Markets | NGI All News Access | NGI Data

Lean EIA Build Can’t Spark Natural Gas Futures Rally; SoCal Spot Strengthens

Natural gas futures pulled back Thursday as weekly government storage data came in tighter than surveys but not enough to rile a market focused on production growth. In the spot market, Southern California prices remained elevated as other regions saw mostly minor adjustments; the NGI National Spot Gas Average added 2 cents to $2.71.

August Nymex futures slid 3.2 cents to settle at $2.797, giving up a good chunk of the prior day’s rally in the process. The prompt month traded as high as $2.827 and as low as $2.789. September fell 3.1 cents to settle at $2.766.

The Energy Information Administration’s (EIA) weekly natural gas storage report missed slightly to the low side of most estimates Thursday, but that didn’t seem to catch futures traders by surprise as prices fell on the news.

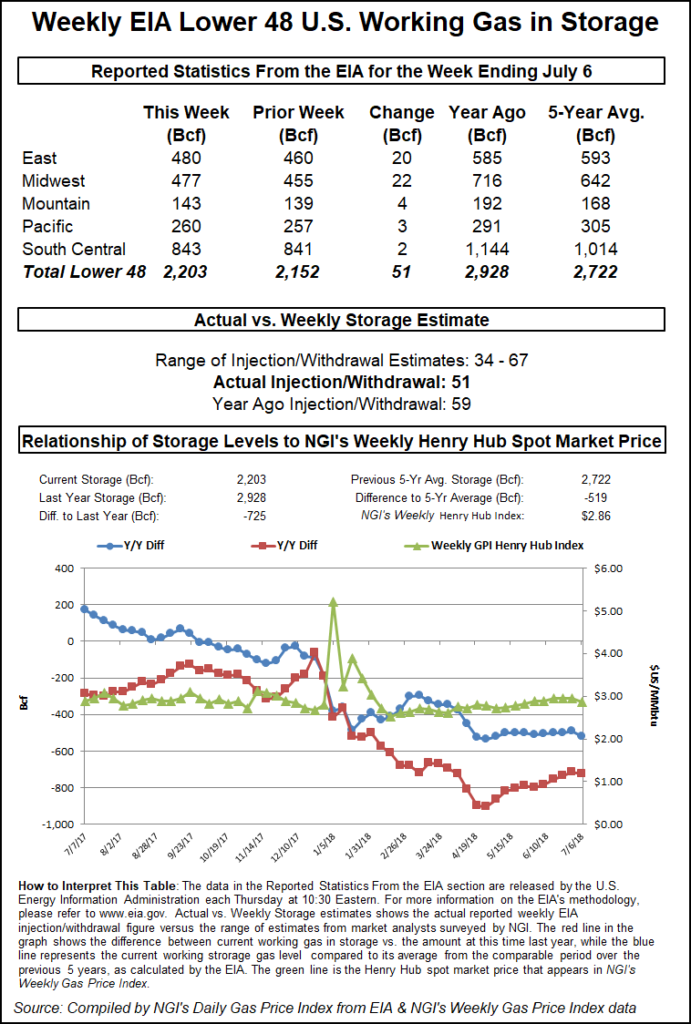

EIA reported a net 51 Bcf injection into Lower 48 gas stocks for the week ended July 6, lower than the 59 Bcf injected last year and well shy of the five-year average 77 Bcf build. The report period saw plenty of heat in key markets but also posed questions regarding potential demand destruction from the mid-week Fourth of July holiday.

Following the 10:30 a.m. ET release of the final number, August Nymex futures made their way down to around $2.798/MMBtu after trading as high as $2.826 just minutes earlier. By 11 a.m. ET, August was trading around $2.803, down about 2.6 cents from Wednesday’s settle.

Prior to Thursday’s report, major surveys had been pointing to a build about 4-5 Bcf larger than the actual figure. Intercontinental Exchange EIA Financial Weekly Index futures had settled at 49 Bcf Wednesday.

Bespoke Weather Services had called for a 54 Bcf build and said the leaner final number showed the impact of the Independence Day holiday was less than expected, “as burns through the holiday remained quite tight.

“Power burns have only continued to tighten into this week as well, which seems likely to help add support around the $2.75-2.77 level,” Bespoke said. “Clearly, though, the natural gas market remains more focused on production levels that sit around 1 Bcf/d off record highs than power burns that are running very tight, as even though” Thursday’s EIA report “indicated significant tightening compared to what we saw through much of May and early June it was not enough to sponsor a rally.”

Total working gas in underground storage stood at 2,203 Bcf as of July 6, versus 2,928 Bcf a year ago and five-year average inventories of 2,722 Bcf, according to EIA. Week/week the year-on-year deficit widened from minus 717 Bcf to minus 725 Bcf, while the year-on-five-year deficit increased from minus 493 Bcf to minus 519 Bcf, EIA data show.

By region, the South Central posted a net 2 Bcf build for the week, with 9 Bcf injected into nonsalt offsetting a 7 Bcf withdrawal from salt. In the East, 20 Bcf was injected for the week, while 22 Bcf was refilled in the Midwest. The Mountain region saw a 4 Bcf build, while 3 Bcf was injected in the Pacific, according to EIA.

Given production growth, the market appears comfortable entering the winter at a deficit, according INTL FCStone Financial Inc. Senior Vice President Tom Saal.

“I guess the people who really need to buy storage and put it in the ground are doing it, and the market is not giving you any incentive to inject because of the flat spread,” Saal told NGI.

“…The perception is that A: we’ve got plenty of gas, and B: we’re going to have some new infrastructure to move that gas to market, and the overall need for storage is not as great as it was before,” he said. “That’s the perception. If we get a cold November and December, people might find out the hard way.”

Turning to the spot market, Southern California continued its run of elevated prices Thursday, with SoCal Citygate tacking on another 31 cents to average just shy of $5.00 at $4.91. SoCal Border Average climbed 8 cents to $3.62, while in Arizona/Nevada, Kern Delivery tacked on 18 cents to $4.21.

Southern California Gas Co. was calling for demand on its system to remain around 2.4 million Dth/d through the end of the work week before dropping to around 2.1 million Dth/d by the weekend. The utility was expecting receipts to total around 2.53 million Dth/d.

Radiant Solutions was calling for highs in Burbank, CA, to reach the low 90s Friday before dropping into the mid to upper 80s over the weekend and into next week, with average temperatures expected to remain above normal.

Natural gas supply constraints have been a key factor in a transforming power pricing dynamics in the California Independent System Operator’s (CAISO) SP15 region in Southern California, according to Morningstar Commodities Research analyst Matthew Hong.

Elevated temperatures like those predicted for California for the remainder of the summer “translate to strong power demand for cooling in the Golden State but no longer automatically result in stronger prices because of the impact of renewables,” Hong said. “…Increases in solar generation coupled with gas retirements have fundamentally changed CAISO market behavior, where hourly prices are largely dictated by the marginal generating fuel.

“Price behavior now generally reflects tightening supply during the evening ramp hours as solar capacity fades. This trend should continue as more solar generators are added and natural gas generators are retired.”

Less snowfall compared to 2017 has meant CAISO is generating less hydropower and relying more on natural gas for baseload, which has contributed to higher prices at SoCal Citygate, according to Hong.

“The SP15 market this summer is tightly related to natural gas prices and changes at the lower end of the supply stack,” Hong said. “Higher electricity demand in Southern California may create challenges for generators looking to secure supply, placing risk to the upside in natural gas prices. This shortage may explain why imports from Mexico have slowly ticked up over the last few days, hitting 140 MMcf/d on July 6, which coincided with 108 degree temperatures in Los Angeles.

“If limitations connecting” SoCalGas and El Paso Natural Gas “persist beyond July, natural gas prices at SoCal Citygate should move up, sending a bullish signal for prices at SP15. Additional solar capacity and fewer natural gas plants will continue to exacerbate differences between midday prices and the evening ramp, providing higher heat-rate natural gas plants the ability to clear in the day-ahead.”

Points across most regions generally saw small adjustments on day-ahead deals Thursday, with a number of regional averages finishing within a nickel of even. In Louisiana, Henry Hub finished flat at $2.84, while ANR SE added a penny to $2.73.

Starting Monday (July 16) and extending until July 20, “ANR will reduce operational capacity through its ”SWML Northbound’ location from 689 MMcf/d to 564 MMcf/d due to planned maintenance at its Havensville and Birmingham compressor stations,” according to Genscape Inc. analyst Vanessa Witte. “Maintenance on this leg has been ongoing since April of this year, and isn’t scheduled to end until September, with various capacity reductions during this time.

“Average nominations through SWML have been 606 MMcf/d for the prior 30 days, however utilization has averaged 92%, indicating scheduled capacity is artificially low due to the fluctuation in operational capacity due to maintenance,” Witte said. “As the Midwest area approaches CDDs in the 16-17 range for this weekend and into the early part of next week, according to Genscape meteorologists, northbound flow restrictions could put pressure on ANR’s SEML to fulfill cooling demand.”

In the Midwest and Midcontinent, prices eased slightly Thursday. ANR SW fell a penny to $2.49, while Joliet finished even at $2.72.

In Appalachia, a number of points strengthened by double digits, including Dominion South, which climbed 11 cents to $2.28.

Columbia Gas Transmission LLC (TCO) plans to return its 1.5 Bcf/d Leach XPress pipeline in West Virginia to full service by Sunday (July 15) following an explosion in Marshall County last month that forced part of the line to be shut in.

TCO said in an update Thursday Leach’s Stagecoach meter has again returned to service, restoring limited capacity. After acknowledging last week that “weather in the region has continued to create challenging conditions during the remediation process,” the company also said it expects repairs to be complete and service to return on the full line this weekend pending approval from the Pipeline and Hazardous Materials Safety Administration.

While the explosion periodically stirred up the Appalachian spot market in the days after it occurred, most of the gas has been rerouted from TCO onto other pipes, mitigating the effects on production in the region.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |