E&P | M&A | NGI All News Access

Permian Players Diamondback, Energen Agree to $9.2B Merger

Diamondback Energy Inc., fresh off a $1.2 billion deal to build its position in the Permian Basin, late Tuesday agreed to buy West Texas-focused Energen Corp. in an all-stock deal valued at $9.2 billion.

The deal includes Birmingham, AL-based Energen’s net debt, estimated at $830 million. Diamondback agreed to trade 0.6442 shares of common stock for each Energen share, representing an implied value for Energen of $84.95/share. Each board has unanimously approved the transaction.

Earlier this month, Diamondback agreed to pay an estimated $1.2 billion in total for Midland sub-basin acreage from Ajax Resources LLC.

The Energen takeover “represents a transformational moment for both Diamondback and Energen shareholders as they are set to benefit from owning the premier large cap Permian independent with industry leading production growth, operating efficiency, margins and capital productivity supporting an increasing capital return program,” Diamondback CEO Travis Stice said.

“The Energen team has done an outstanding job assembling a portfolio of Tier One acreage in both the Midland and Delaware basins, which, when combined with Diamondback’s current portfolio, will present an extended runway for Diamondback’s record of best-in-class execution and low-cost operations. This transaction also adds critical mass for driving capital efficiencies in what is now truly becoming a manufacturing business.

“I expect the pro forma company to be able to grow at industry leading rates while returning capital at a competitive yield.” Diamondback plans to offer Energen employees to the team.

“The synergies provided in this transaction, as well as the opportunities for capital improvements provided by increased size and scale, create a truly outstanding value proposition,” Stice added. “The combined company’s expected production growth, capital productivity and cost structure will enhance our free cash flow profile to grow our long-term capital return program.”

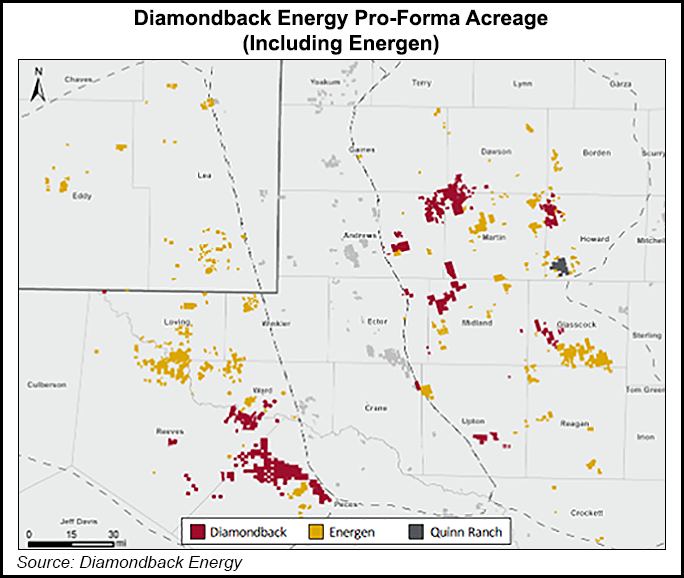

Once completed, Diamondback would hold 390,000 net acres across the Midland and Delaware sub-basins, an 85% increase from Diamondback’s 211,000 net at the end of June. The Energen acreage has more than 7,000 estimated net horizontal locations, which would be a 120% gain in Diamondback’s current estimated locations, pro forma for the Ajax transaction.

Combined pro forma, Diamondback’s 2Q2018 production would have been 222,000 boe/d, 67% weighted to oil, making it the third-largest production for a Permian pure-play.

“This transaction is the outcome of a comprehensive strategic review by Energen’s board with the assistance of our outside advisers,” said Energen CEO James McManus.

Energen’s major shareholders had been pushing for the company to divest its Permian holdings. The strategic process “examined our business plan, competitive positioning, and strategic alternatives,” McManus said. “We believe this all-stock transaction with Diamondback is the best path forward for our company and provides Energen shareholders with an excellent value for their investment, now and in the future.”

Upon closing, Diamondback’s board and executive team would remain unchanged and continue to be headquartered in Midland, TX.

A conference call is scheduled for 7:30 a.m. CT to discuss the proposed transaction, which requires shareholder approval.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |