E&P | NGI All News Access | NGI The Weekly Gas Market Report

Continental Raising Guidance, Capex with Bakken, Midcon Growth in Sight

Continental Resources Inc. raised its production guidance and increased capital expenditures (capex) for the year, as it plans to deploy more rigs in the Bakken Shale and a multi-year development program targeting Oklahoma’s myriad stacked reservoirs.

The Oklahoma City-based independent raised the lower-end of its full-year production guidance to 290,000-300,000 boe/d from 285,000-300,000 boe/d, estimating its 2018 exit rate would be 315,000-325,000 boe/d, versus an earlier forecast of 305,000-315,000 boe/d. Capex was increased to $2.7 billion from $2.3 billion.

Total production was 25.8 million boe (284,059 boe/d) in 2Q2018, a 25.6% increase year/year (y/y), but a 1.2% decline sequentially. The total included 115,116 b/d of crude oil, up 25% y/y, with 761.7 MMcf/d of natural gas, an increase of 26% from a year ago.

Production in Continental’s primary area of operations, the North Dakota portion of the Bakken Shale, was 151,805 boe/d during 2Q2018, a 35.1% increase y/y but down 1.7% sequentially. In the Midcontinent, the company saw production in the SCOOP, aka the South Central Oklahoma Oil Province, increase 6% y/y and 4.5% sequentially, to 64,786 boe/d. Production also increased 62% y/y, to 51,722 boe/d, in the STACK, aka the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties, but production also fell from the first quarter by 3.1%.

During the quarter, Continental completed 35 gross (19 net) operated wells in the Bakken, 16 gross (13 net) wells in the SCOOP and 26 gross (13 net) wells in the STACK. Four Bakken wells made the company’s top-10 list for 30-day production, and one, the Mountain Gap 7-10H in Dunn County, ND, became the company’s first Bakken well to average more than 3,000 boe/d, reaching a mark of 3,104 boe/d.

“Our cost per well is remaining in line,” CFO John Hart said in an earnings call Wednesday to discuss 2Q2018. “We’ve talked about the productivity and the uplift we’re seeing in wells with the revised type curve and with the results that we indicated pretty much across all of our plays — STACK, SCOOP and the Bakken. We’re seeing exceptionally productive wells and strong uplift for very efficient deployment of capital.

“So, we feel good not only about being toward the higher end of our range for this year, but we expect that to continue improving as we go forward through the next few years to get back closer to our historical norm. Over the last 10 years, we’ve been in kind of the 20%-type range.

Continental plans to run an average of six rigs and five completion crews in the Bakken through the second half of 2018, ramping up to seven rigs by year’s end. About 125 additional wells in the Bakken should be completed, with first production by the end of the year, more than half of which would be brought online in 4Q2018. In Oklahoma, an average of 18 rigs and four completion crews are set to run through December, with the 19th rig added before the year is out.

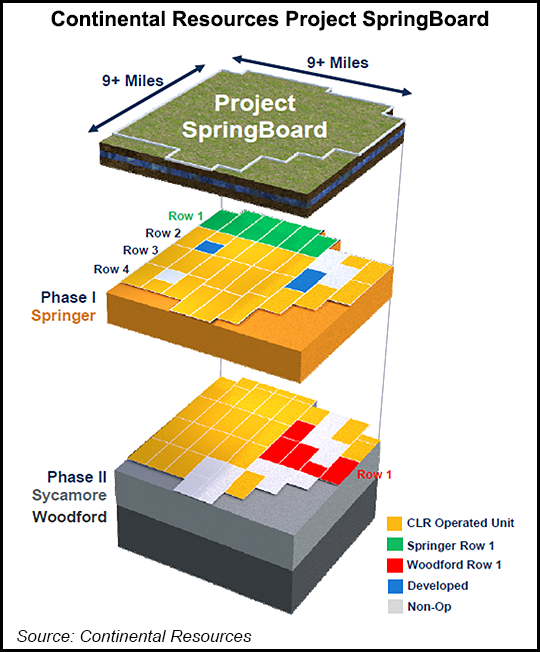

Project SpringBoard, a multi-year oil development program in the SCOOP launched earlier this year, is moving forward, management said, with seven rigs targeting the Springer formation. Meanwhile, Continental also had four rigs drilling the second phase of the program, targeting the Woodford Shale and the Sycamore formation. It plans to add a third rig to the project’s second phase before the end of September, followed by a fourth rig in 4Q2018.

First production from the initial phase of Project SpringBoard is expected late in the third quarter, with full production coming from up to 18 wells by the end of 2018 and up to about 40 wells coming online in 2019. First production in the project’s second phase isn’t expected until 1Q2019, with up to 40 additional wells coming online next year.

The project covers 70 square miles and about 45,000 gross (31,000 net) contiguous acres.

Continental reported net income of $242.5 million (65 cents/share) in 2Q2018, compared with a net loss of $63.6 million (minus 17 cents) in the year-ago quarter. Total revenues grew 72% y/y to $1.14 billion.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |