Markets | LNG | NGI All News Access

Canada Producers Need LNG Exports to Survive Low-Cost U.S. Gas, Says CERI

Only liquefied natural gas (LNG) exports can prevent a decades-long Canadian production slump in retreat from competition by low-cost U.S. supplies, said a state-of-the-industry review issued Wednesday.

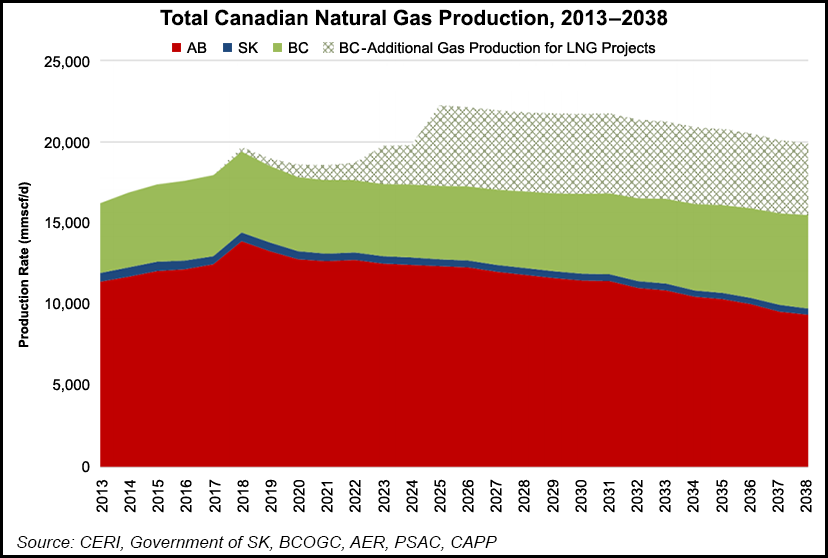

The Canadian Energy Research Institute (CERI) predicted national total output will erode by 15% to 15.4 Bcf/d over the next 20 years unless Pacific coast LNG terminal projects score breakthroughs into construction.

Without LNG successes that have eluded project sponsors for nearly a decade, “Canadian production is expected to decrease out to 2038 because of the declining trend of Canadian natural gas exports to the United States and increased imports from the U.S.,” CERI’s report said.

The country’s currently conceivable LNG potential is 5 Bcf/d, according to Canadian Crude Oil and Natural Gas Production, Supply Costs, Economic Impacts and Emissions Outlook (2018-2038).

CERI, an industry and government-supported independent agency, hedged its bets. The researcher only “assumes” breakthroughs into overseas gas markets are coming to enable Canadian gas production to climb by 13% to 20.4 Bcf/d as of 2038.

“This amount could be perceived as optimistic, but still feasible” if British Columbia (BC) projects take final investment decisions between now and 2020, CERI said.

A decision is imminent by lead sponsor Royal Dutch Shell plc on the biggest surviving BC project, LNG Canada, and the associated Coastal GasLink pipeline.

CERI called the LNG outlook one of three gas “major uncertainties,” along with future prospects for replacing coal in thermal power stations and evolving trade across the Canada-U.S. border.

The new report’s doubts echo an LNG competitiveness study CERI released last week, which said tax and industry cost cuts are essential for Canadian projects even to break even on increasingly crowded Asian and European markets.

Power generation is a potential positive for overall North American gas sales, but the trend in continental trade patterns is liable to continue to be a negative for the Canadian industry, CERI researchers said.

The report pointed out that Alberta, BC and Saskatchewan deliveries to Ontario and Quebec on TransCanada Corp.’s cross-country Mainline dropped by 64% to 2.17 Bcf/d in 2017 from 5.97 Bcf/d in 2006.

Eastern Canadian imports from the United States of relatively nearby, low-cost Marcellus Shale gas grew to 2.5 Bcf/d. Total cross-border pipeline capacity potentially available for Ontario and Quebec could enable northbound American exports to double to 5.4 Bcf/d, CERI said.

As the brightest hope on the Canadian gas industry horizon, LNG exports would spin off a gas byproduct bonus by driving a 43% jump in premium-value, gasoline-like condensate to 311,000 b/d, according to the forecast.

U.S. oil and liquids producers already reap an international marketing bonus from refinery imports of discount-priced Canadian heavy crude and bitumen, noted CERI.

“Because the U.S. has allowed for oil exports effective 2015, it can now monetize its light shale oil at the premium price in export markets, while refining cheaper heavier oil domestically. This model allows for sustaining and even increasing Canada’s oil exports to the U.S. in parallel to U.S. shale oil developments.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |