Mexico Natural Gas Imports in May Averaged 5.15 Bcf/d, Sener Says

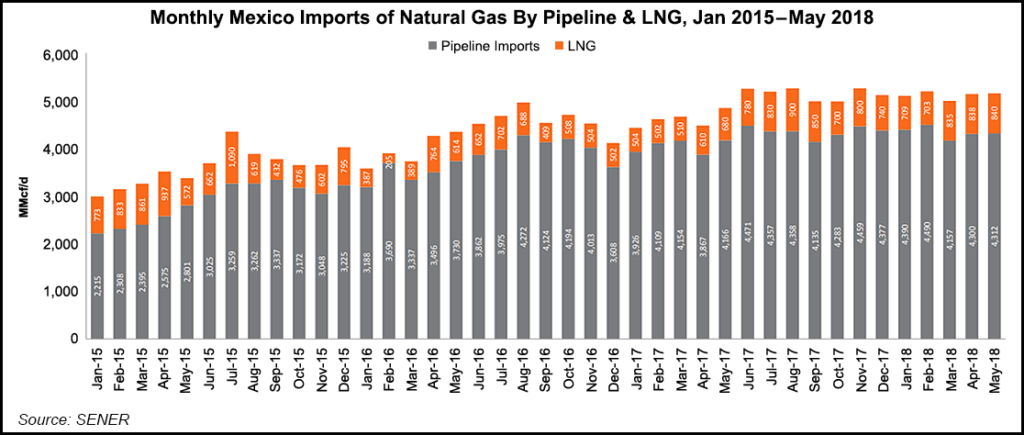

Natural gas imports into Mexico grew 6.3% year/year (y/y) in May as pipeline shipments and liquefied natural gas (LNG) continued to make up for declining domestic output, according to the latest official data.

The country’s imports of the molecule averaged 5.15 Bcf/d during the fifth month of 2018, the Mexico Energy Ministry (Sener) recently reported. Imports were also up 1.6% month/month (m/m) from 5.07 Bcf/d in April.

Imports accounted for 65% of Mexican gas demand in May, which averaged 7.93 Bcf/d. The power sector is the leading consumer of gas in the country, followed by large industrial users.

Pipeline shipments into Mexico, mostly flowing across the northeast border with South Texas, were up 3.5% y/y at 4.31 Bcf/d, compared to 4.17 Bcf/d in May 2017. Sequentially, piped imports were down slightly by 0.9%, versus 4.35 Bcf/d in April.

LNG demand rose 23.5% y/y to 840 MMcf/d, a year-to-date peak in the data reported thus far by Sener. Mexico receives LNG cargoes at two regasification terminals: the Altamira facility (309 MMcf/d in May) on the Gulf Coast and Manzanillo (500 MMcf/d) in Colima on the Pacific Coast. A third facility, the Costa Azul terminal on the Baja California Peninsula, has not delivered any gas to Mexican systems since mid-2016.

Meanwhile, Mexico’s domestic gas output fell 12.4% y/y to 2.78 Bcf/d in May, largely on declining associated gas production at mature oilfields operated by state-run Petroleos Mexicanos, aka Pemex. Production from the onshore Burgos Basin, Mexico’s largest producer of non-associated gas, is also on the decline.

The largest supplier of imported gas is the NET Mexico pipeline,* which delivered 1.89 Bcf/d in May, or 37% of all imports into Mexico. The 2.1 Bcf/d pipeline crosses the South Texas border into the northeast state of Tamaulipas, where it connects with the Los Ramones system, part of the national integrated transmission network known as Sistrangas.

Earlier this month, Mexican regulators approved a new transport rate regime for the Sistrangas, which would increase the number of tariff zones on the system to nine, from the current six. The system’s operator, the Centro de Control del Gas Natural, charges postage stamp rates that accrue as gas moves from zone to zone.

The new regime is due to kick in Oct. 1. Regulators said they expected the new system would, among other things, help to stimulate domestic gas production.

“The tariffs will improve the economic signals for national production near demand centers by reflecting the cost of transporting natural gas within the new zones, including the cost of importing gas,” according to the Comision Reguladora de Energia.

After NET Mexico, the second largest pipeline import point is Mier-Monterrey, owned by Kinder Morgan Inc. Located in Nuevo Leon, the pipeline delivered 492 MMcf/d in May, down 9.7% y/y. The Arguelles border crossing averaged 410 MMcf/d during the month, up 77.5% from May 2017.

The two pipelines at Arguelles — the Kinder Morgan Border Pipeline LLC and the Arguelles pipeline, owned by Energy Transfer Partners LP – have been increasing their delivery capacity in recent months.

All three of these pipelines are in northeast Mexico, on the border with South Texas. Imports from West Texas, where several large cross-border pipelines came online last year, have been constrained by delays to pipeline projects farther south in Mexico.

However, most of the delayed downstream infrastructure is due in-service before the year is out. In July, TransCanada Corp. reported that its 670 MMcf/d El Encino-Topolobampo pipeline had begun operating, completing a link between the Permian Basin in West Texas and southeastern New Mexico and consumers in northwestern Mexico.

“There are a number of expansions we’re tracking in the NATGAS Permian report that are coming due and could trigger another watershed in Mexican gas imports by this fall,” RBN Energy LLC analyst Sheetal Nasta wrote in a July 25 blog post.

These include Fermaca’s 1.2 Bcf/d La Laguna-Aguascalientes line, which extends into central Mexico, and Carso Group’s 500 MMcf/d Samalayuca-Sasabe pipeline in the northwest border area. In the northeast, the 2.6 Bcf/d Sur de Texas-Tuxpan marine pipeline is also due online later this year.

Already by July, Mexican pipeline imports had reportedly reached record levels, breaking the 5 Bcf/d mark for the first time.

“From July 1 to July 3, export volumes jumped by 200 MMcf/d to 4.9 Bcf/d, and by July 5 they got another bump to just over 5 Bcf/d,” Nasta said. “That record was then surpassed two days later, when deliveries to Mexico posted at nearly 5.3 Bcf/d. Since then, the volumes have stayed squarely in 5 Bcf/d territory, which amounts to a 400 MMcf/d gain from the prior month and 600 MMcf/d above last year at this time.”

Some of those incremental pipeline imports were attributable to a seasonal uptick in gas-fired power generation, but new pipelines also helped push volumes past 5 Bcf/d, according to Nasta. Before the El Encino-Topolobampo startup in July, the 600 MMcf/d Nueva Era pipeline in northeast Mexico began ramping up in June.

*Correction: In this original article the operator of the NET Mexico pipeline was incorrectly identified. The pipeline is an asset of NET Midstream LLC, which is owned by NextEra Energy Partners LP. NGI’s Mexico GPI regrets the error.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |