Infrastructure | E&P | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Oil & Gas Rigs Jump By 13; Analysts Bullish on International Growth

Oil and natural gas supply and price signals are still telling exploration and production (E&P) companies to drill, according to the latest U.S. rig count from Baker Hughes, a GE company (BHGE).

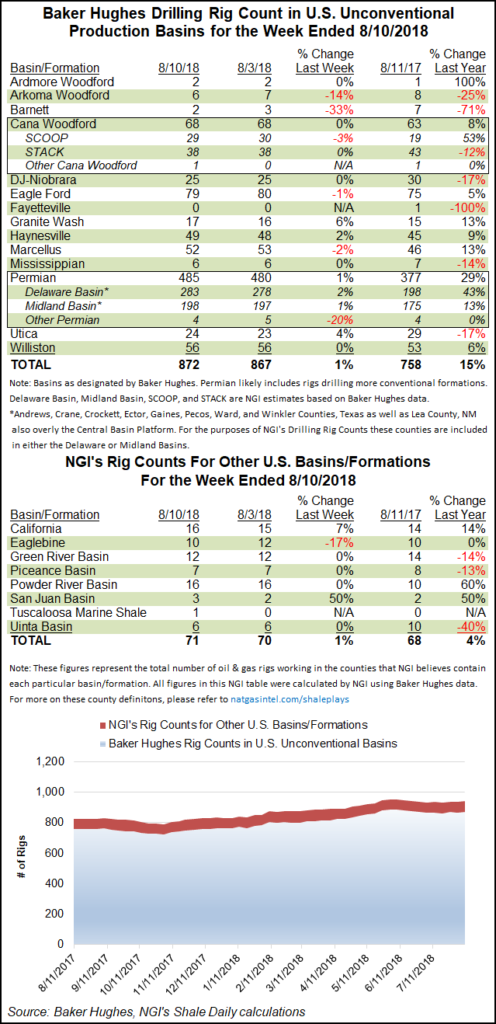

For the week ending Aug. 10, BHGE found that the number of active oil rigs increased by 10 to 869, while the number of rigs drilling for natural gas increased by three to 186. Respectively, these figures represent 13% and 3% premiums to last year’s rig count for the week.

The rig report came during a week where both natural gas and crude prices enjoyed gains. With help from some late-session buying, September natural gas rallied for a sixth straight day on Thursday to close at $2.955. Meanwhile, September crude futures are still comfortably above the $60/bbl mark. The contract opened Friday morning approximately 41 cents higher than Thursday’s close at $67.22/bbl.

Taking a closer look at the BHGE report for the week, the most action — unsurprisingly — took place in the Permian Basin. According to the data, the basin added five rigs for the week to finish at 485, with five rigs added to Delaware sub-basin, one added to the Midland sub-basin and one rig being laid down in the “other Permian” classification.

Around the rest of the country, gains and losses were minimal. The Utica Shale added one rig to 24, while the Marcellus Shale dropped one to 52. The SCOOP (South Central Oklahoma Oil Province), Barnett and Eagle Ford plays all lost one apiece to 29, two and 79 rigs, respectively, while the Granite Wash and Haynesville each added one rig to total 17 and 49 rigs respectively.

On the international drilling scene, a team from Evercore ISI said “global oil markets have tightened,” which will keep the commodity’s price elevated for the next few years leading to a “strong and long” global upcycle.

“Global E&P spending must accelerate significantly, particularly internationally, as it becomes increasingly clear that the current state of projects will inadequately produce the supply to meet demand over the next few years,” according to Evercore senior managing partner James West.

West and his team believe spending growth will accelerate in almost all international markets, led by double-digit growth from both India/Asia/Australia and Russia/Former Soviet Union.

He added that the 2Q2018 earnings season has shown that oilfield service companies see growth in the international segment, noting that Schlumberger Ltd.’s international revenue increased 4% sequentially in 2Q18. “The company expects to deploy 90 international land rigs this year, compared to 29 in 2Q2018, which is a tremendous inflection,” West said.

He also noted that BHGE saw its 2Q2018 oilfield services international revenue increase 8% sequentially.

“The market had been looking for the positive commentary companies have been giving about international markets to start to show up in the BHGE international rig count data,” West said. “The past two months the international rig count actually fell, by eight rigs in June month/month (m/m) and 11 rigs in May m/m. In the month of July, the international rig count was up 38 rigs m/m, 4% sequentially and year/year, to 997 rigs.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |