Regulatory | LNG | NGI All News Access | NGI The Weekly Gas Market Report

Cheniere OK’d to Prep Corpus LNG for Exports; Venture Global Gains Investments

Houston-based Cheniere Energy Inc. late Thursday was granted approval to begin feeding natural gas into the first planned export project in Texas, signaling the Corpus Christi terminal could produce the first commissioning cargo before year’s end.

FERC issued the authorization to allow feed gas to begin at Train 1 of Cheniere’s liquefied natural gas (LNG) project, Corpus Christi Liquefaction LLC (No. CP12-507-000).

The Federal Energy Regulatory Commission’s approval puts Corpus on track for potential cargoes by year’s end, which CEO Jack Fusco had predicted during a second quarter conference call earlier this month.

Corpus is Cheniere’s second export project, and it would be the third domestic facility to carry Lower 48 supply to international markets.

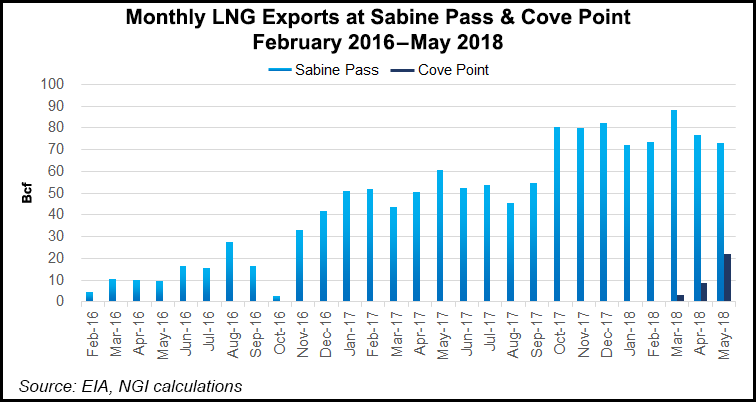

Cheniere’s Sabine Pass export facility in Cameron Parish, LA, a four-train project with 18 million metric tons/year (mmty) of capacity, has been in operation since 2016. Between April and June, Sabine Pass produced and exported 61 cargoes, with the year-to-date total at 150-plus cargoes loaded and exported, Fusco said. LNG from Sabine Pass is now destined for 28 countries.

Dominion Cove Point LNG on the Chesapeake Bay in Maryland, with 5.3 mmty of capacity, began commercial service in the spring.

Train 2 at Corpus is slated to ramp up in 2019. Cheniere earlier this year also issued a final investment decision to build a third train at the South Texas project.

Once operational, the addition of Corpus Christi would increase Cheniere’s run rate distributed cash flow/share by an estimated 20%, he said during the quarterly call. Train 3 also is backstopped by long-term contracts with at least three counterparties.

Meanwhile, other export projects appear to be gathering steam.

Venture Global LNG Inc. said Thursday it has raised about $160 million in additional private capital from large institutional investors, giving it a total of $630 million to support developing two export projects in Louisiana.

On the drawing board at Venture is the 10 mmty Calcasieu Pass project, to be sited on the Gulf of Mexico, and the 20 mmty Plaquemines facility to be built on the Mississippi River. Venture plans to use mid-scale liquefaction technology provided by partner GE Oil & Gas LLC, a unit of of Baker Hughes, a GE company.

“Both new and existing investors recognize our quality execution as we continue signing binding 20-year agreements for the purchase of LNG from our Calcasieu Pass and Plaquemines projects,” said Venture Co-CEO Mike Sabel.

Venture, he said, has secured a “growing list” of partners for its exports, including Royal Dutch Shell plc, BP plc, Edison SpA, Galp and one of Central Europe’s leading utilities, Polish Oil & Gas Co. Investors “can feel confident in our ability to deliver the lowest cost LNG from North America,” Sabel said.

Calcasieu Pass obtained a draft environmental impact statement in June, Co-CEO Bob Pender noted, and Venture is preparing for FERC authorization, with construction likely to begin early next year.

“The contracting momentum for our Plaquemines project continues to grow, and we expect to announce additional milestones in the near term,” Pender said.

Sabel two months ago discussed the Venture projects at the World Gas Conference in Washington, DC.

Venture, he said, has been working in “stealth mode” on the two export projects since pivoting from Asia to the U.S. market in 2010. Venture’s strategy is to take advantage of being “permanently parked” next to U.S. pipeline gas on the Gulf Coast to make its supply attractive to potential customers.

“At the very beginning of this effort, we were certainly building on the foundation of the success of Cheniere,” Sabel said. Venture has modeled flexibility in its contract terms, but it’s not likely to compete against “a Cheniere.” However, “there’s demand for all of the projects in a growing market,” and he expects most projects will succeed in a variety of models.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |