Bullish Surprise from EIA Sparks Natural Gas Futures Rally; SoCal Spot Blowout Continues

Not quite a wake-up call, but government storage data showed an injection well below expectations Thursday, shaking up the natural gas futures market and prompting a rally as bearish production took a backseat for at least one session.

In the spot market, hot temperatures and higher demand for gas-fired power generation extended this week’s price blowout at the volatile SoCal Citygate; with underwhelming forecasts sinking prices in the Midwest and East, the NGI National Spot Gas Average slipped 2 cents to $2.68/MMBtu.

The August Nymex futures contract settled 4.8 cents higher at $2.769 after trading trading as high as $2.776. September added 4.7 cents to settle at $2.736.

A bullish surprise from the Energy Information Administration’s (EIA) weekly natural gas inventory report Thursday served up a clear reminder that even as production growth has dominated the market’s thinking as of late, it hasn’t made a dent in storage deficits — yet.

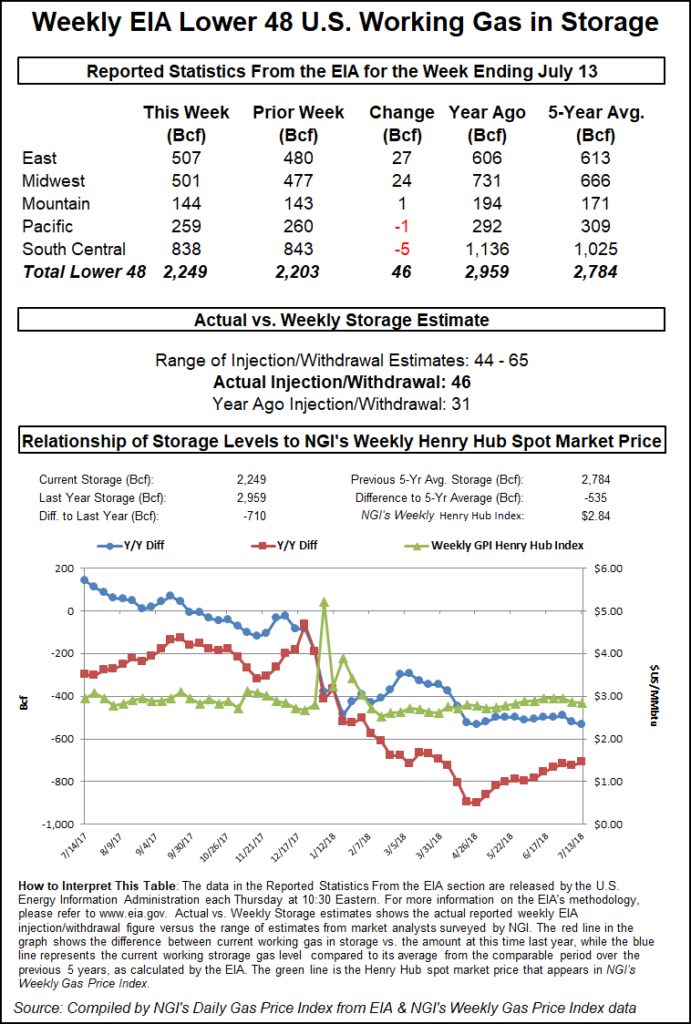

EIA reported a 46 Bcf injection into Lower 48 gas stocks for the week ended July 13, roughly 10 Bcf below consensus estimates based on major surveys. The build also fell below the five-year average 62 Bcf injection. Last year, EIA recorded a 31 Bcf build for the period.

With Thursday’s report marking the second straight week that injections have lagged the five-year average by a wide margin, the bears — firmly in control heading into the session largely because of surging production — seemed to concede that they had gone too far given the risks posed by large inventory deficits.

The number, released at 10:30 a.m. ET, immediately sparked a rally for the prompt month, with prices popping to $2.750-2.760 after languishing down around $2.710 earlier in the morning.

By 11 a.m. ET, the August contract was trading around $2.770, up about a nickel from Wednesday’s settle and near where it ended the session.

Prior to the report, surveys showed the market looking for a build closer to 55 Bcf. A Bloomberg survey of traders and analysts had produced a median 56 Bcf build, with a range of 44 Bcf to 65 Bcf. Intercontinental Exchange EIA Financial Weekly Index futures had settled Wednesday at an injection of 54 Bcf.

“This EIA print was tight enough to have us increasingly seeing more upside for natural gas prices…and accordingly the $2.80 level we first said was in play Wednesday appears all the more in play short-term, as it likely gets tested following the bullish reversal candle today,” Bespoke Weather Services told clients Thursday.

Still, Bespoke pointed to weakness along the winter strip as evidence that the market has its doubts about the tight EIA report, suggesting it may not have much interest in rallying further.

“It is difficult to chalk this week’s EIA miss up to any one factor,” Bespoke said. “Production may be overestimated, burn/demand tightness may be underestimated and/or the holiday impact from the Fourth of July may have been underestimated. Whatever the reason, the natural gas market is tighter than previously expected, and we would need to see material evidence of it loosening to not expect to find prices increasingly bid into the winter (or at the very least see only very limited downside).”

Total working gas in underground storage stood at 2,249 Bcf as of July 13, versus 2,959 Bcf last year and five-year average stocks of 2,784 Bcf, EIA said. Week/week, the year-on-year deficit narrowed from 725 Bcf to 710 Bcf, while the year-on-five-year deficit grew from 519 Bcf to 535 Bcf, EIA data show.

The lean implied flow for the period included net withdrawals in the South Central and Pacific regions. In the South Central, an 8 Bcf pull from salt offset 3 Bcf refilled in nonsalt for the week, according to EIA. The Pacific saw a withdrawal of 1 Bcf. The East and Midwest regions saw the bulk of the injections on the week at 27 Bcf and 24 Bcf, respectively. In the Mountain region, 1 Bcf was injected.

Given low inventories for fast-cycle salt storage heading into the winter, natural gas prices should average $3.40 for 1Q2019, according to a BofA Merrill Lynch Global Research report Thursday.

The firm’s forecast would mean a sharp increase from the current winter strip, with the January contract failing to finish above $3.00 Thursday.

“A low inventory backdrop, especially the salt component, could result in higher Nymex natural gas prices and increased volatility this winter season,” the BofA analysts wrote. “In just three weeks of cold in December 2017 and January 2018, the salt inventories drew down to untenably low levels. Then a mild February 2018 luckily solved the low salt inventory problem by destroying nearly 150 Bcf of natural gas demand.

“We now expect salt inventories to enter this winter at unsustainably low levels,” the analysts said. “Even under normal weather we see a risk of natural gas in salt storage falling below levels last seen during the 1Q2014 Polar Vortex. As such, the low salt inventory path drives our constructive short-term price forecast of $3.15 for 4Q2018 and $3.40 for 1Q2019.”

That said, production growth may limit any winter rally, according to BofA.

“Strong production increases” are likely to overwhelm demand growth from liquefied natural gas exports, Mexico exports and the industrial sector, analysts said. “We expect the loose market balance to lead to total inventories above normal levels by late 2019, putting the market at risk of storage congestion in 2020. In addition to the supply and demand fundamentals, we expect the hedge flows to pressure the back of the natural gas curve as well.

“We see meaningful hedge potential from renewable energy projects as well as from natural gas producers. Our new average price forecast of $2.55 in 2020, down from $2.75 prior, reflects these bearish longer term fundamentals and hedge flows.”

Turning to the spot market, an uptick in heat-driven demand and infrastructure constraints continued to wreak havoc on SoCal Citygate spot prices Thursday, as the location followed up Wednesday’s $1.60 day/day jump by surging another $4.29 to average $13.36.

Utilities Southern California Gas Co. (SoCalGas) and San Diego Gas & Electric Co. issued a system-wide curtailment watch Thursday. “High temperatures across the region have increased demand for natural gas electric generation,” the utilities said. “The high temperatures are expected to continue through the weekend and into next week.”

Radiant Solutions was forecasting highs in the upper 80s and low 90s the next couple days in Burbank, CA, with highs expected to push into the upper 90s by Monday.

SoCalGas reported actual system sendouts for Wednesday of more than 3 million Dth/d, about 300,000-400,000 Dth/d more than what it had been estimating a day earlier. With total receipt capacity capped at around 2.6 million Dth/d, SoCalGas reported a net storage withdrawal for Wednesday of 465,000 Dth/d. This comes as the utility has only restricted use of its Aliso Canyon facility following a 2015 leak that drew public outcry and regulatory scrutiny.

SoCalGas was forecasting demand to remain around 2.8-3 million Dth/d through the end of the week.

Further complicating matters for a market that has been operating on thin margins for some time now, SoCalGas reported an unplanned maintenance event through Friday that is requiring a retrofit of its L5000 pipeline, reducing capacity through the El Paso-Ehrenburg and North Baja Pipeline-Blythe locations by 260 MMcf/d.

SoCal Border Average fell 13 cents to average $3.73 Thursday. Further upstream, El Paso S. Mainline/N. Baja tumbled 43 cents to $4.00, while Kern Delivery shed 99 cents to $3.58.

In the Midwest and East, prices dropped amid cooler temperatures sweeping through over the next few days. Radiant was calling for highs in Chicago in the mid-70s into the weekend, with highs in New York City expected to fall to 80 by Saturday.

Joliet dropped 5 cents to $2.58, while Transco Zone 6 New York shed 6 cents to $2.77.

Prices fell throughout most of Texas Thursday even as forecasts called for miserably hot temperatures from Dallas in North Texas to Houston on the coast to close out the week. Dallas was expected to see highs climb to 110 degrees by Saturday, with temperatures averaging about 10.5 degrees hotter than normal, according to Radiant. The firm was calling for Houston to see highs reach 101 degrees by Saturday.

The heat this week helped set a new record for peak power demand for the Electric Reliability Council of Texas (ERCOT), with the grid operator reaching an all-time systemwide peak of 71,438 MW Wednesday afternoon, breaking the previous record of 71,110 MW set on Aug. 11, 2016.

“Texans continue to deal with extreme heat across the state as ERCOT and electricity providers are working diligently to ensure they have the power they need to keep cool,” the grid operator said. “We fully expect to keep hitting new demand records as summer 2018 continues.”

That outlook jives with an analysis from Morningstar Commodities Research published prior to ERCOT’s announcement.

Houston Ship Channel fell a nickel to $2.84, while further south Tres Palacios gave up 5 cents to $2.73.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |