NGI Archives | NGI All News Access

Moody’s Says AMLO’s Self-Sufficiency Agenda Creates Risks for Pemex

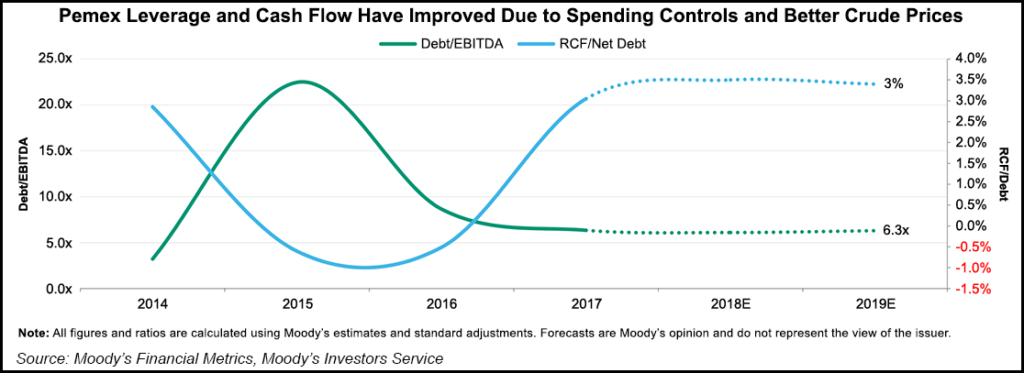

The next Mexican administration’s focus on energy self-sufficiency could pose risks for national oil company Petroleos Mexicanos (Pemex), according to a recent report by Moody’s Investors Service.

Andres Manuel Lopez Obrador, popularly known by his initials AMLO, won the presidency on July 1 with more than 50% of the vote. He also appears headed to a supermajority in the Congress, which would give him a strong mandate for his six-year term that begins Dec. 1.

On the campaign trail, AMLO was a frequent critic of the 2013-2014 energy reforms, which have opened up the country’s oil and gas sector to private and foreign investment. He has also indicated he wants to return Pemex to the glory days of the past decade, when oil production was still in excess of 3 million b/d.

AMLO’s emphasis on self-sufficiency in the energy sector “raises questions about whether Pemex can continue to take advantage of favorable oil prices and solid investment appetite from foreign companies,” according to Moody’s credit ratings analysts.

“The energy agenda of the incoming Lopez Obrador administration poses three particular risks for Mexico’s national oil company: controlling fuel prices, requiring capital spending on building or upgrading refineries, and delaying oil and gas auctions.”

AMLO has pledged, among other things, to review the exploration and production (E&P) contracts awarded in the nine upstream licensing rounds held to date, in order to check for possible irregularities.

The bidding process involved various levels of transparency, and the contracts have been public from the start. However, after the election Mexican regulators decided to postpone three ongoing upstream tenders — two onshore licensing rounds and a farmout auction for seven mature blocks owned by Pemex — until after the December inauguration, partly to allow more time for the contract reviews.

“While cancellations appear unlikely, the review process could stifle Pemex’s production and profitability by postponing new oil auctions indefinitely,” Moody’s analysts said. “Meanwhile, Pemex has a heavy upcoming debt maturity burden, with about $14 billion in cash and fully available committed credit facilities to address some $19 billion in debt coming due during 2018-20.”

AMLO and his advisers have also said they want to build more refineries and upgrade existing facilities to reduce Mexico’s dependence on imported oil products. The proposed refineries — either two small facilities or one large project – would add production capacity of 600,000 b/d at a cost of $6 billion, according to estimates by the campaign.

“However, cost overruns are common in the refining industry and new refineries can end up costing multiples of what was initially planned,” the Moody’s analysts said, citing two recent projects in Brazil and Colombia as examples.

Moreover, putting Pemex in charge of building and owning the new refineries would represent the “greatest financial risk” for the state company.

“Pemex today does not have the cash or free cash flow to take on the construction of new refineries, and if the company decided to finance such an investment with debt or shift capital from exploration and production to refining, its credit metrics would weaken,” analysts said.

A reduction in E&P sending would also risk weakening Pemex’s already declining crude production, which averaged 1.87 million b/d in May.

Pemex owns and operates all six of Mexico’s existing refineries, which have suffered from underinvestment and a lack of maintenance. During 1Q2018, the refineries operated at 37% capacity and produced only 27% of local demand of gasoline and diesel, according to Moody’s.

The AMLO government could also seek to partner with the private sector to build refineries or upgrade the existing ones, although analysts noted that such projects would likely draw limited interest from investors or other oil companies.

After the refinery plans, adjustments to gasoline and diesel prices represent the second biggest risk for Pemex in order of magnitude, according to Moody’s. The incoming administration has said that fuel prices would increase in line with inflation, and that they would decline within three years.

The cost of fuel is a politically sensitive issue in Mexico. A 20% hike in gasoline prices announced at the end of 2016 led to widespread protests against what came to be known as the “gasolinazo.”

“Taxes represent at least 30% of fuel prices at the pump today, and the new administration could continue to adjust taxes to help keep fuel prices relatively stable,” Moody’s analysts said. “But it is uncertain how controlled fuel prices, which could fall below production costs, would affect Pemex.

“In the past, Pemex was able to pay taxes to the government net of fuel subsidies, but extended delays in any government efforts to compensate the company for losses would heighten Pemex’s working capital burden, and probably its total debt load as well.”

Pemex is scheduled to hold its 2Q2018 results call on Friday. In April, the company reported a 1Q2018 net profit of 113.3 billion pesos ($6.2 billion), up 14% year/year, helped by increases in international oil prices and the value in the Mexican peso against the U.S. dollar.

In related news, Mexico’s upstream regulator, the Comision Nacional de Hidrocarburos (CNH), earlier this month approved modifications to Pemex exploration plan for an offshore area that abuts U.S. territorial waters in the Gulf of Mexico.

The area, a narrow strip spanning the offshore Burgos Basin to the deepwater Perdido Fold Belt, combines eight different exploration blocks assigned to Pemex during Round 0 in 2014. The state company in 2017 was granted a two-year extension to meet the minimum work requirements for the Round 0 blocks, or if not return them to the CNH.

The modifications to the exploration plan represent a shift in focus for Pemex, which is now evaluating two new prospects on the acreage. The company recently drilled two wells on the block: Goliat-1, which suffered a mechanical failure, and Tiaras-1, which produced a noncommercial discovery.

“The company has not met the requirements to begin the evaluation phase, which is why they are trying to find other options in order to make a commercial discovery and move to the next phase” in the area’s development, Commissioner Alma Porres Lunes said at a July 18 meeting of the CNH.

The block in question sits adjacent to prolific deepwater regions in United States. Under Mexican law, the area is considered strategic, meaning that Pemex or another state company must have a stake in any project developed on the acreage.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |