Natural Gas Futures Retreat as Weather Forecasts Ease on Expected Heat

September natural gas prices weakened a bit Wednesday as weather forecasts that had been trending progressively hotter in recent days turned slightly cooler in the latest model runs. The Nymex September gas futures contract settled at $2.956, down 2.4 cents on the day. Spot gas prices also softened as mild temperatures were on tap for the remainder of the week. The NGI National Spot Gas Avg. slipped 6 cents to $2.79.

On the futures front, the September contract was a little slow out of the gate Wednesday as a return to hot weather for the end of August/early September and persistent storage deficits remained bullish catalysts for the market. On the flip side, record production and some slight easing in the heat expected to arrive beginning this weekend also weighed on prices.

The prompt month held relatively steady just ahead of the open, and then edged up more than a penny as the session started. From there, the September contract climbed fractionally higher before losing steam as the morning progressed.

The modest retreat came as overnight weather data from both the Global Forecast System (GFS) and European models trended slightly cooler to drop a few cooling degree days (CDD) from the outlook.

“We don’t view this as much of a surprise since after so many successive hotter trending runs, a minor flip back cooler was due,” NatGasWeather said. “The coming pattern after this week is still considerably warmer than normal for much of the country into early September” except portions of the West.

The midday GFS model held the cooler trends, and although weather data still shows a very warm to hot U.S. pattern beginning late this weekend and lasting well into the first week of September, it also showed weak weather systems having better success in exposing flaws in the upper ridge across the northern United States, compared to what the data showed on Tuesday, the forecaster said.

Aside from weather, record production continued to pose downside risk for prices. Genscape Inc. said that with revisions to pipeline nominations data having come in, its Spring Rock daily gas production estimate now showed another record high for production was set on Sunday (Aug. 19), above 81.76 Bcf/d.

Lower 48 production has been on a steady run in the last two weeks with volumes running more than 2.2 Bcf/d above the summer-to-date average and nearly 3 Bcf/d above April levels, according to Genscape senior natural gas analyst Rick Margolin said. Most of the growth in recent weeks continues to be driven by the Northeast (particularly northeastern Pennsylvania and Ohio) along with the Gulf of Mexico because of the return-to-service of several offshore platforms.

Permian Basin volumes, however, topped out at 8.26 Bcf/d a few months ago, and the past week have been coming in about 0.12 Bcf/d lower than the start of summer, “indicating the basin is already contending with the long-awaited constraints getting gas out,” Margolin said.

Still, with the dog days of summer winding down, the natural gas market is likely to face additional headwinds as demand eases.

Power sector natural gas demand has averaged 35.8 Bcf/d since the beginning of June, including 38.5 Bcf/d for July and 37.2 Bcf/d thus far in August, according to EBW Analytics. That reflects a 4.0 Bcf/d uptick in summer power sector burn versus the same period in 2017.

As happens every year, however, power sector natural gas demand is expected to decline alongside fading summer demand. At current Nymex strip prices and in Weather Data Technologies’ most likely weather outlook, power sector burn is expected to average 33.3 Bcf/d from the week ending Aug. 24 through the week ending Sept. 27, up 2.6 Bcf/d year/year.

“The steep decline in power sector natural gas demand — even despite recent late-season bullish shifts — is likely to coincide with rising production and loosen the supply/demand balance” to weigh on Nymex gas futures this fall, EBW CEO Andy Weissman said.

Until then, Genscape meteorologists expect Lower 48 population weighted CDDs to start climbing on Saturday (Aug. 25) toward a peak of 137 CDDs the following Monday and Tuesday, which is about 18% hotter than normal for this time of year. “With the rise in temperatures, our forecast for power burns next work-week averages 36.7 Bcf/d, hitting a max of 37.2 Bcf/d,” Margolin said.

Most of the gains are forecast for the East and South Central regions, which would more than offset anticipated declines in cooling western markets. If the forecast for next week’s national average burn is realized, “it will be about 5 Bcf/d greater than last year and the average of the previous three years, further contributing to this summer-to-date’s notable year-on-year strength in burns,” he said.

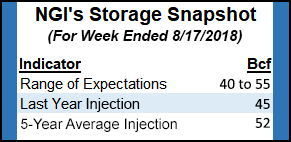

Meanwhile, all eyes will be on Thursday’s Energy Information Administration’s (EIA) weekly storage inventory report. A Reuters survey of 22 market participants had injection estimates ranging between 41 Bcf and 55 Bcf, and a median of 48 Bcf. A Bloomberg survey reflecting 11 market participants’ projections ranged between 40 Bcf and 55 Bcf, with an average of 49 Bcf and a median of 50 Bcf. On the high side of estimates, Kyle Cooper of IAF Advisors expected a 54 Bcf injection, as did EBW Analytics. Intercontinental Exchange settled at a 50 Bcf build.

Last week, 33 Bcf was injected into storage, leaving inventories at 2,387 Bcf, which is 687 Bcf below year-ago levels and 595 Bcf below the five-year average.

There were 93 cooling degree days (CDD) last week, compared with 81 CDDs in the same week a year ago and a 30-year normal of 84 CDDs for the period. A year ago, the EIA reported a build of 45 Bcf into gas stocks, while the five-year average build stands at 52 Bcf.

“Production again set new records this past week, although deficits are expected to remain near 600 Bcf” after Thursday’s EIA storage report that’s favored to print a build in line with the five-year average, NatGasWeather said. “With prices easing off today, this suggests unless hotter trends return in the afternoon European model or overnight, the markets might be content waiting for tomorrow’s EIA weekly storage report before deciding if $3 is warranted.”

Cooler Weather Pushes Spot Gas Lower

Spot gas prices decreased across most of the country as comfortable temperatures were in store for a few more days before hot high pressure was expected to return to key demand regions beginning late this weekend. Until then, the northern and eastern United States were forecast to see daytime temperatures stall out in the 70s and 80s, according to NatGasWeather.

While all the weather models remain hotter compared to the start of the week, they did cool off somewhat on Wednesday, the forecaster said. Underneath the coming hot ridge, highs are forecast to reach the mid-80s to 90s across the Midwest, Mid-Atlantic and Northeast, while hot and humid conditions are expected to linger over the South and Southeast with temperatures climbing into the 90s.

“Where the data has been a touch cooler is across the Midwest, seeing weak weather systems late next week being able to weaken the northern periphery of the hot upper ridge just enough to bring showers and minor cooling,” NatGasWeather said.

Meanwhile, the same weather pattern that is expected to pump heat into the eastern United States is forecast to send cooler weather with spotty rain, high-elevation snow and gusty winds into the West.

“We expect a major shift in the jet stream to develop,” AccuWeather lead long-range meteorologist Paul Pastelok said. The jet stream is forecast to dip southward in the western United States, which would allow cooler air to drain from northwestern Canada and the northern Pacific Ocean.

The most substantial change in the weather is forecast to be across the Northwest, although some cooler and less humid air is also likely to reach parts of California and the Southwest, he said. While temperatures soared into the 90s and even low 100s in parts of the West earlier this month, outlooks showed highs would be slashed by 30-40 degrees in the Northwest. Highs are expected in the 60s and 70s in many of the low elevations and the 40s and 50s over the high country, Pastelok said.

Accompanying the cooler air may be a round or two of cool showers and even some wet snowflakes over the high country of the northern Rockies and perhaps the Washington Cascades, according to AccuWeather.

Spot gas prices in the region were already reflecting the relief in heat. SoCal City-gate next-day gas plunged 47 cents to $4.92; prices earlier this month surged as high as $26.55 on Aug. 6. Malin dropped 17 cents to $2.52 and Northwest Sumas tumbled 14 cents to $2.45.

Northeast spot gas prices slipped a few cents at most pricing hubs, while some Appalachia points posted small gains. Tennessee zone 4 Marcellus edged up a penny to $2.61, and Texas Eastern M-3 Delivery rose 4 cents to $2.75.

Steep day/day declines were also seen in the Southeast, where Transco zone 4 fell a nickel to $2.94 and Transco zone 5 slid 6 cents to $3.01.

Benchmark Henry Hub prices eased by a couple of pennies to average $2.99, while Houston Ship Channel in East Texas lost 4 cents to hit $3.07.

In West Texas/southeastern New Mexico, El Paso-Permian next-day gas tumbled 13 cents to $2.03, while Waha slipped just a few cents to $1.97.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |