Infrastructure | LNG | NGI All News Access

Energy Operators Increasingly Optimistic on LNG Canada Prospects

Imminent construction of the first northern Pacific coast liquefied natural gas (LNG) export terminal will sire more projects, according to increasingly optimistic participants in northern British Columbia (BC) and Alberta unconventional drilling.

“Once the first person puts their toe in the water others follow,” said Mullen Group CFO Stephen Clark. “We feel much more confident today than we would have six or nine months ago,” said Horizon North Logistics CFO Scott Matson.

To the Mullen trucking and oilfield services conglomerate, LNG projects look likely to follow the oilsands pattern, Clark told an annual TD Securities energy services conference held Wednesday in Calgary.

Northern Alberta bitumen grew fast when decades of mining and underground extraction trials achieved reliable operations. Production jumped more than four-fold to 2.8 million b/d when large-scale development spread to multiple companies after 2000.

The gas optimists expect a similar example to be set by the overseas export terminal project poised for construction as the BC industry pioneer, the LNG Canada proposal led by Royal Dutch Shell plc (50%) with Asia-Pacific partners.

“All the actions they’re doing indicate they’re getting close to the final investment decision,” or FID, said Trican Well Service CEO Dale Dusterhoft. The consortium is “going through” the construction requirements list “and checking all the boxes.”

The encouraging signs include Petroliam Nasional Berhad, aka Petronas, joining LNG Canada as a 25% partner. The May deal stood out as a dramatic return by Malaysia’s state energy company, which scrapped a similar BC coast terminal project in mid-2017.

The gas optimists pointed to further positive hints from construction and worker camp contract awards by LNG Canada and the pipeline planned to supply its terminal, TransCanada Corp.’s Coastal GasLink from northeastern BC shale fields.

Among gas exploration and production companies, Birchcliff Energy President Jeff Tonken said “we’re locked and loaded and ready to go.” While recognizing “the flavor of the month is oil and liquids,” he predicted “we’re going to see a significant change in gas.”

Tonken said, “The value of dry gas is about to go up” after years as the poor sister of Western Canadian products. Construction of LNG Canada would revive interest in BC and Alberta by international producers that make such 50- to 70-year investments.

Low-cost gas specialists that have survived prolonged price lows like Birchcliff will have “a totally different conversation next year” with investors if the project proceeds, Tonken predicted. Matson observed that international gas giants such as Chevron Corp. quietly continue planning additional BC export terminals that would benefit from infrastructure and experience developed by LNG Canada as the pioneer Pacific coast project.

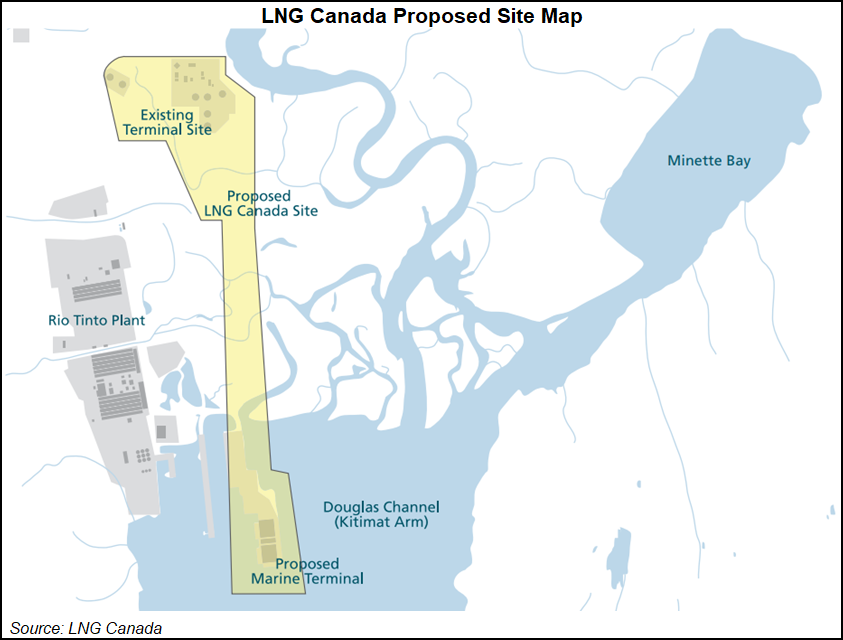

The total value of the LNG Canada delivery and supply development package is estimated at C$40 billion ($32 billion). Facilities construction includes C$14 billion ($11 billion) for the Kitimat terminal for up to 3.7 Bcf/d and C$4.7 ($3.8 billion) billion for Coastal GasLink, which would be capable of carrying 5 Bcf/d by adding compressors to its jumbo pipe 48 inches in diameter.

The project remains under review, with the owners repeatedly cautioning that the decision will depend on costs and international gas market conditions. The BC government has given LNG Canada until November to accept an incentive offer of C$6 billion ($4.8 billion) in provincial income, sales and carbon tax cuts.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |