NGI The Weekly Gas Market Report

Markets | Forward Look | NGI All News Access

California Dreaming? SoCal Citygate August Natural Gas Surges $2-Plus on Heat

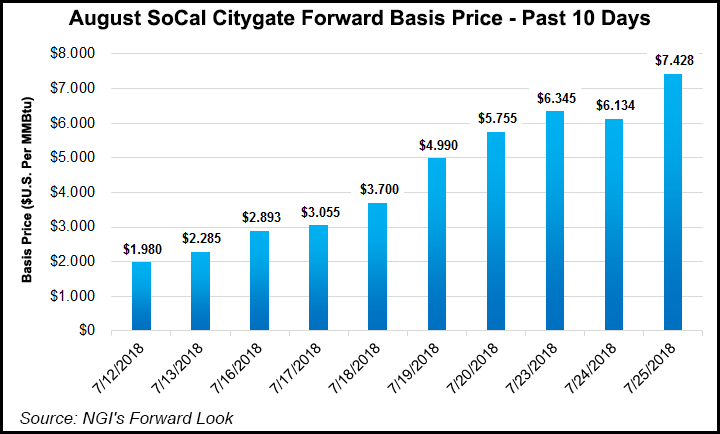

Although much of the United States is expected to get a brief reprieve from hot summer temperatures during the next few days, California will have no such luck as weather forecasts show the state trending even warmer. Already, the intense heat wave had boosted spot natural gas prices to new highs and now, SoCal Citygate August forward prices have increased by a whopping $2.44 from July 19-25, according to NGI’s Forward Look.

The stout gains at SoCal Citygate began late last week when August forward prices jumped 75 cents on Friday (July 20). The prompt month added another 55 cents on Monday but then retreated Tuesday with a downturn in cash prices that had one day earlier skyrocketed to levels not seen since at least 2008. Alas, August prices came roaring back on Wednesday, charging well more than $1 higher even as spot gas prices continued to moderate.

While the most dramatic increases along the SoCal Citygate forward curve were seen at the prompt month, which surged to $10.203 as of Wednesday July 25, the rest of the strip also posted substantial gains, Forward Look data showed. September prices jumped 61 cents to $6.37, the balance of summer (September-October) rose 46 cents to $5.14 and the winter 2018-2019 climbed 27 cents to $4.63.

The rally came as excessive heat warnings were to remain in effect for parts of Southern California through Friday evening. AccuWeather showed daytime highs in Los Angeles near 90 degrees through the end of July and into the first week of August. What’s making matters worse for the state is that, similar to Texas, the demand driver is not only temperatures but also dew point, which, when combined, leads to higher air conditioner use, according to Morningstar Commodities Research natural gas analyst Matthew Hong.

“Dew points in California on the high pricing days have hovered above 60 degrees, with peaks almost hitting 75 degrees. The balance of July should see dew points between 50 and 55 degrees, with similar levels carrying over into August,” Hong said.

Another weather-related factor bumping up prices this summer is higher load in the overnight hours, he said. Average loads in the evening hours this year have been 100 MW to 900 MW higher than July 2017, depending on the specific hour. Higher overnight temperatures boost air conditioner usage, putting additional demand on the California Independent System Operator (CAISO) natural gas generating fleet when renewable assets produce less.

Meanwhile, the increase in CAISO natural gas demand is inversely related to a fall in hydro generation year/year, reflecting lower snow and rainfall precipitation in California, Hong said. Looking at the past 10 years, total precipitation between January and June 2018 is down about 11 inches from the same period in 2017.

“Although 2018 rainfall lows are nowhere near 2013 levels, the current year does rank in the bottom half of the 10-year range. The shortfall caused by less hydro generation is typically met by increased power burn, placing the natural gas generating fleet under additional pressure,” he said.

California has seen a steady increase in natural gas generation this year, with power burn rising from around 300 MMcf/d early in June to around 600 MMcf/d in July, Hong said. And although spot gas prices had been in retreat for the past couple of days, ongoing and additional constraints on the Southern California Gas Co. (SoCalGas) system, along with elevated, heat-induced demand levels, are keeping prices printing double-digit handles.

SoCalGas has an ongoing system-wide curtailment for electric generators because of high system demand. This could be an indicator that withdrawals from the Aliso Canyon storage facility could be announced soon, Genscape Inc. said, as SoCalGas “is stretched thin to maintain system sendout amid ongoing import capacity restrictions.”

The pipeline has been and continues to coordinate with the local balancing authorities, CAISO and the Los Angeles Department of Water and Power, to reduce electric generation demand, but it determined that these voluntary curtailments were insufficient and that this additional mandatory curtailment was needed, Genscape said.

“There is also a new unplanned outage disrupting about 100 MMcf/d” of SoCalGas’ receipts from PG&E at the Wheeler Ridge interconnect. This outage began Wednesday (July 25) and was expected to last through Thursday, according to Genscape natural gas analyst Joe Bernardi.

Firm operating capacity had been limited to 270 MMcf/d; previous month-to-date flows were 382 MMcf/d. Bernardi said, however, that actual flows came in about 20-40 MMcf/d higher than firm operating capacity during a recent smaller maintenance event at this point.

Meanwhile, nominated demand on the SoCalGas system remained above 3 Bcf/d for Thursday, the third day in a row. In addition, Wednesday evening’s cycle nominations were revised upward to breach the 3.2 Bcf/d mark. “While that does mark the high point so far this summer, it is still well shy of last summer’s 3.6 Bcf/d peak,” Bernardi said.

New England Winter Prices Rise

Most other price points across the United States posted gains that were generally in line with the small increases seen in the Nymex futures strip, which picked up no more than a few pennies throughout the curve.

One exception was in New England, where Algonquin Citygate saw its prompt winter strip jump 10 cents from July 19-25 to reach $7.52, likely on the news that the regional electric grid operator was ending its winter reliability program. That means non-gas-fired generation would not have oil/liquefied natural gas (LNG) subsidized this coming winter.

Interestingly, despite fuel security risks tied to New England gas market constraints, no LNG-fired units participated in last winter’s program. This indicates that the LNG used to fuel Exelon Corp.’s Mystic generating station was not subsidized during the incredibly volatile 2017-2018 heating season.

Mystic’s size (boasting the highest nameplate capacity of any station in Massachusetts) and fuel security (because it is not reliant on the often constrained Algonquin pipeline) make it crucial to the Independent System Operator New England stack, “as seen when Mystic fell out of the stack amidst high demand last April,” Genscape natural gas analysts Josh Garcia and Robert Lance said.

Regarding the Nymex futures curve, the August contract settled Thursday at $2.78, up a mere half-cent on the day despite yet another bullish miss on storage injection expectations. During the July 19-25 period, the prompt month gained just 2 cents.

The fact that prices failed to break out of their recent range provided a clear signal that the market remained confident in production’s ability to meet demand, even this coming winter when storage inventories are significantly lacking.

The Energy Information Administration (EIA) reported a 24 Bcf injection into Lower 48 gas stocks for the week ended July 20, lower than most estimates and well below the five-year average 46 Bcf. Last year, EIA recorded a 19 Bcf injection. Total working gas in underground storage stood at 2,273 Bcf as of July 20, versus 2,978 Bcf last year and five-year average inventories of 2,830 Bcf. Week/week, the deficit to last year narrowed from 710 Bcf to 705 Bcf, while the year-on-five-year deficit increased from 535 Bcf to 557 Bcf, EIA data show.

Looking further ahead, there is a high likelihood of deficit reductions in each of the subsequent two storage inventory reports, Mobius Risk Group analysts said. While directionally the market is not expecting a string of bullish data points, the lack of an increasingly bearish trend could be seen as supportive. “…a 700 Bcf year-over-year storage deficit can only be accepted for so long.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 | ISSN © 1532-1266 |