M&A | Markets | NGI All News Access | NGI The Weekly Gas Market Report

Tidewater, GulfMark Combination to Create Houston-Based OSV Giant

Houston-based operators Tidewater Inc. and GulfMark Offshore Inc. have agreed to combine in a transaction valued at $1.25 billion, creating a global offshore support vessel (OSV) leader positioned to capitalize on cost synergies and growth opportunities as a recovery gains traction.

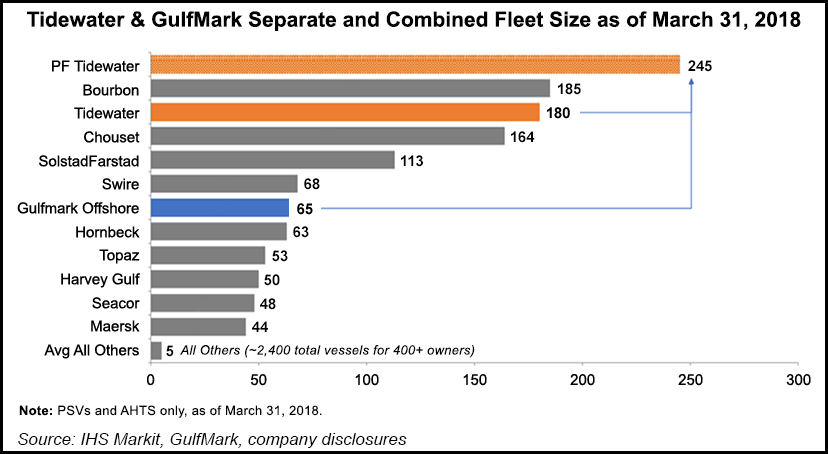

The combined company, using the Tidewater brand and run by Tidewater CEO John Rynd, would have the industry’s largest fleet and the broadest global operating footprint in the OSV sector.

“By combining our fleets and shore-based activities we will be better able to provide customers with access to modern, high-specification vessels while maintaining a strong commitment to safe operations and superior, cost-effective customer service,” Rynd said. “The transaction preserves Tidewater’s strong financial profile and allows the company to fund both organic growth and possible additional acquisitions.”

GulfMark and Tidewater, he said, “share similar values in regards to safety, compliance and customer service, and we expect the integration process to be smooth.”

Rynd said during a conference call that Tidewater planned to redeploy “underutilized GulfMark vessels, particularly in regard to the mid-water vessels historically operated within GulfMark’s Americas region…

“While the enhancement to Tidewater’s North Sea operation is the primary geo market benefit of the transaction, this deal will also strengthen our footprint in the Americas, particularly in the U.S. Gulf of Mexico, the Caribbean Sea, and offshore areas along the northern coast of South America.”

Both companies were dragged down following the market turnaround in 2014, and they each restructured their business last year. The OSV market still hasn’t rebounded, which offers more opportunities for additional mergers and acquisitions (M&A) down the road, Rynd said.

“The offshore support vessel business remains highly fragmented and is still characterized by broad-based financial distress,” he said. “If rationality prevails, additional consolidation should take place in the coming years.

“Given this strong pro forma financial profile of the combined Tidewater and GulfMark, the combined company will be well-positioned to consider additional M&A in the future. Whether or not additional consolidation happens, the combined company is well positioned for organic growth given our ability to fund the reactivation of currently idle vessels.”

GulfMark CEO Quintin Kneen said his company had been “longstanding advocates for consolidation of the OSV industry. This transaction is an important first step in that process. The combined company will be better positioned to build upon GulfMark’s strong track record in the recovering North Sea region.

“The combined company’s global operating footprint also provides scope for significant scale-based economies and improved utilization of our fleet by redeploying under-utilized vessels across the combined company’s broader operating footprint.”

Tidewater owns and operates one of the largest fleets of OSVs in the industry and has more than 60 years of experience supporting offshore energy exploration and production activities worldwide.

Tidewater created the “workboat” industry with the 1956 launch of the Ebb Tide, the world’s first OSV tailor-made to support the oil and gas industry. More than 90% of its fleet today works internationally in more than 60 countries.

GulfMark, whose forte is marine transportation services, operates in three core regions: the Americas, North Sea and Southeast Asia. In the Americas, GulfMark’s principal operating bases are in the Gulf of Mexico, Brazil, Mexico and Trinidad.

GulfMark stockholders for each common share are to receive 1.100 shares of Tidewater common stock. Tidewater also agreed to assume $100 million of GulfMark’s existing debt.

Tidewater would own about 73% of the combined company. Tidewater’s board would be expanded to 10, with three new directors selected by GulfMark.

The merger, scheduled to be completed by year’s end, is expected to produce “transaction-related cost synergies” estimated at around $30 million by 4Q2019.

“The combined company also expects to realize revenue synergies through improved vessel utilization, with future pricing improvements largely driven by the timing and trajectory of a recovery in demand, and the availability of competitive vessels that are in compliance with classification requirements,” Tidewater management said. “The larger cash flows and greater diversification of the combined company may also provide access to capital on more attractive terms.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |