Markets | Mexico | NGI All News Access | NGI Mexico GPI | NGI The Weekly Gas Market Report

U.S.-China Trade War Barbs Bleed Over Into Central America’s Natural Gas Revolution

What had looked like a routine trip to Panama for U.S. Treasury’s David Malpass, undersecretary for International Affairs, has unexpectedly pitched him into the frontline of trade tensions between the United States and China against a backdrop of Lower 48 liquefied natural gas (LNG) exports to Central America.

Malpass was in Panama late last week for the inauguration of AES Corp.’s $1.15 billion 381 MW power plant and LNG reception terminal to bring natural gas to Central America, a region of mainly weak economies that remain heavily dependent on energy imports. The LNG import terminal received its first cargo in June.

Until recently Central America maintained diplomatic and economic relations with Taiwan, rather than mainland China. However, three years ago Costa Rica opted to break the links with Taiwan in favor of Beijing. Panama did likewise a little more than a year ago. What came as a much bigger shock was that El Salvador chose to follow suit within hours of Malpass leaving the region.

And, as in Panama, Energia del Pacifico, (EDP) a joint venture of Salvadoran business people and U.S.-based Invenergy LLC, is planning to create a second wave of Central America’s gas revolution with an LNG import terminal and 378 MW combined-cycle plant in El Salvador that is expected to take three years to build. A unit of Royal Dutch Shell plc is to supply the LNG at a cost indexed to Brent, not Henry Hub.

El Salvador President Salvador Sanchez Ceren is hardly a soulmate of Malpass. He was a commander of rebel forces during the civil war in the late years of last century.

Costa Rica, famed throughout Latin America for its democratic institutions and relative prosperity, and Panama, the region’s fastest growing economy powered by the Canal and its geopolitical importance, were of a considerable loss to Taiwan.

Honduras, El Salvador, Guatemala and Nicaragua are among the poorest nations of the Americas.

Malpass, like other members of the Trump administration, has been a strong critic of China’s trade and economic practices.

In remarks to an event in February at the Center for Strategic & International Studies, Malpass, in addressing an audience of experts on Latin America, sharply criticized the regimes of Cuba and Venezuela. But he also added severe words of warning on China.

“China has grown to be an economic force in the world economy, and for many years the United States welcomed and supported its gradual liberalization,” he said. “China’s growth contributed to global economic growth, and the hope was that China would develop into a fair and reciprocal trading partner.

“However, the direction in China has clearly shifted. Market liberalization has stalled and certain policies and activities have even moved back toward a more state-dominated economic model. While China professes to embrace globalization and openness, in practice its markets are relatively closed.”

Latin America should be aware of the dangers, Malpass said. China’s industrial policies “can have serious implications for countries tempted by its massive non-market export credits and loose financing terms, especially if their governments and institutions aren’t robust.”

Not many governments and institutions are robust in Central America. Only in recent months, Nicaragua’s long-time president and former leader of the 1970s revolution in the country has been facing an uprising that has cost hundreds of lives.

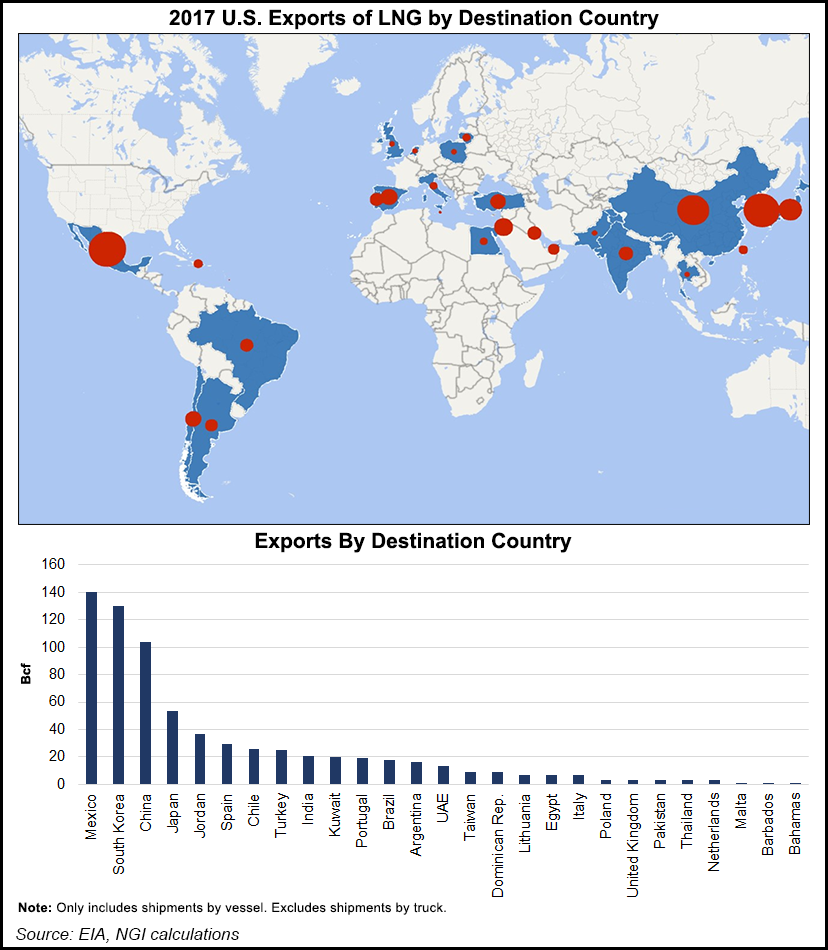

During the Malpass visit to Panama, the U.S. Treasury and Energy departments were reported to have signed a memorandum of understanding that aims to encourage more private investment to expand the importation and distribution of U.S. LNG in Latin America.

Malpass said he hoped the agreement would be the first of several with countries in the region to encourage investment to increase access to cheaper, cleaner energy. It is part of a Treasury-led initiative called America Crece, incorporating the Spanish word for growth, aimed at boosting U.S. exports of LNG, developing Latin American energy resources and downstream demand.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |