E&P | NGI All News Access | NGI The Weekly Gas Market Report

Mexico Postpones E&P Bid Rounds, Farmout Tender to 2019

Mexico’s National Hydrocarbons Commission (CNH) postponed two onshore bid rounds and a farmout tender for operating stakes in upstream blocks held by national oil company Petróleos Mexicanos (Pemex) until the first half of 2019.

The postponements, which were requested by the Energy Ministry (Sener), were unanimously approved by commissioners in an extraordinary session on Wednesday. The tenders were originally scheduled to occur later this year.

Under the new timeline, the deadline for paying sign-up fees for all three bidding processes is Jan. 8, which is also the last day that interested firms can access the tenders’ respective data rooms. Offers for all three tenders are now due on Feb. 14.

The previous deadline for onshore bid rounds 3.2 and 3.3 was Sept. 27, while offers for the Pemex farmout tender, which makes available operating interests in seven licenses currently held by the NOC in southern Mexico, were due Oct. 31.

MartÃn Ãlvarez, head of the CNH’s legal unit, said that interested firms have requested more time to verify information obtained in the data rooms, and to prepare the necessary documentation to participate.

CNH President Juan Carlos Zepeda said he viewed the time extension as “positive,” citing a desire to ensure participation by the maximum possible number of companies, and to allow president-elect Andrés Manuel López Obrador’s incoming administration time to review all contracts awarded through previous bid rounds held under the current government.

Lopez Obrador won the presidency in a landslide July 1 victory, and will take office Dec.1.

The process of reviewing the contracts, a campaign pledge of López Obrador’s, could take weeks or even months, Zepeda said. Zepeda indicated that local content requirements for the upcoming rounds could be increased as well, a move that has been advocated in the Mexican press.

Following the announcement of the postponement, Gonzalo Monroy, managing director of Mexico City-based energy consultancy GMEC, tweeted that the move was “expected,” and that it was driven more by “contractual things” than by “issues with the political environment.”

“It seems to me that [the extension] sends a message of certainty to those who have signed up, or those who plan to sign up,” said commissioner Héctor Alberto Acosta.

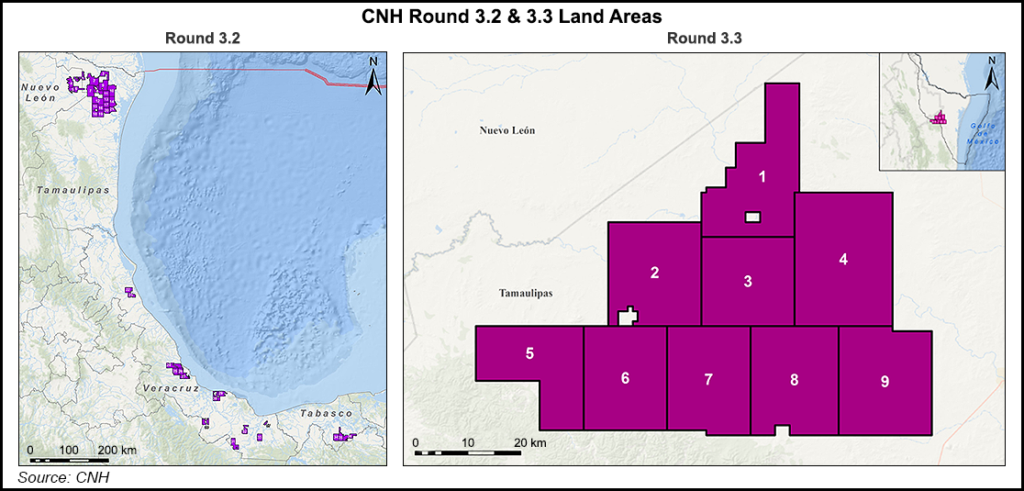

Round 3.2 places on offer 37 onshore conventional blocks, of which 21 are located in the Burgos Basin, which is Mexico’s leading non-associated gas-producing basin. To date, 12 firms have begun the prequalification process.

Round 3.3 includes acreage targeting both conventional and shale resources. So far, only Pemex has begun prequalification for this round.

Six firms have begun prequalification for the farmout tender, which pertains to seven blocks combining multiple fields in the southern states of Veracruz, Tabasco and Chiapas that contain a combined 392 million boe of proven, probable and possible (3P) reserves.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |