ICD, Sidewinder Combining U.S. Land-Based Drilling Fleets

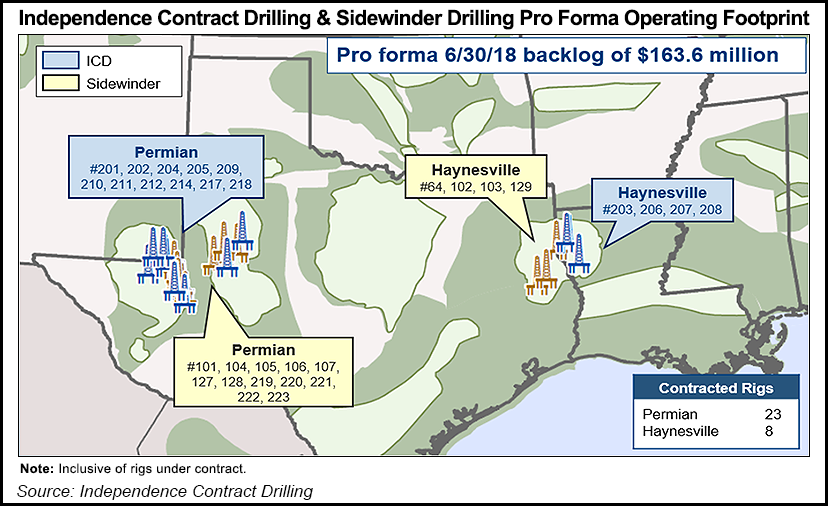

Houston-based Independence Contract Drilling Inc. (ICD) on Thursday said it would merge with cross-town rival Sidewinder Drilling LLC, a combination that would bring together contract drilling fleets concentrated in the Permian Basin and Haynesville Shale.

Under the definitive merger agreement, ICD would acquire all of the outstanding equity in Sidewinder, giving it a majority stake at 51% and an enterprise value estimated at $200 million. The deal would more than double the size of ICD’s pad-optimal rig fleet to 34 rigs, following “modest” upgrades to five Sidewinder rigs.

“The benefits to ICD of this combination are significant, and the industrial and geographic fit is obvious,” said CEO Byron Dunn. “We expect to gain significant size and scale, expand growth opportunities and realize significant synergies.

“We also expect to strengthen our cash flows and balance sheet, add operational expertise and capabilities, and create significant opportunities to market additional rigs into our expanding customer base.”

Sidewinder, formed in 2011, shares complementary fleets and operations with ICD, as well as “a common focus and commitment to safety, operational excellence and customer service,” said CEO Anthony Gallegos, who is to run the combined company.

“Through the combination of our operations and premier assets strategically located in North America’s most active basins, I believe we have compelling opportunities for operational synergies and growth as well as career advancement for the employees of both companies.”

ICD’s fleet in the first three months of this year operated at 100% utilization and recorded 1,259 revenue days, compared to 100% utilization and 1,289 revenue days in 4Q2017, and 91.7% utilization and 1,073 revenue days in the year-ago period.

All 14 of the its proprietary walking rigs known as ShaleDrillers, were contracted and operating under term contracts. The backlog of revenues from contracts at the end of March, with original terms of six months or more, was $52.7 million. About 84% of the backlog was expected to be realized during the remainder of 2018.

Privately held Sidewinder has 19 total rigs, including 16 contracted, with 13 high-tech, aka “super-spec,” alternating current (AC) walkers, according to Tudor, Pickering, Holt & Co. (TPH).

ICD expects to achieve synergies with the combination of more than $8 million once the merger is completed, which is expected before the end of the year. The transaction needs customary regulatory approvals and a thumbs’ up from ICD shareholders. Under the terms of the transaction, Sidewinder unitholders would receive an aggregate of 36.75 million shares of ICD common stock, representing about 49% of the total outstanding shares. ICD also would assume an estimated $50 million of Sidewinder net debt.

The combined board is to consist of four existing ICD board members, including Chairman Thomas R. Bates, and two members appointed by the controlling owners of Sidewinder. ICD CFO Philip Choyce would continue as financial chief.

The merger has been unanimously approved by the boards and received the requisite approval of Sidewinder unitholders. Evercore ISI acted as ICD’s financial adviser.

In conjunction with the signing of the merger agreement, ICD received binding commitments for a $130 million, secured, five-year term loan and a $40 million revolving credit facility, with proceeds to be used to refinance existing debt and the Sidewinder debt.

ICD plans to upgrade Sidewinder’s four silicon-controlled rectifier rigs, which should cost about $12.5 million and take about a year, TPH said. ICD also wants to reactivate/upgrade one lower-spec AC-rig, which would cost around $8 million.

Because “size and scale” are important in today’s drilling environment, the combination is a good one, TPH analysts said. They estimated the enterprise value at roughly $200 million using ICD’s stock closing price on Wednesday of $4.06.

Once the upgrades are completed, “ICD will more than double its fleet to 34 total pad-optimal rigs,” said the TPH team. “Strategically, while slightly dilutive to asset quality, this transaction makes sense for ICD as it helps to improve growth prospects (company is growth-constrained today) while also immediately improving public float.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |