Markets | NGI All News Access | NGI Data

EIA’s Big Bullish Storage Miss Shakes Up Natural Gas Market Lulled by Production

A bullish surprise from the Energy Information Administration’s (EIA) weekly natural gas inventory report served up a clear reminder that even as production growth has dominated the market’s thinking as of late, it hasn’t made a dent in storage deficits — yet.

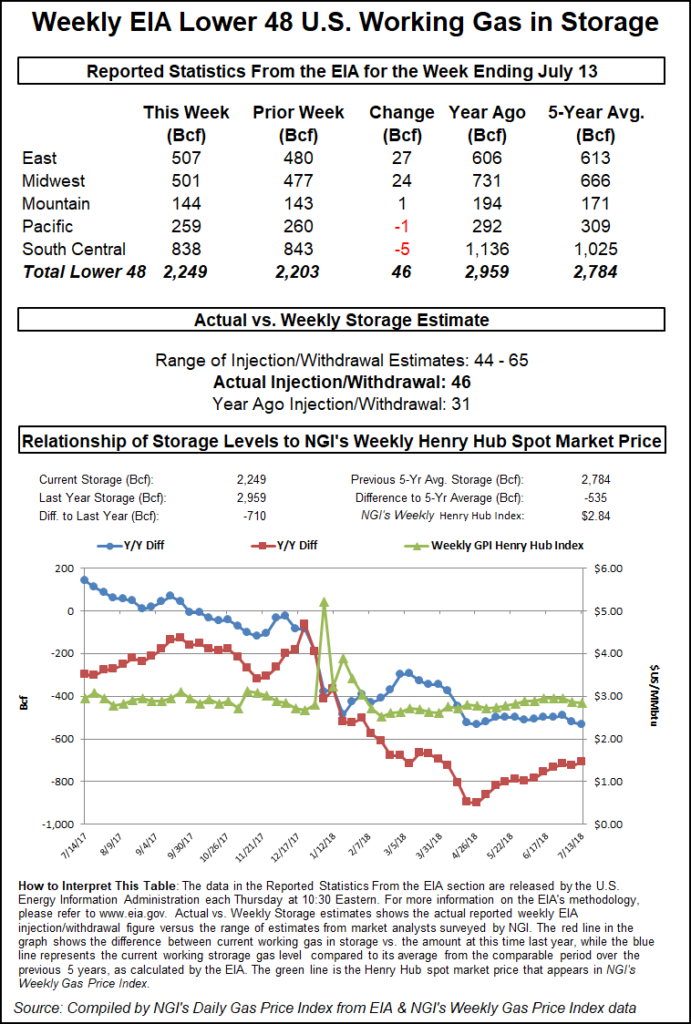

EIA reported a 46 Bcf injection into Lower 48 gas stocks for the week ended July 13, roughly 10 Bcf below consensus estimates based on major surveys. The build also fell below the five-year average 62 Bcf injection. Last year, EIA recorded a 31 Bcf build for the period.

With Thursday’s report marking the second straight week that injections have lagged the five-year average by a wide margin, the bears — firmly in control heading into the session largely because of surging production — seemed to concede that they had gone too far given the risks posed by large inventory deficits.

The number, released at 10:30 a.m. ET, immediately sparked a rally for the prompt month, with prices popping to $2.750-2.760 after languishing down around $2.710 earlier in the morning.

By 11 a.m. ET, the August Nymex futures contract was trading around $2.770, up about a nickel from Wednesday’s settle.

Prior to the report, surveys showed the market looking for a build closer to 55 Bcf. A Bloomberg survey of traders and analysts had produced a median 56 Bcf build, with a range of 44 Bcf to 65 Bcf. Intercontinental Exchange EIA Financial Weekly Index futures had settled Wednesday at an injection of 54 Bcf.

Bespoke Weather Services said this week’s figure came in “a whopping 15 Bcf below our expectation. This indicates that there was significantly more holiday in the print last week than expected, and that the natural gas market is materially tighter” than previously thought.

“This appears due both to power burns that have tightened markedly over the past few weeks as well as production that has pulled back from record highs (and may potentially be overestimated),” Bespoke said. “Unimpressive forecasts could limit how far prices have to run off this bullish print, but we had already been watching for a test of $2.80 that appears more likely following a print that should make the market care more about demand again.”

Total working gas in underground storage stood at 2,249 Bcf as of July 13, versus 2,959 Bcf last year and five-year average stocks of 2,784 Bcf, EIA said. Week/week, the year-on-year deficit narrowed from 725 Bcf to 710 Bcf, while the year-on-five-year deficit grew from 519 Bcf to 535 Bcf, EIA data show.

The lean implied flow for the period included net withdrawals in the South Central and Pacific regions. In the South Central, an 8 Bcf pull from salt offset 3 Bcf refilled in nonsalt for the week, according to EIA. The Pacific saw a withdrawal of 1 Bcf. The East and Midwest regions saw the bulk of the injections on the week at 27 Bcf and 24 Bcf, respectively. In the Mountain region, 1 Bcf was injected.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |