Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Adds Two Natural Gas Rigs, While Oil Count Flat, Says BHI

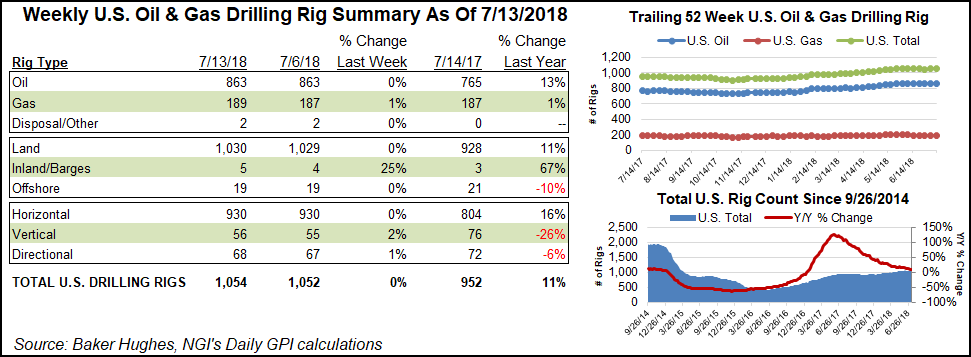

Two natural gas-directed rigs returned to action in the United States during the week ended Friday as oil activity held steady, according to data from Baker Hughes Inc. (BHI).

The total number of domestic natural gas rigs finished the week at 189, roughly in line with 187 rigs running a year ago. Domestic oil-directed units held at 863, but up from 765 a year ago.

The net gains included one directional and one vertical unit. One rig was added on land, along with one in inland waters. BHI’s Gulf of Mexico tally increased by one to 19 for the week.

Canada added 15 rigs for the week, 13 oil-directed and two gas-directed, to finish at 197 active units, up from 191 last year.

The combined North American rig count finished the week at 1,251 units, versus 1,143 rigs in the year-ago period.

Among plays, no major changes were reported for the week. The Permian Basin added a unit to finish at 476 (373 a year ago), while the Granite Wash saw one rig depart to finish at 15 (14 a year ago).

One rig was added in the Cana Woodford, and a more detailed breakdown by NGI’s Shale Daily showed that rig is going to work in the STACK, aka the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties.

The two domestic gas rigs added for the week did not reflect any changes to activity in the Northeast, as the Marcellus and Utica shales both finished flat at 53 and 23 units, respectively. The Haynesville Shale in Louisiana and Texas also finished flat at 49 rigs.

Among states, Texas led gainers as it added two net rigs overall for the week to end at 528, up from 466 units this time last year. Colorado and Louisiana added one rig each. Alaska and Colorado each saw one rig exit the patch, according to BHI.

Even as BHI’s domestic gas rig count has shown little to no growth over the past year, surging Lower 48 output, driven in particular by the Northeast and associated gas from the Permian, has become a force of seemingly relentless downward pressure on natural gas prices.

During trading Friday, the January New York Mercantile Exchange Henry Hub futures contract was struggling to hold onto a $3 handle, just one day after the Energy Information Administration’s storage report put the year-on-five year inventory deficit at more than 500 Bcf as of the first week of July.

“The industry, the market, the buyers and sellers, they’re not that concerned about being a little short on gas going into the winter” due to substantially higher production year/year, INTL FCStone Financial Inc. Senior Vice President Tom Saal told NGI. “Now winter’s kind of far away right now…maybe you get closer to winter and there may be more of a concern, but right now that’s the situation.”

Recently, RBN Energy LLC analyst Sheetal Nasta highlighted a rapid 1.5 Bcf/d surge in Lower 48 gas production over the final three weeks of June to help explain why prices have been heading lower as of late despite a persistently large storage deficit.

“It’s no surprise that Lower 48 production has been on a tear lately,” given capacity expansions in the Northeast and high rig counts, Nasta said. “What has taken the market by surprise, however, is the abruptness and sheer strength with which production has surged in just the past couple of weeks.

“…It wasn’t until the second half of June that output shifted into high gear,” she said. “If we compare average volumes in the week ended June 7, versus the week ended June 28, we see that total Lower 48 dry gas production zoomed higher by about 1.5 Bcf/d in that time to 81.8 Bcf/d by June 30, with the bulk of those gains occurring in the last week of the month.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |