Weekly Natural Gas Spot Prices Even Amid Rising SoCal, Falling New England

The natural gas spot market for the week ended Friday featured rising prices in toasty Southern California and discounts along the opposite coast thanks to some more moderate temperatures in the East; the NGI Weekly National Spot Gas Average finished unchanged at $2.70/MMBtu.

After it spiked the week before on a triple-digit heat wave, more hot temperatures strengthened prices at the constrained SoCal Citygate, which added 11 cents to average $5.19. Elsewhere in the region, SoCal Border Average jumped 64 cents on the week to $3.49.

In the Northeast, heat backed off during the week, resulting in lower prices at a number of points. Algonquin Citygate tumbled 24 cents to $2.74, while Maritimes & Northeast shed $1.29 to average $3.90.

In Canada, NOVA/AECO C added C34 cents on the week to average C$1.48/GJ.

“Intra-Alberta natural gas demand continues to post impressive figures, pushing up to 4.9 Bcf/d this week, despite a 0.2 Bcf/d loss due to the Syncrude outage,” analysts with Tudor, Pickering, Holt & Co. (TPH) said Friday. “To give this some context, this week’s demand is up around 0.8 Bcf/d over year ago levels and roughly equal to mid-winter demand two years ago.”

Recent storage data “indicated Western Canadian storage build by 8 Bcf” during the prior week, “in line with seasonal norms, and storage remains 11% below the five-year average,” the TPH team said. “We expect to return to below-average builds” during the upcoming week, “as we’re forecasting a 5 Bcf build.”

Natural gas futures bulls gave up more ground Friday as production continued to allay the market’s storage concerns. The August Nymex futures contract fell for the second straight session Friday, slipping 4.5 cents to settle near the intraday low at $2.752. The prompt-month fell more than 8 cents on the week after opening Monday at $2.839.

Further along the strip, the January contract finished the week just below the psychologically significant $3 mark, settling Friday at $2.999.

Bespoke Weather Services said the drop to support around $2.75-2.77 Friday came as expected.

The strip Friday “again did not add much support until prices moved below $2.77,” with October/January “finally widening later in the day and providing some support up against $2.75,” Bespoke said. “Still, the strip indicates a market that is more concerned about production levels sitting right at record highs as opposed to power burns that only continue to tighten further on a weather-adjusted basis. Eventually, we see this market as having to take note of power burns unless weather entirely collapses, and this is keeping us from having a bearish sentiment into the weekend.”

The firm said it’s looking for slight losses in gas-weighted degree days for the end of July, “as tropical forcing indicates cooler risks should win out across areas that saw the strongest heat in June. This should stunt any natural gas rallies next week.”

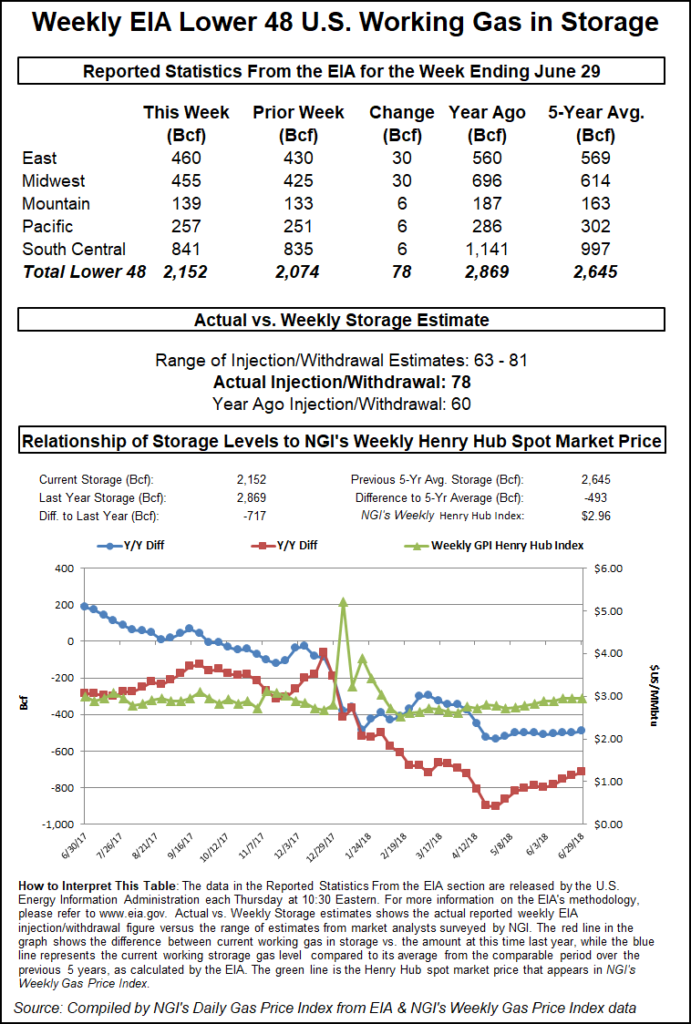

The Energy Information Administration’s (EIA) weekly natural gas storage report missed to the low side of most estimates Thursday, but that didn’t seem to catch futures traders by surprise as prompt-month prices fell on the news.

EIA reported a net 51 Bcf injection into Lower 48 gas stocks for the week ended July 6, lower than the 59 Bcf injected last year and well shy of the five-year average 77 Bcf build. The report period saw plenty of heat in key markets but also posed questions regarding potential demand destruction from the mid-week Fourth of July holiday.

Following the 10:30 a.m. ET release of the final number, August Nymex futures made their way down to around $2.798/MMBtu after trading as high as $2.826 just minutes earlier. By 11 a.m. ET, August was trading around $2.803, down about 2.6 cents from Wednesday’s settle.

Prior to Thursday’s report, major surveys had showed the market looking for a build about 4-5 Bcf larger than the actual figure. A Reuters survey of traders and analysts on average had showed respondents anticipating a 56 Bcf build, with responses ranging from 47 Bcf to 67 Bcf. A Bloomberg survey had produced a median 55 Bcf injection, with a range of 34 Bcf to 67 Bcf.

Intercontinental Exchange EIA Financial Weekly Index futures had settled at 49 Bcf Wednesday, below the major survey averages and the actual figure.

Bespoke Weather Services had called for a 54 Bcf build and said it viewed the leaner final number “as more of an indication that the holiday impact was slightly less than we had modeled (as some daily balance numbers had shown) as opposed to an indication that the market has tightened further.

“The market appeared to agree, falling off a print that was slightly below our expectation but did not surprise very bullish,” the firm said. “However, we do not see this print as too bearish either, coming in slightly below our expectation and likely allowing for some support from $2.75-2.77. Rather, it confirms a market that could still weakly bounce short-term, but which has strong resistance with risk skewed lower.”

Total working gas in underground storage stood at 2,203 Bcf as of July 6, versus 2,928 Bcf a year ago and five-year average inventories of 2,722 Bcf, according to EIA. Week/week the year-on-year deficit widened from minus 717 Bcf to minus 725 Bcf, while the year-on-five-year deficit increased from minus 493 Bcf to minus 519 Bcf, EIA data show.

By region, the South Central posted a net 2 Bcf build for the week, with 9 Bcf injected into nonsalt offsetting a 7 Bcf withdrawal from salt. In the East, 20 Bcf was injected for the week, while 22 Bcf was refilled in the Midwest. The Mountain region saw a 4 Bcf build, while 3 Bcf was injected in the Pacific, according to EIA.

“The industry, the market, the buyers and sellers, they’re not that concerned about being a little short on gas going into the winter” due to substantially higher production year/year, INTL FCStone Financial Inc. Senior Vice President Tom Saal told NGI. “Now winter’s kind of far away right now…maybe you get closer to winter and there may be more of a concern, but right now that’s the situation.”

Analysts with TPH said the numbers suggest it will be a difficult climb for the market to reach normal inventories in the roughly 18 weeks left in injection season, requiring about 4.0 Bcf/d of slack.

“However, the 8-14 day outlook indicates ”normal’ temperatures in the Midwest” and the expected weekend return to service of Columbia Gas Pipeline’s Leach XPress indicates “a Northeast production ramp is imminent,” the TPH team said.

Genscape Inc. analysts Vanessa Witte and Nicole McMurrer on Friday said the region lost about 120 MMcf/d of production because of an explosion last month that forced part of the Leach XPress line to be shut in.

Immediately after the explosion, “impacts were uncertain, but due to the recent in-service of the pipeline path, almost all production was able to be routed onto other pipelines,” Witte and McMurrer said. Further output from Leach XPress would add to what has been a “meteoric rise” in Lower 48 dry gas production this year.

At least, that’s how RBN Energy LLC analyst Sheetal Nasta described the 3 Bcf/d surge since April that has seen production reach nearly 82 Bcf/d month-to-date. That’s roughly 9 Bcf/d (12%) higher year/year (y/y), Nasta said.

Still, “record demand volumes thus far have managed to keep storage injections in check,” Nasta said, describing a situation where “the record production level is clearly dampening the gas futures price action but appears to be having little effect on shrinking the deficit, at least so far.”

There are a couple factors at play, according to Nasta. For one, a solid chunk of production gains showed up over the last couple weeks “and then they happened all at once, just as seasonal air conditioning demand was also picking up.

“That leads us to the other major factor — that demand has been exceptionally strong as well…In terms of U.S. consumption,” including power generation, residential/commercial and industrial, “daily volumes have averaged nearly 70 Bcf/d this injection season to date, which is about 7 Bcf/d higher than the same period last year and the highest on record for this time of year,” Nasta said.

“The incremental demand has been in part due to weather, but also due to structural changes to the power generation fleet, including new gas plant additions and the retirement of a substantial volume of coal plant capacity.”

Injection season demand got off to a strong start thanks to an exceptionally cold April, then May proved unusually warm. June and July have delivered higher cooling demand y/y, while industrial demand has also come in about 2 Bcf/d higher y/y, according to Nasta. And that’s just domestic demand. Add in exports, and in total the market’s seeing about 8.8 Bcf/d of demand growth y/y, versus an incremental 8.7 Bcf/d of supply.

Still, with the recent surge in production “we have seen the balance loosen up drastically compared to last year — even in the face of record power generation,” Nasta said. “In the first 12 days of July, the balance has shifted to a plus 1.8 Bcf/d versus the same period in 2017, and if we home in on just the week ended July 12, our storage model indicates that the moderating weather has shifted the balance to being 4 Bcf/d more bearish than last year, even with the declines in production in recent days.”

The market may be less sensitive to the storage deficit given elevated supply numbers, but “the lingering deficit still does raise the risk for a bullish winter, as it still leaves open the potential for deliverability issues day-to-day during peak heating demand periods.”

Spot prices fell throughout the Midwest Friday with cooler temperatures in the forecast, while the volatile SoCal Citygate gained heading into the weekend; the next-day NGI National Spot Gas Average dropped 3 cents to $2.68/MMBtu.

“Hot high pressure will dominate most of the country into early next week with highs of upper 80s to 100s, hottest from California to Texas for strong demand,” NatGasWeather said. “Weather systems with showers and cooling will sweep across the northern and east-central U.S. during the middle and end” of the week ahead, bringing “highs of 70s to lower 80s for lighter demand, while the rest of the country remains hot with highs of 90s and 100s, including into the Northwest.”

Radiant Solutions was predicting highs in Chicago over the weekend in the upper 80s, slightly dipping into the mid 80s by Monday, and then falling into the upper 70s by Wednesday. The firm was calling for Minneapolis to see temperatures drop into the upper 70s by Tuesday.

Chicago Citygate shed 11 cents to average $2.63, while Joliet gave up 8 cents to $2.64.

The Northeast and West Coast should expect more heat in the week ahead, according to Genscape Inc. analyst Josh Garcia.

“The Pacific Northwest will be especially hot,” as temperatures were slated to get as high as 10 cooling degree days (CDD) above the normal on Sunday, Garcia said. “The Northeast and New England will also get a slight raise in temps, with CDDs in New England currently slated to be almost twice as much as normal. Genscape meteorologists currently forecast that heat to sustain for the next two weeks. However, an eastward moving cold front in the Midwest presents downside risk to this forecast.”

In New England, Algonquin Citygate saw a bump Friday, adding 18 cents to $2.85. Ditto for Tennessee Zone 6 200L, which added 15 cents to $2.81.

In the West, prices didn’t respond much to the forecast heat Friday, though the supply-constrained SoCal Citygate added another 21 cents to average $5.12. In Northern California, Malin added 2 cents to $2.58, while to the south SoCal Border Average shed 16 cents to $3.46. In the Rockies, Cheyenne Hub dropped a penny to $2.50, while Stanfield gave up 4 cents to $2.42.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |