September NatGas Streak Continues After On-Target Storage Report; Spot Gas Mixed

With help from some late-session buying, September natural gas rallied for a sixth straight day against a backdrop of an on-target storage injection and weather forecasts calling for cooler temperatures beginning late next week. The Nymex September traded sideways throughout the day before going on to settle at $2.955, up six-tenths of a cent.

Spot gas prices were mixed amid unrelenting heat in key demand regions like the Northeast, but chances of rain and slightly cooler weather in other regions like the South. The NGI National Spot Gas Average jumped 14 cents to $3.15.

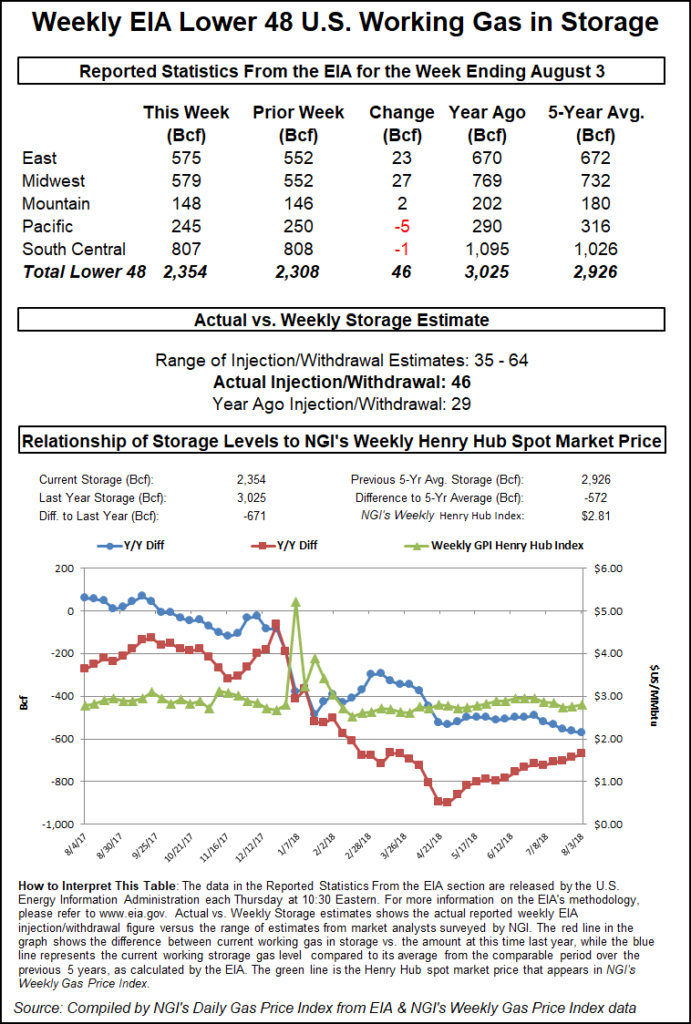

As for futures action, the September contract traded sideways for much of the day, trading in a tight band of 3 cents throughout the session. The prompt month was fractionally lower just ahead of Thursday’s market open and held there before the Energy Information Administration (EIA) released its weekly storage inventory report, which one market analyst had pegged as the “most important” storage report of the summer so far. The EIA reported a 46 Bcf build into storage inventories for the week ending Aug. 3, lifting stocks to 2,354 Bcf.

Nymex futures had a muted reaction to the reported build, moving up to trade flat on the day in the minutes after the report. After briefly moving into positive territory, however, the September contract reversed course and was trading one-tenth of a cent lower just before 11 a.m. ET. The prompt month stayed in the red for much of the day until some buying sent the contract back into the black in the last half-hour of trading.

Some traders and analysts were perplexed at September’s initial move lower after five straight weeks of tight injections and as several regions currently sit below five-year minimum storage levels. “This market is just have a problem getting to and staying above $3,” said INTL FC Stone’s Tom Saal.

He attributed some of the earlier pullback to producer selling. “They’re more worried about prices going lower than consumers are about prices going higher.”

Industry estimates for this week’s report were wide-ranging given the recent string of substantial misses, in the mid-30s Bcf to mid-60s Bcf, with the average pointing to a build in the high 40s Bcf. Kyle Cooper of IAF Advisors projected a 47 Bcf build, EBW Analytics expected a 48 Bcf build, Genscape Inc. estimated a 50 Bcf build and a Bloomberg survey had a range of 35 Bcf to 64 Bcf, with a median 47 Bcf injection. The IntercontinentalExchange settled at a 48 Bcf build.

Genscape said power burns were estimated to have averaged 35.6 Bcf/d, helping maintain this summer’s spot as the five-year leader of power burns this summer-to-date. Mexican exports averaged 4.8 Bcf/d (including a 5 Bcf/d day) and liquefied natural gas sendout averaged 3.3 Bcf/d.

With the reported 46 Bcf injection, Saal said the market didn’t learn anything new, as production is still strong and storage inventories are still low. “Summer has lost some of its sizzle as far as its influence on prices,” he said, noting that even hurricanes aren’t quite what they used to be.

On Thursday, seasonal forecasters with the National Oceanic and Atmospheric Administration’s Climate Prediction Center increased the likelihood of a below-normal Atlantic hurricane season to 60% from 25% in their pre-season forecast.

As for storage, Lower 48 inventories as of Aug. 3 stood at 2,354 Bcf, 671 Bcf below last year and 572 Bcf below the five-year average. The deficit to year-ago levels shrank by 17 Bcf, while the deficit to the five-year average grew by 7 Bcf.

Broken down by region, 23 Bcf was injected in the East, 27 Bcf in the Midwest and 2 Bcf in the Mountain. The Pacific region reported a draw of 5 Bcf, while the South Central saw a draw of 1 Bcf.

Hot temperatures and regional withdrawals from the South Central and Pacific regions have dominated coverage of the EIA’s weekly storage report. In the South Central region in particular, extremely hot temperatures and year/year coal retirements have strengthened power sector gas demand faster than analysts have projected, resulting in the repeated bullish storage injections, according to EBW Analytics.

“As summer temperatures ease in the South Central, however, we expect power sector demand to similarly wane faster than many may now expect,” EBW CEO Andy Weissman said.

In addition to the cooler weather ahead, traders also continue to bank on growing production to help refill storage and meet demand for the coming winter. Despite the record production, though, Saal warned that supply has to get to where it’s needed. “California should remind folks that it’s all about the location. If you don’t have the gas where you need it, you’re going to pay.”

Spot Gas Prices Mixed As Weather Shifts

Turning to the spot gas markets, prices were stronger as daytime temperatures are expected to remain well entrenched in the upper 80s to low 90s across the East, according to NatGasWeather. The West is also hot with widespread highs of 90s and 100s, including in the typically cooler Northwest.

Demand is expected to begin easing on Friday as several weak weather systems/boundaries trigger areas of heavy showers and thunderstorms focused over the southern and east-central United States, the weather forecaster said. A notable weather system is expected to spin up and stall over Texas and the Southwest during the next several days with heavy showers and cooling.

For the middle of next week (Aug. 13-17), the Texas weather systems are expected to eject, as will a second system over the east-central United States, NatGasWeather said. This will allow hot high pressure to restrengthen late next week into the Aug. 18-19 weekend to dominate most of the country with another swing back to stronger demand.

There are likely to be weak weather systems that test the upper ridge, however, trying to find weaknesses for locally cooler conditions. “It’s still a very warm second half of August pattern, just with the nuisance weather systems potentially exposing flaws in the upper ridge to prevent widespread heat. This is where the greatest uncertainty in the coming forecast lies,” NatGasWeather said.

In Texas, next-day gas at Texas Eastern S. TX slipped a penny to $2.96, while Houston Ship Channel was flat at $3.05. In West Texas, El Paso-Permian tumbled 8 cents to $2.16, and Waha dropped 6 cents to $2.04.

Meanwhile, Natural Gas Pipeline Company of America (NGPL) declared force majeure on Segment 22 of its Gulf Coast Line, which may result in restrictions on gas flowing south into Texas, “though the total impact is not expected to be major,” according to Genscape.

The force majeure is at compressor station (CS) 302 in Montgomery County, north of Houston. It was effective Thursday (Aug. 9) and continues until further notice due to an anomaly found during pipeline integrity work, Genscape said. Any gas received north or east of CS 302 and flowing southbound will be reduced to 76% of contract maximum daily quantity, which is estimated to be a reduction in operational capacity of about 90 MMcf/d, to 278 MMcf/d from 368 MMcf/d.

Flows through CS 302 and onto Segment 22, taken from “Sta 341 to Sta 302”, have averaged 218 MMcf/d during the past 30 days with a high of 315 MMcf/d, according to Genscape. Despite the increase in recent flows, this event will likely remain largely unimpactful, with the potential of restricting about 40 MMcf/d, Genscape natural gas analyst Vanessa Witte said.

In the Midwest, spot gas prices also moved lower as temperatures were expected to slide, lowering demand for the remainder of the week. Chicago Citygate next-day gas fell 8 cents to $2.93, while most other pricing hubs in the region posted losses of less than a nickel.

Midcontinent spot gas was mostly higher, with ANR SW jumping more than 15 cents to $2.51 and Panhandle Eastern climbing 7 cents to $2.40. OGT, however, fell 7 cents to $1.84.

Benchmark Henry Hub prices tacked on a penny to $2.98, while Appalachian price points fell a few cents on average.

In the Northeast, Algonquin Citygate next-day gas tumbled 19 cents to $3.07, and Iroquois Zone 2 fell 7 cents to 3.15. Transco Zone 6-NY was down 6 cents to $3.01, and Tennessee Zone 6 200L plunged 29 cents to $2.99.

Returning heat on the West Coast sent prices in constrained southern California higher Thursday. SoCal Citygate surged as high as $18 before averaging $15.81, a gain of $1.64 on the day. Other pricing hubs in the West moved lower; Malin dropped 11 cents to $2.70.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |