Regulatory | NGI All News Access

CRE OKs Revised Open Season, Secondary Market Rules for Mexico Natural Gas Pipelines

Mexican regulators have issued updated rules for open seasons and capacity releases on pipelines in the country’s fledgling natural gas market.

The Comision Reguladora de Energia (CRE) on Aug. 3 approved proposed modifications to the country’s open access rules for gas pipelines, known as the DACG per the Spanish acronym. The changes are intended to streamline pipeline open seasons and facilitate the emergence of a secondary market for transport capacity. The new rules would take effect after they are published in the Diario Oficial, the Mexican equivalent of the Federal Register.

Pipeline companies “have indicated to the CRE, in various working meetings, their desire to simplify and streamline the regulator’s approval process for open seasons, in order to reduce the time and costs incurred when they are carried out,” according to the CRE.

The regulator also said it had received queries from pipelines and shippers about the procedures and terms for releasing excess transport capacity into the market.

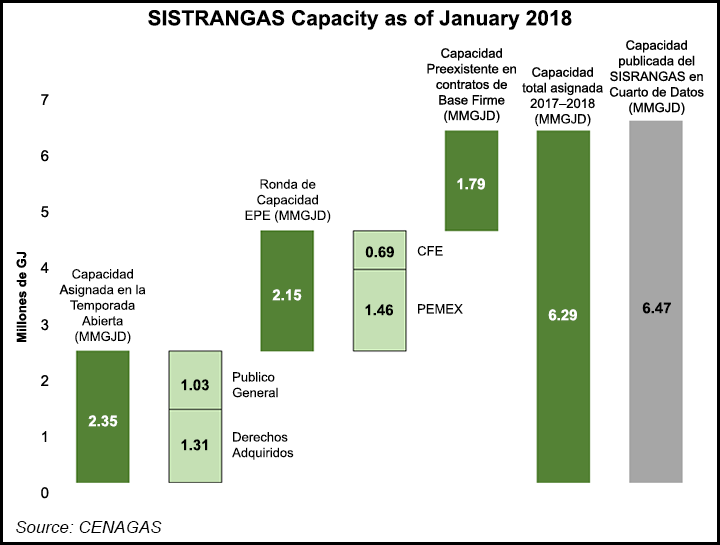

While current rules require that shippers relinquish idle capacity, a secondary market has yet to fully emerge in Mexico. The current capacity reservation regime officially launched in mid-2017, and the market is still in the early stages of development, with rudimentary trading activity, low liquidity levels and a near absence of local gas producers independent from state energy giant Petroleos Mexicanos (Pemex).

Mexico imports about 65% of its natural gas via pipeline and liquefied natural gas, while the remainder is produced domestically, mostly via associated gas from Pemex’s offshore oilfields in the south and non-associated gas from the onshore Burgos Basin in the northeast.

CRE published a draft of the revised open access rules in November to solicit feedback from market participants.

The final version approved early this month eliminates the requirement that pipeline operators seek regulatory approval for each open season. Pipelines, both proposed projects and existing lines, would submit a model procedure to the CRE for one-time review and approval, after which they would only need to notify the regulator each time they hold an open season. The rules also state that the CRE would publish the open season notices on its website.

The duration of open seasons should rely on “best practices” in the market, except in the case of new pipelines or expansions, which should last “no less than 20 days,” according to the CRE.

The changes in the secondary market are more wide-ranging and are designed to refine the previous regulatory framework and facilitate the market’s development, the CRE previously told NGI’s Mexico GPI.

Under the new rules, shippers may freely set the terms for bilateral capacity trades, although this does not exempt them from paying the rates set in the transport agreement that the original capacity holder signed with the pipeline.

CRE has also clarified the roles and obligations of pipelines and shippers in the secondary market and streamlined the categories of capacity releases into two types: “temporary” and “permanent.”

A temporary release is when a shipper cedes all or part of its contracted firm capacity on a pipeline for a period that is less than the full term of its transport agreement. In this case, the releasing shipper retains its contractual rights and obligations to the pipeline.

A permanent capacity release, in turn, would cover the contract’s full term — or what remains of it — and transfer the contractual obligations to the shipper receiving the transport rights.

A third category of “definitive” releases no longer exists under the updated regulations, and it would no longer be mandatory to hold an open season if a capacity placement exceeds six months.

The revised rules also specify that shippers must maintain a minimum utilization rate of 70% for their firm capacity contracts, creating a market-wide definition for idle capacity.

Per the rules, idle capacity on a contract would be the difference between a shipper’s actual utilization rate and the 70% minimum, as calculated on a quarterly basis. Thus a shipper using 60% of its firm capacity on a pipeline in the first quarter of the year would be forced to release 10% of that capacity into the secondary market for the duration of the following quarter.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |