Markets | NGI All News Access | NGI Data

Weekly Prices Surge on Heat; Eastern U.S. Packs Hefty Gains

Weekly prices skyrocketed as a heat wave blanketed much of the East Coast throughout the week, lifting daytime temperatures into the low 90s and making for some of the strongest demand of the summer so far.

Gains in the futures market also provided some uplift to weekly prices, as growing storage concerns sent the September contract higher every day this week except Friday. The NGI Weekly National Average rose 20 cents to 3.07.

Increases were once again strongest in California, which can’t seem to catch a break from the unrelenting heat that has plagued the region for the better part of the summer. Outlooks for next week don’t appear to offer much hope either, as temperatures are forecast to remain in the 90s and 100s in most areas, save for the Northwest.

SoCal Citygate weekly prices jumped 2.81 to $16.55, while SoCal Border Avg. prices were up 1.46 on the week to $5.88.

In Arizona/Nevada, Kern Delivery prices were up 2.51 to $7.90, and El Paso S. Mainline/N. Baja prices were up $1.50 to $7.01.

On the East Coast, the heat and high humidity sent Algonquin Citygate weekly prices up 28 cents to $3.29, while even steeper increases were seen along the Transcontinental Gas Pipe Line, aka Transco. Transco zone 6 non-NY jumped 30 cents to $3.21, while Transco zone 6-NY was up 27 cents to $3.19.

Ending the week in the red were pricing points in West Texas/southeastern New Mexico, where Waha dropped 13 cents to $2.09 and Transwestern slipped 9 cents to $2.11.

As for futures action, the Nymex September gas contract ran out of steam Friday, ending a six-day streak fueled by storage concerns that lifted the prompt month to a weekly high of $2.955 before pulling back a bit. September settled Friday 1.1 cents lower at $2.944 after trading in a tight range of less than a nickel.

At the heart of Friday’s modest retreat was weather data that has been a touch cooler trending overall the past 24 hours, with weather systems consistently finding flaws in hot high pressure that tries to strengthen over the northern and eastern United States in the weeks ahead, according to NatGasWeather.

It’s still a very warm pattern, especially over the western and southern United States, “just not as hot as needed over the northern half of the country with consistent intrusions of showers and minor cooling,” the weather forecaster said.

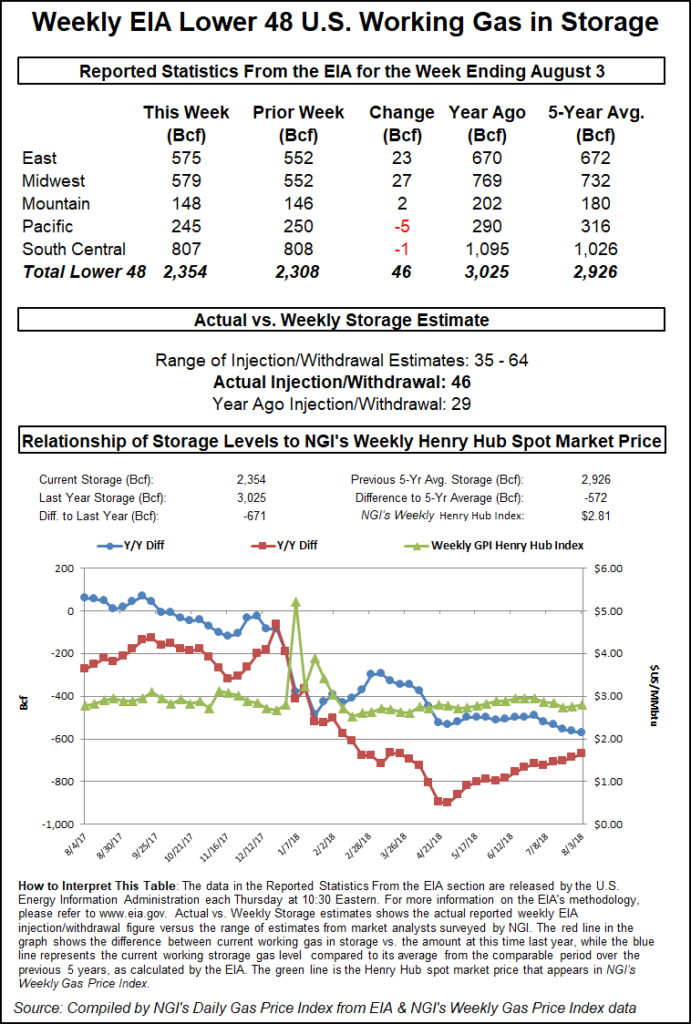

The pullback in prices follows a string of gains that began earlier this month when the Energy Information Administration when the Energy Information Administration (EIA) on Aug. 2 shocked the market with a well below-consensus 35 Bcf injection, the third bullish miss in a row. This week’s storage report was more on target as the EIA reported a 46 Bcf injection, but the print still indicated a tight market and did little to chop away at the persistent deficit. In fact, the deficit to year-ago levels shrank by just 17 Bcf, while the deficit to the five-year average grew by 7 Bcf. At 2,354 Bcf, stocks are 671 Bcf below last year and 572 Bcf below the five-year average, according to EIA.

“We are over halfway through the summer injection season, and total inventories are on pace to enter winter below 2014 levels,” analysts with BofA Merrill Lynch Global Research said. The underwhelming injection pace has occurred despite production growth averaging about 7.4 Bcf/d higher year/year thus far this summer. “We expect production to continue growing for the balance of summer, but time is quickly running out to inject gas,” commodity strategist Clifton White said.

Indeed, it appears that even with growing production, supply/demand balances remain tight, suggesting the next storage report could come in lighter than the five-year average by more than 20 Bcf due to widespread heat over the West, South and East, thereby increasing deficits even further, NatGasWeather said.

Compared to degree days and normal seasonality, the 46 Bcf injection is about 1.0 Bcf/d tight versus the five-year average, according to Genscape Inc. And while the latest EIA report helped to slightly close the year/year deficit, the deficit to the five-year average actually widened once again, and inventories are the lowest they have been at this time in the last five years.

The data and analytics firm agreed that the situation shows no signs of correcting in the EIA’s Aug. 16 report: its supply/demand model’s preliminary estimate for the week ending Aug. 10 is showing an injection of only 39 Bcf.

“While we do show production holding above the 80 Bcf mark, power burns this week have been strong, having topped the 40 Bcf/d level on a couple of days, sustaining what has come to be the strongest summer-to-date for burns in the past five years,” Genscape senior natural gas analyst Rick Margolin said.

He noted, however, that Genscape’s storage estimate is early and not its composite estimate, which includes its storage sample. “But at the moment, if realized, we would be looking at an injection about 40% smaller than last year and the five-year average for that week,” Margolin said.

Bespoke Weather Services said Friday’s trading action was slow, and with the strip moving in tandem, “it would likely be wise to not read too much into the daily price action.” Still, the October/January spread ticked slightly more narrow, and the March contract saw decent weakness, “keeping us from seeing the strip as being nearly as supportive as it was early in the week,” the weather forecaster said.

Thus, $2.98-$3 resistance was quite likely to hold early next week, especially the firm looked for cash prices to remain a bit weaker now that the significant heat has passed.

Meanwhile, revisions showed a strong bump up in production, and if that continues into the Aug. 13-17 week, Bespoke would expect to see further pressure on prices, especially with initial indications that weather-adjusted burns were decently looser Friday as well.

“Our sentiment sits between neutral and slightly bearish into the weekend as the gas strip does not appear particularly strong with production recovering, cooler medium-range risks and burns loosening, but EIA data remains tight and dips are still bought,” Bespoke chief meteorologist Jacob Meisel said.

As for weather, several weak weather systems were expected to send temperatures over the southern and east-central United States to much more comfortable levels for the weekend and into the Aug. 13-17 week. The West, however, was expected to remain hot apart from some cooling into the Northwest.

A weather system over the east-central United States was forecast to finally track out late during the Aug. 13-17 week, allowing very warm conditions to return. This is likely to be brief as additional weak weather systems are forecast to arrive in the Midwest and east-central United States during the Aug. 18-19 weekend; this is where the data has been cooler trending in recent runs, NatGasWeather said.

Later this month, the weather pattern for Aug. 20-25 is expected to remain very warm to hot across the southern United States, where most of the nation’s cooling demand will be driven. “This should lead to gradually waning national demand, with builds set to start increasing after next week’s report comes in well under the five-year average due to widespread heat this past week over the West, South, and East,” the weather forecaster said.

Spot Gas Prices Soften on Cooler Weather

Spot gas prices moved Friday as several weak weather systems/boundaries were expected to trigger areas of heavy showers and thunderstorms through the weekend, focused over the southern and east-central United States and cooling major Northeast cities into the more comfortable 80s instead of 90s.

A weather system was expected to spin up and stall over Texas and the Southwest during the next several days with heavy showers and cooling, then slowly ejecting as next week progresses. The West is expected to remain hot with widespread 90s and 100s apart from cooling into the Northwest.

Tennessee Zone 6 200L dropped 16 cents to $2.83, while Transco Zone 6 New York gave up 7 cents to $2.94.

In the West, recently elevated points in California and the Desert Southwest sold off sharply heading into the weekend, led by the mercurial SoCal Citygate, which averaged $10.42, down $5.39 on the day.

SoCal Border Average tumbled $3.35 to $5.82, while in Arizona/Nevada, Kern Delivery plummeted $6.47 to $7.66.

Radiant Solutions was calling for temperatures to moderate slightly in Southern California during the weekend, with highs in Burbank expected to drop from the low 90s Friday down to the upper 80s by Monday.

Intercontinental Exchange indices for power delivered Sunday and Monday showed peak prices falling off sharply in Southern California and Desert Southwest markets. Meanwhile, Southern California Gas Co. was forecasting the typical weekend drop in demand on its system, anticipating sendout to total around 2.1 million Dth/d Saturday and Sunday after reaching close to 2.8 million Dth/d on Thursday.

Further upstream in West Texas, prices fell, outpacing declines in East Texas and at benchmark Henry Hub. Waha dropped 16 cents to $1.88.

Meanwhile, in the Rockies, planned maintenance on the Ruby Pipeline in the week ahead could reduce flows west to California by as much as 500 MMcf/d, according to Genscape analyst Joe Bernardi.

“Ruby plans to conduct its annual Roberson Creek Compressor test on Tuesday, which will limit operational capacity at the ”ROBERSON CREEK – WY/UT ST LINE’ throughput meter to zero for the first three cycles, and to 931,000 Dth/d for the last two cycles,” Bernardi said. “The previous month has seen an average flow of 481 MMcf/d. Last year’s iteration of this annual event had the exact same capacity reduction, and end-of-day flows came in at 126 MMcf/d.

“This will disrupt gas moving from Ruby onto PG&E’s Redwood Path, and similar past events have resulted in a spike in Gas Transmission Northwest’s (GTN) deliveries to PG&E to accommodate for the drop in Ruby receipts,” according to Bernardi. “PG&E will also have the option to source alternative gas by increasing storage withdrawals, but typically these have not reacted as strongly to the Ruby flow cut as have GTN’s deliveries.”

In 2015 and 2016, the maintenance event corresponded with short-term spikes at the Malin hub, but not in 2017, while PG&E Citygate has not historically reacted to the event, Bernardi said.

Malin dropped 10 cents Friday to $2.60, while Stanfield gave up 7 cents to $2.52.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |