Record-Setting Week for SoCal as August Natural Gas Futures End on High Note

Big heat-driven spikes in California and the Desert Southwest stood out in an otherwise quiet week for natural gas spot prices; a record-setting day for the volatile SoCal Citygate helped send NGI’s Weekly National Spot Gas Average 21 cents higher to $2.93/MMBtu.

SoCal Citygate, dealing with ongoing constraints on pipeline imports and storage, saw the largest weekly gain, surging $9.04 from the prior week’s already elevated levels to average $19.41. That included trades as high as $41.00 on the way to averaging nearly $40 in day-ahead trading Monday — a record high for data going back to 2008.

Prices outside the citygate also surged as temperatures in California and the Desert Southwest hit triple digits, driving up both natural gas and power prices as SoCal Citygate had to compete with demand further upstream. Kern Delivery added $7.40 on the week to reach $11.55, while SoCal Border Average added $3.64 to $7.33.

Further upstream, the constrained Permian Basin producing region saw prices fall during the week, with West Texas locations giving up more than 30 cents across the board. Waha fell 33 cents to average $1.89.

Much of the rest of the spot market saw modest adjustments for the week. In the Northeast, some warm days in New England supported higher weekly spot prices. Algonquin Citygate notched a 9-cent increase to average $2.83.

The August Nymex futures contract rallied ahead of expiration Friday, with potential August heat and a tight storage picture offering support in a market still heavily weighed down by production.

The front month went off the board on a high note after adding 4.2 cents to expire at $2.822. Gains were more modest further along the strip, with the September contract adding 2.0 cents to settle at $2.782 and January adding 1.4 cents Friday to settle at $3.039. Week/week August picked up 6.5 cents after settling at $2.757 the Friday before.

Bespoke Weather Services noted after Friday’s close that “in this low storage environment with firmer cash relative to prompt month futures we continue to see strong contract expiries.” The firm’s team sees “a market with risk weakly skewed higher but concern about storage not yet high enough to really break prices out. We would want to see a winter-led rally bring the September contract above $2.80-2.82 to really believe that sentiment has shifted back in a bullish direction.

“Yet fundamentals appear to remain quite bullish overall; burns continue to run quite tight on a weather-adjusted basis and though production is still very elevated it sits off recent highs,” the firm said. “Throw in how tight” Energy Information Administration (EIA) storage data has been the past few weeks, “and it becomes harder to believe production is exactly as elevated as estimated.”

Another bullish miss on Thursday from the Energy Information Administration’s (EIA) weekly natural gas storage report failed to spark much of a rally as the market continues to count on production replenishing stockpiles once summer heat subsides.

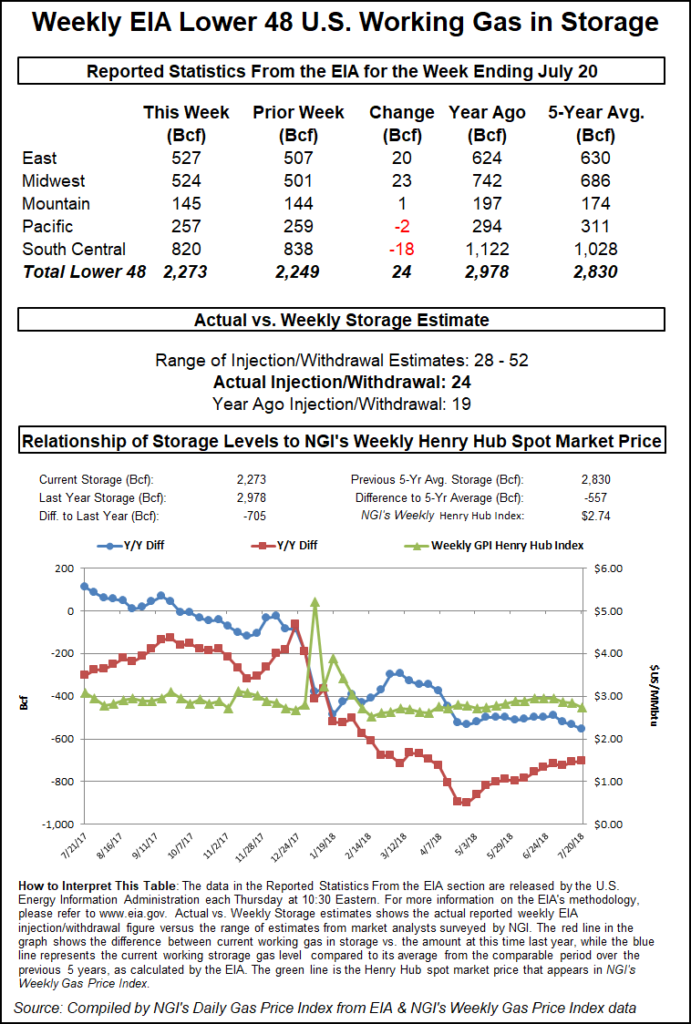

EIA reported a 24 Bcf injection into Lower 48 gas stocks for the week ended July 20, lower than most estimates and well below the five-year average 46 Bcf. Last year, EIA recorded a 19 Bcf injection. Last week’s EIA report covering the week ended July 13 also missed to the bullish side of estimates at 46 Bcf, as surging production has kept a lid on prices but can’t seem to shrink deficits.

Wednesday’s 4.3 cent rally for the front month suggested the market was anticipating a tight EIA report, which may help explain why the immediate price response Thursday was muted. When the number was published at 10:30 a.m. ET, the August Nymex contract picked up about 2.0 cents to trade up around $2.790. By 11 a.m. ET, August was trading around $2.794, up about 1.9 cents from Wednesday’s settle. September, set to take over as the prompt month once August expires Friday, was trading around $2.776, up about 2.1 cents from Wednesday’s settle.

Prior to the report, consensus estimates had the market looking for a build about 10 Bcf higher than the actual figure. A Bloomberg survey had produced a median 36 Bcf injection, with a range of 28 Bcf to 52 Bcf. Intercontinental Exchange EIA Financial Weekly Index futures came closer to the mark, settling Wednesday at an injection of 25 Bcf.

Bespoke Weather Services said the figure came in about 9 Bcf below its estimate, largely because of a “massive draw” reported for the South Central region.

“We had been looking for a small implicit revision from last week’s very tight print, but instead today’s print seemed to confirm last week,” Bespoke said. “The result is a natural gas strip that is remaining quite firm, with December leading in early post-print trading.

“Any winter leadership would be quite bullish moving forward, and short-term we see $2.85 in play off such a supportive print, especially with options expiry today. Any rebound in production will result in a rather quick reversal, though.”

Total working gas in underground storage stood at 2,273 Bcf as of July 20, versus 2,978 Bcf last year and five-year average inventories of 2,830 Bcf. Week/week (w/w), the deficit to last year narrowed from 710 Bcf to 705 Bcf, while the year-on-five-year deficit increased from 535 Bcf to 557 Bcf, EIA data show.

By region, the South Central saw an 18 Bcf withdrawal for the period, including 16 Bcf pulled from salt and 2 Bcf pulled from nonsalt. The Pacific also posted a w/w withdrawal of 2 Bcf, while 1 Bcf was refilled in the Mountain region. The Midwest and East saw injections w/w at 23 Bcf and 20 Bcf, respectively, according to EIA.

“Compared to degree days and normal seasonality, the 24 Bcf injection is about 1.5 Bcf/d tight versus the five-year average,” Genscape Inc. analysts Margaret Jones and Eric Fell said. “Relative to the previous week, total power generation was up about 20 average GWh. Collectively, nuclear and renewable gen were close flat week/week (w/w). Coal was up an estimated 7 average GWh w/w, and gas generation was up about 13 average GWh for an estimated 2.6 Bcf/d more gas burn w/w.”

While inventories sit at a 705 Bcf deficit to last year, “the year-on-year deficit did tighten marginally and is now the smallest it has been since late March,” Jones and Fell noted.

Looking ahead, The Desk’s Early View storage survey issued on Friday showed respondents on average expecting EIA to report a 42.9 Bcf build for the week ending July 27. Responses ranged from 32 Bcf to 51 Bcf. Last year, EIA recorded an 18 Bcf injection, and the five-year average is a build of 43 Bcf.

In the spot market Friday, most regions posted discounts on three-day deals, including in the sweltering California and Desert Southwest; the NGI National Spot Gas Average dropped 21 cents to $2.70/MMBtu.

SoCal Citygate fell $7.16 to average $8.64, still a hefty premium to Henry Hub but downright cheap compared to prices that averaged close to $40 on Monday. Elsewhere in the region, SoCal Border Average shed $2.80 to average $3.78, while in Arizona/Nevada, El Paso S. Mainline/N. Baja plummeted $6.58 to $3.23 as Kern Delivery tumbled $6.09 to $4.26.

“A dangerous heat wave will continue out West through Saturday underneath of a stubborn upper level ridge,” the National Weather Service said Friday. “Temperatures across portions of the Desert Southwest and California are forecast to be in the triple digits, which is as much as 5 to 10 degrees above normal. Excessive heat warnings and heat advisories remain in effect across interior and southern California, far northwest Arizona and southern Nevada.

“Furthermore, another heat wave is expected across the Pacific Northwest, with highs forecast to be in the low to mid 90s for Sunday into Monday. An excessive heat watch is in place across this area.”

Southern California Gas Co. (SoCalGas), which ended a system-wide curtailment watch Thursday in place because of elevated heat-driven demand, was forecasting total system demand to drop to around 2.3 million Dth/d over the weekend, versus an estimated 2.6 million Dth/d on Friday. The utility was expecting demand to bounce back up to around 2.6 million Dth/d after the weekend.

Meanwhile, Intercontinental Exchange power indices for delivery Sunday and Monday showed peak prices in the SP-15 and Palo Verde regions hovering close to $100/MWh after surging above $300/MWh early in the week.

Elsewhere, prices in the Northeast and Midwest dropped heading into the weekend as Radiant Solutions was forecasting comfortable temperatures Monday across a number of major cities in those regions.

The forecaster predicted highs in Chicago on Monday and Tuesday in the upper 70s, while Boston and New York City were expected to start the work week with temperatures averaging near normal, including highs in the low 80s.

Chicago Citygate gave up a nickel Friday to average $2.65, while in the East, Transco Zone 6 New York dropped 7 cents to $2.81.

The weather outlook Friday appeared “relatively bearish” through the middle of the upcoming week “as a series of weather systems with showers and cooling sweep across the Midwest and east-central U.S., including bringing showers deep into the South for a little lighter demand,” according to NatGasWeather. The East Coast was expected to remain warm through the weekend into the early of the upcoming week, “with highs of mid to upper 80s, then warming several additional degrees” during the middle and end of the week “as hot high pressure arrives off the Atlantic Ocean.”

Further upstream in Appalachia, Dominion South dropped 6 cents to $2.39.

While Atlantic Sunrise nears full service, Appalachian producers could soon see even more takeaway capacity hit the market with the east-to-west Nexus Gas Transmission project making strides.

“A simple linear projection based on completion percentages reported in the last few Nexus construction reports suggests that the project is well on track to hit its scheduled mechanical completion in mid-August, almost exactly in line with its implementation plan filed last year,” Genscape analysts Colette Breshears and Laura Munder said.

Genscape analysts expect Nexus to file negotiated rate contracts and tariff information in the coming days that total about 885 MMcf/d of contracts, “representing approximately 60% of the project’s 1.5 Bcf/d of incremental capacity.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |