E&P | NGI All News Access | Permian Basin

Diamondback Strikes $1.2B Deal with Ajax to Build Permian West Texas Leasehold

West Texas stalwart Diamondback Energy Inc. has struck a deal to buy Permian Basin acreage in the Midland sub-basin from Ajax Resources LLC for $900 million and 2.58 million shares worth an estimated $345 million.

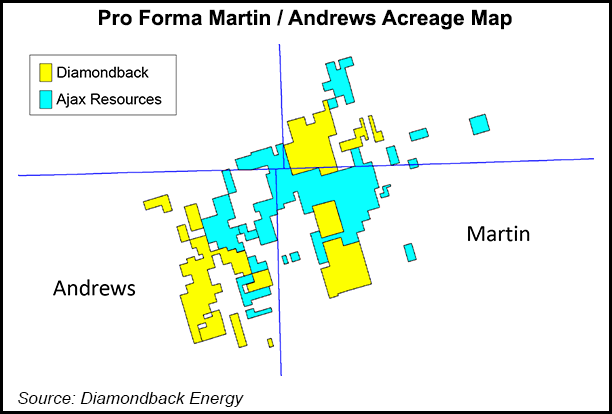

The transaction includes about 25,500 net acres in West Texas, 89% held by production (HBP), which would give the Permian pure-play a leasehold encompassing around 230,000 net acres.

“Diamondback’s announced acquisition of high quality assets from Ajax Resources provides additional Tier 1 resource directly adjacent to our existing acreage in northwest Martin and northeast Andrews counties,” CEO Travis Stice said. “With approximately 220 net locations capable of generating 100% or greater internal rates of return at $60/bbl across three zones, this transaction is accretive to our top quartile inventory, net asset value and 2019 financial metrics.”

The agreement comes less than three years after Ajax, sponsored by private equity firm Kelso & Co., acquired the Yellow Rose field in West Texas from W&T Offshore. Tudor, Pickering, Holt & Co. Inc. estimated the leasehold’s value at around $26,000-28,000/acre.

“Ajax Resources acquired the asset in 2015 at a time when our acreage was viewed by the industry as the northernmost edge of the basin and only the Lower Spraberry was considered prospective,” said Ajax Chairman Forrest Wylie.

Current production is around 12,000 boe/d net, 88% weighted to oil. The leasehold has 367 net identified potential horizontal drilling locations with an average lateral length of more than 9,500 feet.

“Credit is due to the Ajax team for displaying impressive results in two emerging zones for the area, the Wolfcamp A and Middle Spraberry,” Stice said. “These results highlight the value of this acreage in our existing portfolio, and more than doubles Diamondback’s inventory to 680 net pro forma locations in this area.”

Ajax CEO Rich Little called the tie-up a “logical transition…as it complements Diamondback’s acreage position very well and further consolidates the northern Midland Basin.” The Houston-based explorer “looks forward to partnering with Kelso again on our next acquisition opportunity.”

Included in the deal, set for completion by the end of October, is saltwater disposal and freshwater access infrastructure. There are 40,000 barrels/day in saltwater gathering and disposal, 45,000 barrels/day of existing freshwater production and ownership of more than 700 surface acres.

Diamondback, which also delivered its second quarter results on Wednesday, said production climbed 10% sequentially and 46% year/year. Output totaled 112,600 boe/d, 73% weighted to oil.

Based on the latest results, the operator has increased pro forma production for 2018 to 115,000-119,000, a 4% hike from previous guidance, which implies 45%-plus annualized growth from 2017 at the midpoint.

Additionally, Diamondback is continuing to “deliver on securing firm takeaway out of the Permian as we look to maximize our exposure to international pricing,” Stice said. “Diamondback’s oil marketing strategy in the near term is to secure firm transportation at fixed discounts to Gulf Coast pricing while not compromising realizations over the long term.”

The company executed agreements that kicked in during 3Q2018 to secure firm oil transportation from the Permian at fixed discounts to Gulf Coast pricing; term sales agreements cover the remainder of expected annual production.

Diamondback also took an option to acquire up to 10% equity interest in the Epic Crude Oil Pipeline, a 730-mile 440,000 b/d system that would move product to Corpus Christi on the Texas coast. The option doubled Diamondback’s previously announced volume commitment to 100,000 b/d, 50% take or pay.

“In terms of in-basin transportation, we currently have over 92% of our total production on pipe, moving to 95% or higher by the end of the year, which removes the risk of rising trucking costs from our forward operating plan,” COO Mike Hollis told analysts.

Beginning in 2019, most of the gross production is covered by firm transport contracts, “but the pricing terms will become more favorable than in 2018,” he said. “These agreements will continue into 2020 and beyond, when we will have 100% of our oil production protected via firm transportation to Gulf Coast markets. We see this as a true wellhead-to-water solution that eliminates risk of illiquid onshore U.S. market volatility.”

Diamondback’s natural gas production represents less than 5% of total revenue, but “we have dedicated gatherers and processors that have secured downstream firm and/or Diamondback has take-in-kind rights,” Hollis said. “Although our gas will remain exposed to the Waha basis, we will continue to have flow assurance.”

Between April and June, 53 gross horizontal wells were drilled and 50 operated horizontals were turned to sales. The average completed lateral length for the newly drilled wells was 9,300 feet. Operated completions included 29 Wolfcamp A wells, 18 Lower Spraberry wells and three Wolfcamp B wells.

Diamondback operated 11 drilling rigs and five dedicated fracture spreads during the quarter and plans to add two more rigs by the end of September. For the full year, the explorer expects to turn 170-190 gross operated horizontals to sales.

Net income was $219 million ($2.22/share) in 2Q2018, compared with year-ago profits of $158 million ($1.61). Total revenues jumped to $526 million from $269 million with income from operations climbing to $281 million from $132 million.

Average realized prices in 2Q2018 were $61.57/bbl oil, $1.54/Mcf natural gas and $28.02/bbl natural gas liquids, resulting in a total equivalent unhedged price of $50.26/boe, down 1% sequentially.

Cash operating costs were $8.83/boe in the second quarter, including oil equivalent lease operating expenses of $4.16/boe, general/administrative expenses of 87 cents and taxes/transportation costs of $3.80. Diamondback spent $338 million on drilling, completion and nonoperated properties, as well as $88 million on infrastructure and midstream.

Diamondback also has narrowed full-year capital spending guidance to $1.4-1.5 billion from $1.3-1.5 billion.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |