 1980, “lining up the current injection season as one of the most bullish on record,” EBW CEO Andy Weissman said.

But the steep storage deficit isn’t just because of weather as other demand drivers are also growing, Cooper said. “Yes, production is surging, but so is demand, and it’s not all temperatures.

“I don’t care about supply. I don’t care about demand. I care everything about the difference between the two, and that is storage.”

Mild Temps Lead To More Losses For Spot Gas

Spot gas prices were lower across most of the country as national demand was expected to be lighter than normal through Friday as comfortable daytime highs in the 70s to lower 80s were forecast to cover much of the Midwest, Mid-Atlantic and Northeast, according to NatGasWeather. There’s also a weather system over the Plains with showers and cooling, leaving only the western and southern United States with hot conditions.

Hot high pressure remains on track to rapidly expand across the eastern half of the country this weekend into next week where highs are forecast to reach the mid-80s to 90s over most regions except the West. Heat and humidity are also expected to remain over the South and Southeast, with temperatures soaring into the 90s and making for strong late summer national demand, the weather forecaster said.

“Where the data has been a touch cooler is late next week across the Midwest, seeing the ridge weaken just enough for a weather system to sneak across with minor cooling,” NatGasWeather said.

SoCal Citygate continued to post dramatic declines as heat begins to subside in the region. Next-day gas dropped 93 cents to hit $3.99. Other western pricing hubs softened as well. Malin was down 12 cents to $2.40, and PG&E Citygate was down 4 cents to $3.30.

In the Rockies, CIG dropped 8 cents to $2.31, while Opal tumbled 17 cents to $2.34.

Midcontinent regional prices less than a nickel on average, with OGT slipping just 1 cents to $1.83. Midwest prices were down just a penny on average.

In the Northeast, Transco zone 6 NY next-day gas was down 12 cents to $2.85, while Tennessee zone 5 200L next-day gas jumped more than 10 cents to $2.89.

Benchmark Henry Hub spot gas traded at $2.965, a hair above the Nymex September settle.

In other market news, FERC on Thursday authorized Rover Pipeline LLC to place its Burgettstown and Majorsville laterals into service. The in-service authorizations come after Rover on Monday provided the Federal Energy Regulatory Commission with a detailed timetable of its efforts to repair slips along the routes of the Majorsville and Burgettstown lines, where the operator has encountered erosion control setbacks.

In a note Thursday published prior to the authorizations, Genscape analyst Colette Breshears said “there have been some indications lately that Rover’s relationship with FERC has improved with several good-faith efforts, which may make placement of new laterals into service less onerous. After FERC approves the Burgettstown and Majorsville laterals, Rover will need to again ask permission to bring on” Sherwood and CGT, “which are still in late construction stages and/or in the process of remediation.

“While Rover has seemed somewhat less concerned with bringing the Sherwood Lateral into service,” Antero Resources Corp. officials said they were “counting on it being online in their 4Q2018 plans, which suggests that Rover will be pursuing approval in the next few months.”

The timing of the start-up of Rover’s Majorsville and Burgettstown lines does not impact Genscape’s production forecast for the region, according to Breshears.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |