E&P | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

BP Delivers Best Upstream Results in Nearly Four Years

Fresh off a mega-acquisition in the Lower 48, BP plc on Tuesday delivered sharply higher second quarter profits, with the upstream delivering its strongest results in almost four years on both a replacement cost and underlying basis.

Underlying replacement cost (RC) profits, which mirror U.S. net profits, climbed to $2.8 billion in 2Q2018 — four times higher year/year and the best results since 3Q2014.

“We continue to make steady progress against our strategy and plans, delivering another quarter of strong operational and financial performance,” Group CEO Bob Dudley said during a conference call from London.

Two more major projects came online in the quarter, and BP high-graded its portfolio big-time with a $10.5 billion transaction announced last week to take nearly all of BHP’s Lower 48 portfolio.

“Given this momentum and the strength of our financial frame, we are increasing our dividend for the first time in almost four years,” Dudley said. “This reflects not just our commitment to growing distributions to shareholders but our confidence in the future.”

Oil and gas production totaled 3.6 million boe/d. Upstream production, excluding stakes in Russia’s Rosneft, was 2,465 million boe/d, 1.4% higher than a year earlier and 9.6% higher when adjusted for portfolio changes and pricing effects.

“We are now six quarters into our 20-quarter plan and we continue to move ahead,” Dudley said. “We also continue to build our portfolio in a way we believe is distinctive to BP, optimizing the value of our assets in both incumbent and growth areas.

“Last week’s announcement is a good example of our approach,” which he said “materially high-grades and repositions our U.S. Lower 48 business in line with our upstream strategy.”

Global demand for liquefied natural gas (LNG) is rising, and while BP expects to be prepared to deliver. Last fall BP took delivery of six state-of-the-art LNG tankers to support the Freeport LNG export project on the Texas coast, as well as its expanding global portfolio.

“I think some people forget how much LNG we do have, with Atlantic LNG out of Trinidad” and Australia’s Northwest Shelf,” Dudley said in response to a question about whether the oil major still needed to beef up its gas assets.

“We’ve got the two trains in Tangguh, and the third one coming along well to start-up. So I think it’s a fair number. We’ve invested in offtake agreements. We’ve got some big offtake agreements in Mozambique with Eni SpA and some big ones off the Gulf of Mexico. So we’re certainly trading a lot of LNG.”

In addition, BP’s Alaska unit and the Alaska Gasline Development Corp. in May agreed to key terms of a gas sales agreement, including price and volume, for the state corporation to purchase BP Alaska’s share of 30 Tcf from the Prudhoe Bay and Point Thomson units for potential exports.

Adding more LNG options at this point is “not a burning desire in the portfolio,” Dudley said

Regarding the macro environment, the world economy is continuing to grow, “despite concerns around potential trade disputes and other market forces.” Global gross domestic product should increase by around 3% this year and in 2019, “supporting strong oil demand growth, as well as increasing demand for natural gas,” notably Asian demand for LNG.

“There are questions over the timing and effects of U.S. sanctions on Iranian crude exports and U.S. infrastructure bottlenecks, particularly in the Permian Basin,” said the CEO. In addition, the Organization of the Petroleum Exporting Countries and its allies are increasing oil production to counter supply disruptions, “but there is uncertainty as to whether there is sufficient spare capacity if the disruption increases significantly.

“These uncertainties could serve to maintain upward pressure on the oil price over the near term. Looking further out, we continue to plan for oil prices in the range of $50-65/bbl.”

BP, he said, has a “strong set of major projects out to 2021, driving growth in the near-term and creating deep optionality into the next decade. I can’t remember when it has looked this good.”

BP also will “continue to look for things that are accretive to shape our portfolio, through inorganic investments such as the recent BHP transaction, which creates increased optionality across our existing U.S. onshore operations, as well as growing value in a basin where we previously didn’t have access,” he said, referring to the Permian.

In the downstream arena, the strategy is making progress by expanding into growth markets that include China and Mexico.

BP also is moving forward in the “broader advanced mobility space, which is integral to our low carbon agenda. We have made a number of investments so far this year in electric vehicle charging infrastructure and battery technology. These investments position us to take a compelling offer to a mobility market that is increasingly looking to electrification for its solutions.”

Dudley and CFO Brian Gilvary spent several minutes discussing and answering analyst questions regarding the BHP transactions, which the CEO said was “one of the most exciting and transformational investments we have made in recent years.

“The Lower 48 team laid the groundwork for this over the last four years, having radically transformed that business, driving significant improvements through the application of leading operational processes and technologies, and turning it into a top quartile operator. The acquisition of these US onshore assets builds on this proven track record.”

To tie into the acquisition, BP plans to divest $5-6 billion of assets, mostly from the upstream arm, with proceeds to fund the deal and more share buybacks.

By 2021, “the Lower 48 is expected to be contributing an additional $1 billion to upstream pre-tax free cash flow,” Dudley said.

Upstream production should be broadly flat in the third quarter to reflect seasonal turnarounds and maintenance, offset by more project start ups, Gilvary said.

“In summary, our financial framework is robust. Underlying earnings continue to grow, underpinning the 2.5% increase to our quarterly dividend, to 10.25 cents per ordinary share. Our organic capital spend is now expected to be around $15 billion in 2018 and we continue to expect 2018 organic free cash flow breakeven to be around $50/bbl.

“Beyond this, we expect the oil price breakeven to steadily reduce to around $35-40/bbl by 2021, and over the same period our return on average capital employed to improve to over 10% at $55/bbl.”

BP, the largest North American gas marketer, said U.S. gas volumes increased to 1.744 Bcf/d from 1.576 Bcf/d a year earlier, but were off from first quarter volumes of 1.790 Bcf/d. Lower 48 liquids output fell year/year to 42,000 b/d from 43,000 b/d.

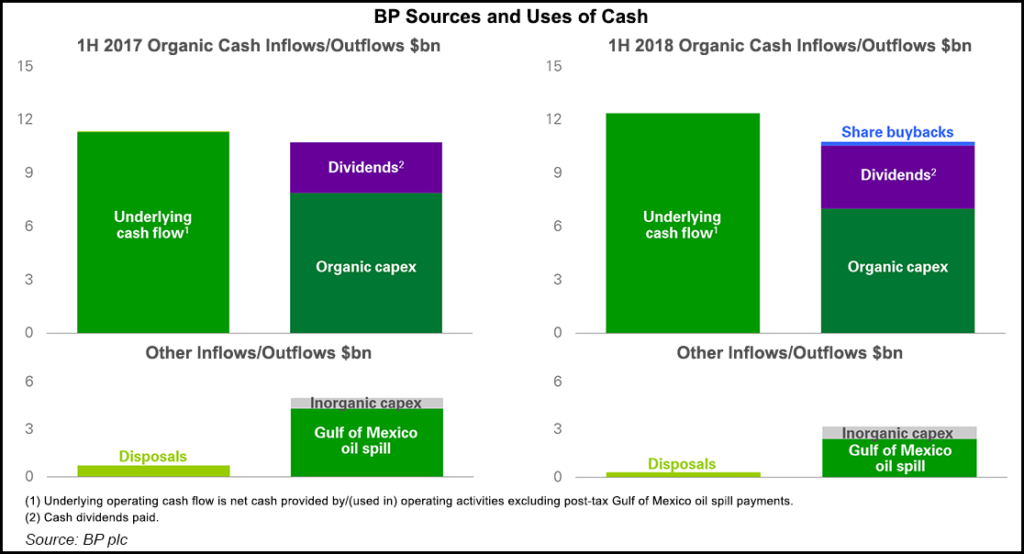

Excluding post-tax amounts related to the Macondo blowout in the Gulf of Mexico (GOM) in 2010, operating cash flow was nearly flat from a year ago at $7.0 billion from $6.9 billion. Including Macondo payments, operating cash flow was $6.3 billion versus year-ago cash flow of $4.9 billion.

Organic capital expenditures totaled $3.5 billion, compared with year-ago spending of $4.3 billion. Unit production costs improved by 3% from a year ago.

Production costs fell year/year to $6.52/boe from $7.25 and from $7.11 in the first quarter.

U.S. upstream profits totaled $742 million, versus $179 million in 2Q2017.

For its Lower 48 production, BP fetched $1.97/Mcf for its natural gas in 2Q2018, versus $2.37 a year ago and $2.24 in the first quarter. Domestic crude oil and natural gas liquids were priced on average at $35.33/bbl in 2Q2018 from $26.94 a year ago and $32.43 in 1Q2018.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |