E&P | NGI All News Access | NGI The Weekly Gas Market Report

AMLO Administration Considering Natural Gas-Only Bid Rounds, Says CNH Official

Mexico’s next government may conduct bid rounds aimed solely at boosting natural gas production, according to an official from the Comisión Nacional de Hidrocarburos (CNH).

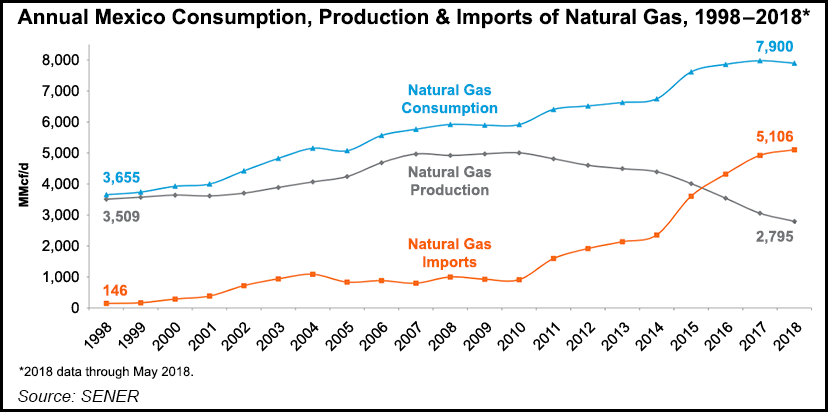

Speaking on an afternoon panel on Wednesday at EnerCom’s The Oil & Gas Conference in Denver, CNH’s Oscar Roldan said “85% of the natural gas that we consume in Mexico is coming from the U.S., so what they are putting on the table is [to] probably do some specific bid rounds for just natural gas, to try to see if we can cut that number by half at least in the next probably four [to] six years.”

Roldan, who heads CNH’s Centro Nacional de Información de Hidrocarburos (CNIH), was responding to the question of whether leftist President-elect Andrés Manuel López Obrador would continue with the outgoing administration’s 2014-2019 plan for upstream bid rounds.

López Obrador, commonly known by his initials AMLO, has criticized President Enrique Peña Nieto’s 2013-14 constitutional energy reform, which de-nationalized the hydrocarbon and electric power industries and paved the way for competitive, open bidding processes in both.

“I think it’s a question of priorities,” Roldan said. “And this new administration, they have different priorities, but they [are] basically going to the same place. The priority right now for them is energy security and [national oil company] Pemex.”

The energy security concern is two-pronged, Roldan said. First, López Obrador wants to reduce Mexico’s dependence on gasoline imports from the United States, the motivation behind his widely reported and widely questioned pledge to allocate $11 billion to shore up utilization rates at Mexico’s existing oil refineries and to build a refinery in Tabasco state.

Even more important for the incoming government, Roldan said, is weaning Mexico off U.S.-produced natural gas imports.

Roldan did not specify whether the gas-focused tenders would target unconventional resources in the Burgos Basin, seen as essential to counteracting a steady decline in associated gas output from Mexico’s dwindling conventional oil reservoirs.

López Obrador raised eyebrows in the industry recently when he said that his administration would not allow hydraulic fracturing, or fracking, which is used in unconventional drilling.

The incoming president’s transition team also is reviewing the 107 contracts awarded through the bid rounds so far for irregularities, a campaign pledge that factored heavily into CNH’s decision to postpone two bid rounds and a farmout tender for operating stakes in Petroleos Mexicanos (Pemex) acreage to February from next month. López Obrador is set to take office Dec. 1.

Suspending Rounds?

The deferral of the tenders, and the anti-reform rhetoric of López Obrador’s energy team, have led to concerns that the rounds scheduled under Peña Nieto’s government could be suspended indefinitely, a fear that was corroborated by a Wall Street Journal report published shortly after Roldan’s panel concluded on Wednesday.

The report said López Obrador “will hold off auctioning any new oil blocks for at least two years and plans to modify laws to bolster the dominant role of state oil company Petróleos Mexicanos,” citing two sources with knowledge of the situation. No mention was made about plans for gas-specific tenders.

However, López Obrador apparently is planning changes that “would let Pemex choose partners to develop reserves without needing the favorable opinion of oil regulators, allow the government to grant Pemex new oil blocks directly, and make Pemex the sole marketer of oil produced by private firms under production-sharing contracts,” the report said.

Roldan did not say outright whether he expected the next administration to suspend the scheduled tenders. He did say, however, that, “The best is yet to come” in Mexico’s oil and gas industry, citing the country’s world-class hydrocarbon resources and infrastructure, strategic geographic location, and its transparent and stable regulatory environment.

“Mexico is…a natural gateway to Asia for hydrocarbons,” he told the audience, estimating that it is 30% cheaper to export hydrocarbons produced in the Gulf of Mexico via Mexico than through the Panama Canal.

Existing midstream infrastructure makes Mexico “a very suitable spot to take the natural gas precisely from the Permian [Basin in the United States] all the way down to the Pacific and liquefy the gas on the Pacific coast of Mexico…without going all the way down through the Panama channel.”

In an apparent effort to assuage concerns about the business environment under López Obrador, he said, “The hydrocarbons commission is an autonomous agency. We don’t change with the changes in the administration. All the board members from this commission have been appointed by two-thirds of the senate, so that brings a lot of stability to the system.”

Roldan added, “Thanks to the money that we charge for the access of data and the different services we are self-sufficient on the budget side so we don’t really ask for money from the budget.”

Autonomous or not, CNH is tasked with implementing and overseeing energy policy, not dictating it. The latter responsibility falls to energy ministry Sener, which is to be led under the next government by reform critic and former Pemex engineer RocÃo Nahle, assuming her appointment by López Obrador is approved by the national congress.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |