Natural Gas Futures Gain Ahead of EIA Report as Deficits Seen Growing; SoCal Moderates

Natural gas futures rallied Wednesday ahead of a government storage report expected to show deficits increase for the third straight week, while the potential return of heat to the East in August and a small dip in pipeline production estimates also offered support.

In the spot market, prices continued to moderate in Southern California and the Desert Southwest as the region manages through a heat wave that sparked record gains this week; the NGI National Spot Gas Average fell 2 cents to $2.91/MMBtu.

The August Nymex futures contract, set to expire Friday, added 4.3 cents to settle at $2.775 after probing as high as $2.777. September settled at $2.755, up 3.6 cents, while January added 3.2 cents to settle at $3.021.

The midday weather data Wednesday trended slightly hotter for the East “late next week and beyond to add a few” cooling degree days, according to NatGasWeather. Still, “the hot upper ridge needs to prove it will gain territory over the northern and eastern U.S. during the first and second weeks of August, which the data has been a little hotter on overall but likely needs more data to come on board to be considered full-fledged bullish.”

The August and September contracts have bounced off support at around $2.70, “giving the bulls some momentum as we approach an important” Energy Information Administration (EIA) storage report and front-month expiration, NatGasWeather said.

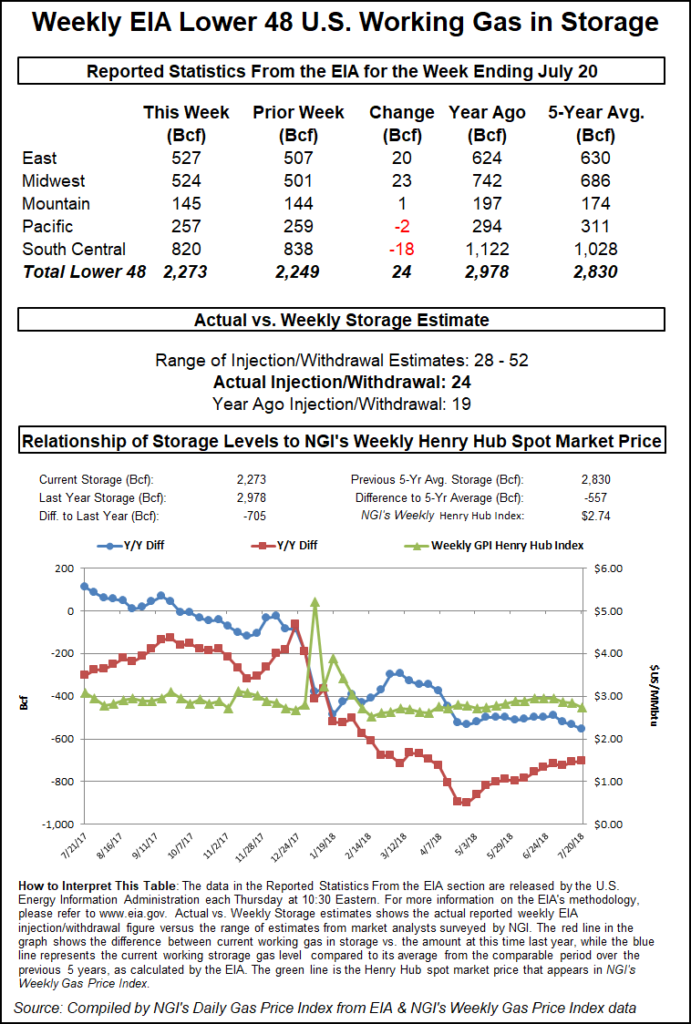

Estimates for this week’s EIA report point to another lean build that would grow the year-on-five-year deficit, as summer heat has kept stockpiles in check despite record-level production.

A Bloomberg survey showed traders and analysts expecting a median 36 Bcf injection for the week ended July 20, with a range of 28 Bcf to 52 Bcf. IAF Advisors analyst Kyle Cooper called for a 30 Bcf injection, while Intercontinental Exchange EIA Financial Weekly Index futures settled Tuesday at an injection of 27 Bcf.

Last year, EIA recorded a 19 Bcf injection, while the five-year average is a build of 46 Bcf.

Last week’s report covering the week ended July 13 missed to the bullish side of estimates at 46 Bcf, showing a stubborn year-on-five-year deficit not only sticking around but widening to well over 500 Bcf.

Still, Price Futures Group analyst Phil Flynn said he for one isn’t fretting storage deficits, an attitude seemingly reflected in prices.

“I think the only reason we’re seeing these supply deficits is because of the heat and because there’s not been a lot of incentive to store gas,” Flynn told NGI. “My belief is as soon as we hit shoulder season, as soon as the heat gives us a break,” deficits will shrink.

Genscape Inc. affiliate SpringRock’s estimates Wednesday were showing a 0.9 Bcf/d decline day/day (d/d) in Lower 48 production, though the firm noted that daily pipeline-reported revisions recently have added as much 1 Bcf/d to that total.

“The initial top-day estimate based off grossed up pipeline nominations is showing Lower 48 volumes down to 78.65 Bcf/d, led by nearly 0.5 Bcf/d of declines out of the Northeast, about 0.2 Bcf/d of drops in the Gulf of Mexico and a over 0.1 Bcf/d drop out of the San Juan,” Genscape senior natural gas analyst Rick Margolin said.

“Northeast estimated declines are spread across all regions, with the largest (0.18 Bcf/d) out of Ohio, led by a nearly 0.11 Bcf/d d/d drop in receipts on REX gathering systems in Monroe County,” Margolin said. “West Virginia’s pipeline sample is also down around 0.1 Bcf/d d/d with more than half the declines occurring on Equitrans’ receipt meter from the Mobley processing plant.”

Meanwhile, the prospect of an improved trading relationship with Europe gave U.S. liquefied natural gas (LNG) players some potentially good news Wednesday, teasing new demand-growth opportunities to soak up some of the North American market’s abundant supply.

At press-time, President Trump, finishing up a meeting with European Commission President Jean-Claude Juncker, apparently reversed course on his trade war with the U.S. allies, telling a televised news conference that under new policies the European Union would be resolving steel and aluminum tariffs problems with the United States, while importing soybeans and “massive” amounts of LNG. No formal statement was immediately available.

Turning to the spot market, SoCal Citygate fell for the second straight day after averaging close to $40 on Monday. But with a heat wave continuing to put pressure on the region’s natural gas and electric infrastructure, prices inside the citygate remained at an exorbitant premium Wednesday, averaging $15.02 even after giving up $3.35 d/d.

“Dangerous heat still remains across the Southwest and parts of the western U.S. where excessive heat warnings and heat advisories remain in effect through at least Thursday,” according to the National Weather Service. “Temperatures begin to moderate by Friday — although will still be above the century mark, especially for Southern California and the Southwest.”

Radiant Solutions was calling for highs in Burbank, CA, to hit 100 degrees Thursday before easing to 96 Friday, with average temperatures around 10-13 degrees hotter than normal.

Even after a steep drops since Monday, prices at SoCal Citygate remain among the most expensive Daily GPI has recorded there for data going back to 2008. The previous record highs at the location came this past February, when averages approached $20.

The more moderate spot prices since Monday have likely been helped by “modestly lower demand and some relief of constraints,” according to Genscape’s Margolin. “Monday’s demand estimate was revised down by about 0.1 Bcf/d to come in at 3.024 Bcf/d, and Tuesday’s evening nominations are lower than evening nominations for Monday at 3.096 Bcf/d. El Paso Natural Gas lifted” a force majeure declared Monday at its Willcox compressor “on the South Mainline in Arizona, and San Diego Gas & Electric (SDG&E) cancelled a previously called Stage 4 Low Operational Flow Order.

“However, notices of stressed operating conditions remain in effect on El Paso, Kern River and Southwest Gas serving the Las Vegas area,” Margolin said. Both Southern California Gas (SoCalGas) and SDG&E “are keeping in effect gas curtailment programs. In addition, the heat wave driving all of this is forecast to stick around into early next week.”

Other points in the region also moderated, with Socal Border Average giving up $1.86 to average $6.98, while in Arizona/Nevada, El Paso S. Mainline/N. Baja shaved off 9 cents to $9.95 and Kern Delivery dropped $1.72 to $10.36.

Much of the rest of the spot market saw minor adjustments Wednesday as the latest NWS six- to 10-day outlook advertised more comfortable near- to below-normal temperatures stretching from the Southeast and Gulf Coast to the Upper Midwest and Northern Plains.

NatGasWeather said Wednesday that it expects “a relatively bearish pattern to play out late this week through the middle of next week as a series of weather systems and cool fronts sweep across the Midwest and east-central U.S., including deep into the South, easing national demand to lighter levels.”

In the Midwest, Chicago Citygate added 4 cents to average $2.69, while farther East, Transco Zone 6 New York picked up a nickel to $2.88.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |