September NatGas Rallies Ahead of “Most Important” EIA Storage Report of Summer So Far

September natural gas busted at the seams Wednesday, clearing another technical hurdle as prices jumped 5.2 cents to settle at $2.949 as traders clearly had one thing on their mind: storage. Spot gas prices, however, failed to follow suit despite lingering hot weather in key demand regions. The NGI National Spot Gas Average fell 2 cents to $3.06.

On the futures front, the Nymex September gas contract was in positive territory from the start of trading, edging up a little more than a penny just ahead of the open. Prices briefly retreated by a fraction of a cent at the open, but then continued climbing to a high of $2.951 before easing into the settle.

Bespoke Weather Services said there were indications that a $2.92 test was likely Wednesday morning, but that test brought a quick short-covering spike and prices continued to settle at their highs. The settlements also reflected a narrower October/January spread but wider September/October spread, “indicating a very strong technical picture.

“This level of buying is often hard to reverse without a crystal clear catalyst; though weather forecasts cooled this afternoon in line with our morning expectations, it is similarly clear that weather alone will not reverse the rally,” Bespoke chief meteorologist Jacob Meisel said.

Rather, the weather forecaster is looking for Thursday’s Energy Information Administration (EIA) storage injection to come in at 50 Bcf, which appears slightly above market expectations and looser than recent weeks.

The Energy Information Administration is set to release its weekly storage inventory report at 10:30 a.m. ET Thursday.

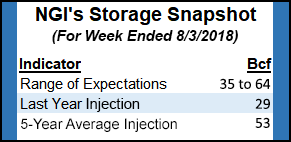

Estimates for this week’s report (for the week ending Aug. 3) were wide-ranging given the string of substantial misses, in the mid-30s Bcf to mid-60s Bcf, with the average pointing to a build in the high 40s Bcf. Kyle Cooper of IAF Advisors projected a 47 Bcf build, and a Bloomberg survey had a range of 35 Bcf to 64 Bcf, with a median 47 Bcf injection. The IntercontinentalExchange settled at a 48 Bcf build.

Bespoke noted that it is very rare that EIA data comes in significantly bullish to expectations four weeks in a row, and with comparatively cooler weather during the reporting week (especially across the South), as well as production setting a record high before falling, “we would look for as much high risk to this print as lower risk.”

NatGasWeather said it expects Thursday’s storage report to be quite telling as to whether recent implied tightening in the supply/demand balance was real or simply due to underestimated impacts from widespread western and southern heat. “Clearly, bulls have gained the upper hand so far this week as the markets view record production secondary to hefty deficits.”

As of July 27, inventories stood at 2,308 Bcf, 688 Bcf below year-ago levels and 565 Bcf below the five-year average. Deficits are likely to remain near 565 Bcf since estimates are very close to the five-year average build of 53 Bcf, NatGasWeather said.

Meanwhile, weather guidance trended slightly cooler for both the Aug. 13-17 week and Aug. 19-22 periods, seeing a hot upper ridge failing to build as strong across the northern and eastern United States, NatGasWeather said. The East Coast is expected to remain hot the next couple of days with highs holding in the low 90s.

A weak weather system is currently tracking across the Great Lakes and Ohio Valley with showers and thunderstorms, though, opening the door for several additional weather systems to follow. These could potentially advance deep into the central and east-central United States this Thursday through Tuesday of next week.

“One of these systems will push deep into Texas and the Southwest, then stalling with heavy showers, easing recent impressive heat and dropping national demand to slightly lighter than normal,” NatGasWeather said.

Where the data has been a touch cooler is early during the Aug. 13-17 week, with a weather system getting trapped between high pressure over the West and East coasts. The pattern late next week is still favored to bring very warm to hot conditions across most of the country as high pressure dominates, the forecaster said. It sees ways, however, that flaws in the upper ridge get exposed to prevent widespread national heat.

“Essentially, nuisance weather systems are likely to make the mid-August pattern less intimidating and could lead to further cooler trends in time,” NatGasWeather said.

Even with cooler weather ahead, Bespoke said “this strong a strip and storage concerns clearly rising” could lend to prices ripping above $3 if the EIA reports a build below 45 Bcf. “This therefore may be the most important EIA print of the summer thus far,” Meisel said.

Demand Sliding Despite Persistent Heat

Turning to the spot gas markets, prices were down almost across the board despite hot weather lingering in key demand regions for another day or so.

SoCal Citygate prices continued to come off recent highs as demand has been downward trending during the last couple of days, according to Genscape Inc. Southern California Gas system demand earlier in the week was just above 2.6 Bcf/d, with Wednesday’s nominated demand expected to top out at 2.58 Bcf/d. “These levels are well shy of summer-to-date highs and levels that occurred during recent record-setting price spikes,” Genscape natural gas analyst Joe Bernardi said.

In addition to slightly lower demand peaks during the current hot spell, SoCalGas has less competition for flowing supply than the last basis blowout event. Bernardi noted that demand in upstream Pacific Northwest, Rockies, Desert Southwest and Mexican markets has been more moderate, and power loads are currently being satisfied by a better-functioning transmission system unlike during the last heatwave event.

Furthermore, no additional pipeline capacity restrictions have been implemented prior to this current event, as one that was originally set to occur on Aug. 7-8 was cancelled in light of the projected demand. Still, “SoCalGas may not be out of the woods just yet,” Bernardi said.

Genscape meteorologists projected that regional population weighted cooling degree days (CDD) would increase Wednesday and peak Thursday at 18.3, roughly 7 CDDs above seasonal norms. CDDs are expected to remain above normal through the end of the week.

SoCal Citygate next-day gas traded in a tight range of less than $2 before going on to average $14.17, down $1.62 on the day.

Rockies gas continued its production drop-related upswing as most markets tacked on a few cents day/day. Northwest Sumas rose 7 cents to $2.70, while Opal climbed about a nickel to $2.74.

In Appalachia, Dominion South slipped a few cents to $2.59, while Transco-Leidy Line dropped 6 cents to $2.56.

Over in the Northeast, Algonquin Citygate tumbled 24 cents to $3.26 as demand is expected to ease in the coming days after failing to reach the high levels expected by the market earlier in the week.

Independent System Operator-New England (ISO-NE) reported that power demand hit 24,340 MW on Tuesday, well shy of the 25,000 MW expected by the electric grid operator earlier in the week. The all-time summer peak in the region is 28,130 MW, set on Aug. 2, 2006.

With temperatures expected to ease in the coming day, ISO-NE expected demand to hit 23,300 MW on Wednesday, 22,300 MW on Thursday and 21,500 MW on Friday.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |