NOV CEO Says Steel Tariffs Increasing Costs

Houston-based National Oilwell Varco Inc. (NOV) is beginning to see inklings of a recovery in the global oil and gas business, and while it’s not complete, the upturn “creeps a little closer every day,” CEO Clay Williams said.

Speaking during a second quarter conference call, Williams said the industry overall has had to overcome a lot of things since the downturn began in late 2014. While the international markets and offshore businesses are once again picking up, NOV and its peers are now dealing with President Trump’s decision to impose 25% tariffs on steel imports.

“We are managing higher steel costs arising from tariffs as best we can, with most but not all business units reporting that they are able to pass on at least a portion of the higher costs to our customers,” CEO Clay Williams said during a conference call to discuss results last week.

“Other commodities we buy are also seeing cost increases. Resins for our fiberglass pipe products, for instance, have risen 61% since the beginning of the year. All these factors can take a toll on our incrementals and our margins.

“However, our ability to recapture cost increases through pricing appears to be improving as oil prices remain high and as macro driven wins continue to shift slowly to our backs.”

The three-plus years of exploration and production (E&P) company “under investment depletion-driven well declines, strengthening synchronized global economic growth and geopolitical ”flash bang’ events are all conspiring to drive the worldwide excess production capacity cushion down and oil prices up.”

NOV’s oilfield services customers, which comprise about 70% of the revenue base, “are very good at postponing maintenance and cannibalizing equipment and keeping it all together with duct tape and bailing wire through at least the first part of a downturn,” Williams said.

However, customers can only do that for so long, so it has not surprised management that it is now seeing “higher demand for spare parts for rigs, to see more orders for conductor pipe connections, to see higher demand for tubular coating and inspection services, to see more offshore special purpose surveys…”

Embedded in the “demand mosaic,” he said, “are indications increasingly clearer that the E&P industry is getting back to playing offense in a $70/bbl world.”

International markets have begun to grow again, as E&Ps around the world are “stretching and warming up and readying themselves to get back in this game. This includes the offshore.”

Williams also waxed on about technology and best practices, which he said “never cease evolving in the E&P jungle. The current downturn is demonstrating that the low oil price has merely prompted brilliant minds in this industry to think harder and these brilliant E&P minds have steadily lowered the marginal cost to develop and produce oil and gas from conventional basins, unconventional basins and offshore basins…”

The Wellbore Technologies business generated quarterly revenues of $793 million, up 12% sequentially and 29% from a year ago. The ongoing recovery in the United States and seasonal rebound in the Eastern Hemisphere led sequential growth across every business unit in the segment. Operating profit was $38 million, or 4.8% of sales.

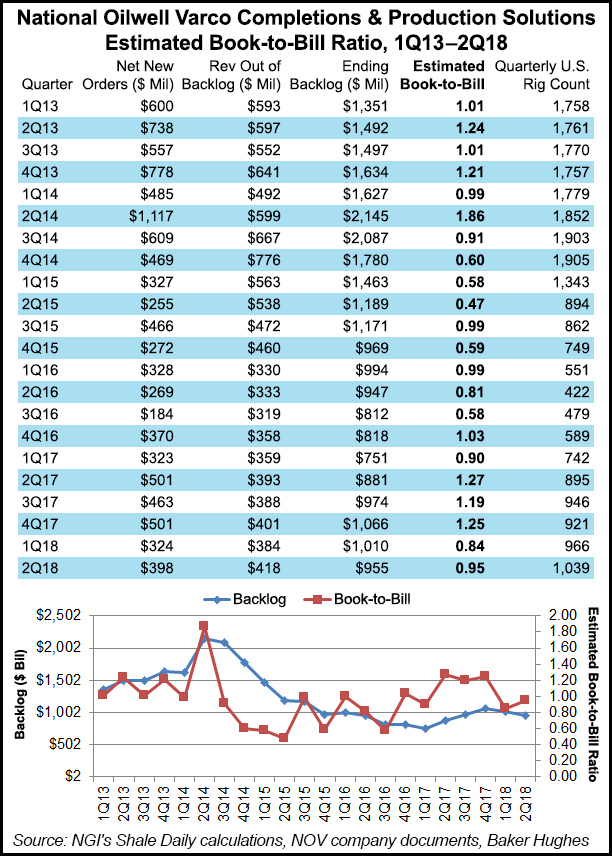

Revenues in the Completion & Production Solutions (CPS) business saw revenues climb 10% sequentially and 13% year/year to $738 million. Improving demand for capital equipment in North America and an increase in deliveries of pressure pumping and composite pipe offset lower revenues from offshore products. Operating profit was $40 million, or 5.4% of sales.

Backlog for capital equipment orders for CPS at the end of June was $955 million. New orders booked during the quarter totaled $398 million, representing a book-to-bill of 95% when compared to the $418 million of orders shipped from backlog.

In Rig Technologies, revenues totaled $651 million in 2Q2018, an increase of 35% sequentially and 19% from a year ago. The sequential increase was attributed to progress on constructing offshore newbuild drilling rigs, delivery of two land rigs in the Middle East and improving aftermarket sales. Revenue shipped from backlog increased by $123 million to $276 million during the quarter. Operating profit was $62 million, or 9.5% of sales.

New orders booked during the quarter totaled $2.03 billion, which included $1.80 billion associated with the recently announced joint venture agreement with Saudi Aramco. The company also agreed to cancel a long-dated drillship equipment package order in exchange for commitments by the customer to continue forward with other projects. The agreement resulted in deleting $282 million from the segment’s backlog.

Backlog for capital equipment orders at the end of June for Rig Technologies was $3.51 billion.

Net income was $24 million (6 cents/share) compared with a year-ago loss of $74 million (minus 20 cents). Revenues climbed 20% year/year and 17% sequentially to $2.11 billion. Operating profit for was $52 million, or 2.5%of sales. Cash flow was $239 million.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |