Another Light EIA Build Expected as NatGas Futures Slide; SoCal Spikes Again

The prospect of low stockpiles heading into the winter hasn’t bothered natural gas futures traders as of late, a trend that continued Wednesday as prices fell ahead of government storage data expected to show another leaner-than-average build. In the spot market, SoCal Citygate turned in another day of volatility, gaining big as most other regions pulled back; the NGI National Spot Gas Average dropped 4 cents to $2.70/MMBtu.

August Nymex futures settled 1.9 cents lower at $2.721 Wednesday after trading as high as $2.754 and as low as $2.720. The September contract settled 1.8 cents lower at $2.689, while January fell 1.4 cents to settle at $2.954.

Weaker cash prices driven by cooler short-term forecasts helped drag down prompt-month prices into support right at $2.72, according to Bespoke Weather Services.

“Yet increasingly we are seeing the market tighten on a weather-adjusted basis, with adjusted power burns remaining quite tight…and production apparently pulling back modestly from recent record highs,” Bespoke said. “This tightness has been masked by weather forecasts that have trended cooler in the medium- and long-range,” a trend that’s showing early signs of reversing heading into early August.

“Over the past few weeks the natural gas market has been lulled to sleep as production levels rose high enough to ease any significant concerns about limited stockpiles headed into the winter season,” the firm said. The market may be “attempting to put in a short-term bottom around the $2.72 level” even as it’s unlikely to start showing more concern about storage “until the first serious cold makes it a significant risk.”

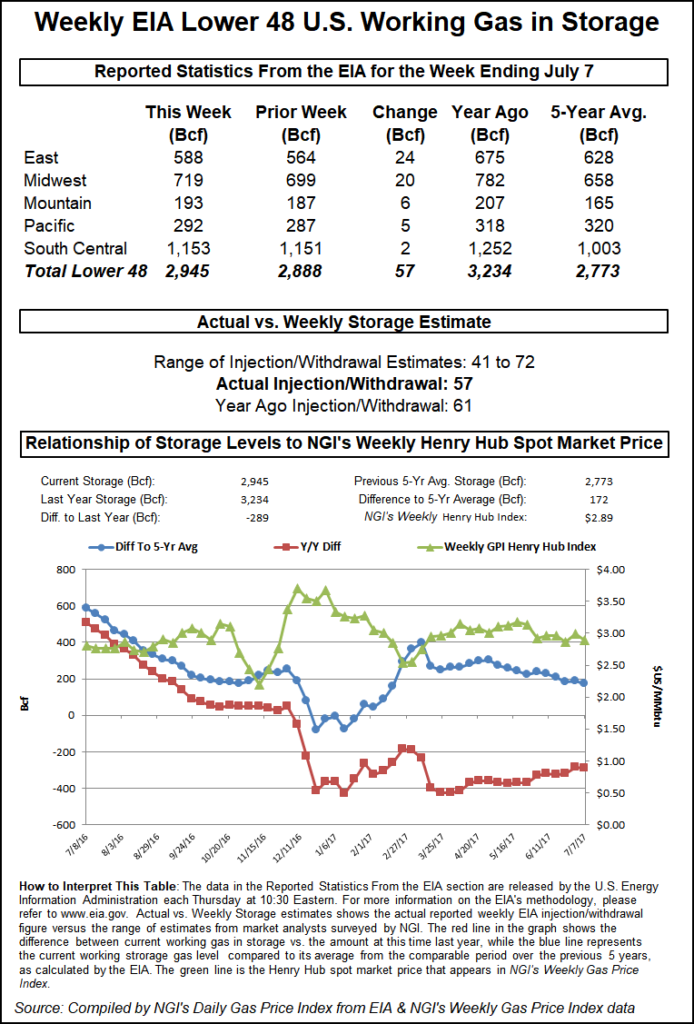

Estimates for Thursday’s Energy Information Administration (EIA) storage report point to another lighter-than-average inventory build this week. A Bloomberg survey of traders and analysts produced a median 56 Bcf build for the week ending July 13, with responses ranging from 44 Bcf to 65 Bcf.

Last year, EIA recorded a 31 Bcf injection, and the five-year average is a build of 62 Bcf. Last week, EIA reported a 51 Bcf injection for the week ended July 6, well below the five-year average 77 Bcf injection.

IAF Advisors analyst Kyle Cooper called for a 56 Bcf build for the upcoming report, while Intercontinental Exchange EIA Financial Weekly Index futures settled Tuesday at an injection of 54 Bcf.

Genscape Inc.’s latest production data Wednesday showed total Lower 48 volumes dipping back below the 80 Bcf/d threshold on a drop in volumes from the Permian Basin, according to senior natural gas analyst Rick Margolin.

Earlier in the week, Permian volumes on average fell below 8 Bcf/d for the second day this month, “though those volumes were revised to just a tick above 8 Bcf/d,” Margolin said. “However, volumes out of the area are still running about 0.3 Bcf/d below” levels from earlier in the month.

“We are seeing notable drops in interstate receipts from the Ramsay and Midkiff facilities/areas,” he said. “Ramsay plant volumes hitting El Paso Natural Gas had at one point dropped more than 0.5 Bcf/d. It is unclear if any volumes out of the plant are getting re-routed to nontransparent” intrastate pipelines.

The dip in supply comes as power burns are likely to pull back over the next few days, though July is still on a record-setting pace, according to Margolin.

“Our proprietary estimate of burns showed Monday’s levels hit 41.6 Bcf/d, the highest daily mark since August 2016,” Margolin said. “This has lifted the July month-to-date (MTD) average to 37.75 Bcf/d, the highest since at least 2008 and about 4.6 Bcf/d above the previous July MTD mark from 2012.

“Though moderately cooler temperatures are not expected to get burns back above the 40 Bcf/d mark in the next 14 days, forecast levels are expected to put the total month average on track for a record-setting 36.9 Bcf/d.”

In the spot market Wednesday, SoCal Citygate spiked yet again, jumping $1.60 to average $9.07, the highest the location has traded since February, when average prices peaked at close to $20.00. Wednesday’s day-ahead average also tops the recent high of $8.28 recorded July 5, when forecasts showed a wave of triple-digit temperatures hitting the Southern California market.

Radiant Solutions was calling for above-normal temperatures in Burbank, CA, over the next several days, but nothing so toasty as the heat that beset the region earlier in the month. The forecaster was expecting highs in the upper 80s through the end of the work week, with highs climbing into the mid- to upper-90s next week.

Utility Southern California Gas Co. (SoCalGas) has been operating with a number of ongoing constraints on pipeline imports and storage that have at times contributed to significant volatility for SoCal Citygate prices.

SoCalGas was forecasting total system demand of around 2.5 million Dth/d Thursday, roughly in line with demand of just under 2.6 million Dth/d estimated for Wednesday. Demand on Tuesday totaled just over 2.6 million Dth/d, according to the utility, topping receipts just under 2.6 million Dth/d.

California ISO, meanwhile, was forecasting Thursday’s peak demand to come in at 42,617 MW, up slightly from Wednesday’s forecasted peak of 41,772 MW.

The volatility at SoCal Citygate comes as recent heat has helped drive up spot prices elsewhere in Southern California and in the Desert Southwest. SoCal Border Average fell 11 cents to average $3.86 Wednesday, still more than a dollar above where it traded throughout the month of June. In Arizona/Nevada, average prices at El Paso S. Mainline/N. Baja also fell on the day but remained elevated, giving up 13 cents to $4.43.

Earlier this week, Genscape said the strong prices have also corresponded with electric transmission line issues and “upstream gas supply volatility” from pipeline constraints and slightly lower production out of the Permian and the Rockies.

According to Genscape, total demand in the California/Nevada region has averaged 6.45 Bcf/d over the past week, with demand expected to remain above 6 Bcf/d Thursday and Friday. Desert Southwest demand has been averaging around 2 Bcf/d, according to the firm.

Gulf Coast prices fell amid expectations for cooler weather in the Midwest and East to weaken Lower 48 demand. Henry Hub mirrored prompt-month futures, dropping 6 cents to average $2.72.

“A cool front has brought cooling through the Midwest and east-central U.S. with highs dropping into the 70s to lower 80s the next few days for lighter demand,” NatGasWeather said in its one- to seven-day outlook Wednesday, adding that hotter conditions in the rest of the country should lead to strong regional demand, especially from California to Texas.

In the Midwest, Chicago Citygate gave up 6 cents to average $2.66.

In East Texas, prices weakened even as AccuWeather was calling for highs to approach triple digits in Houston Thursday. Katy shed 8 cents to $2.84. In West Texas, El Paso Permian fell 12 cents to $2.29.

A combination of hotter temperatures and an increase in industrial baseload generation driven by higher oil and gas sector drilling has resulted in record high loads so far this summer for the Electric Reliability Council of Texas, aka ERCOT, the grid operator for most of the state. This potentially paves the way for “a blowup in July and August peak loads,” according to Morningstar Commodities Research analyst Dan Grunwald.

Recent forecasts show July and August totaling 575 and 579 cooling degree days (CDD), respectively, or about 14 and 13 CDDs above normal, Grunwald said.

“The increasing baseload means it wouldn’t be unwarranted to expect” record loads for July and August. “A sizable increase in industrial demand over the past five years in coast and western zones lies behind this higher baseload. The trend is most apparent in the Far West Zone, where average load has doubled in the last five years and is up 500 MW just since the start of 2017,” according to Grunwald.

“Total average load in ERCOT so far this year is 1,500 MW higher than 2017. July has already beat last year’s all-time peak, which typically occurs in August, leaving plenty of time for a new record this year.”

Coal capacity retirements have coincided with “a modest uptick in solar generation and a sizeable increase in wind capacity,” but natural gas has filled “a bulk of the void” from recent coal retirements.

“This trend is affecting the region’s natural gas storage picture, as South Central’s faster-cycling salt storage has experienced natural gas withdrawals since mid-June,” Grunwald said. “While nonsalt storage has seen moderate injections, high power burn demand suppressed injection levels near to flat last week. While this is not uncommon in the southern regions during summer, it is leaving a heavy lift for the autumn injection season. We expect high summer demand to continue through the fall, suppressing storage levels come winter.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |