Regulatory | Infrastructure | LNG | NGI All News Access | NGI The Weekly Gas Market Report

LNG Awakening Part 3: Second-Wave Developers Optimistic About Future Despite Growing Trade Disputes

Note: This is the third in a three-part NGI series titled “Navigating the Nascent LNG Market Through A Choppy World Trade Sea,” which explores the emerging global liquefied natural gas market and the challenges it poses to buyers and sellers seeking to capitalize on the worldwide expansions underway.

Even with the United States seemingly on the brink of an international trade war, and growing concern in the oil and natural gas industry that recently enacted tariffs on goods from China and other countries could threaten development, second-wave liquefied natural gas (LNG) developers appear to be cautiously optimistic that the economic and environmental benefits of U.S. exports will ensure future projects get off the ground.

NextDecade Corp. CEO Matthew Schatzman recently touted LNG exports as a way for the U.S. government to positively impact the environment by promoting the use of low-cost natural gas over coal in both developed and emerging markets. NextDecade is developing the Rio Grande LNG export project at the southern tip of Texas in Brownsville.

Schatzman told NGI he thinks the global market needs at least 150 million metric tons/year (mmty) of new liquefaction capacity by 2025. Two-thirds of the supply likely would come from North America, mainly from the U.S. Gulf Coast.

“The U.S. has abundant natural gas reserves and is well-positioned to provide global markets with reliable, low-cost LNG. In fact, due to its abundance of natural resources, the United States has an opportunity to emerge as the world’s largest supplier of LNG in the coming years,” Schatzman said.

Still, the recent tariffs imposed on steel and aluminum from China, the European Union, Mexico and Canada, as well as additional tariffs on Chinese products collectively valued at about $50 billion in 2018 trade values, are keeping some in the industry on pins and needles when it comes to whether the United States will be able to capitalize on the rapidly growing LNG demand in the Asia Pacific region.

“Some of these LNG project developers have pointed out that Chinese customers are telling them that they can buy their LNG from several other producers,” an official with an LNG consultancy said. China’s three largest LNG suppliers today are Australia, Qatar and Malaysia, while pipeline imports come from central Asia and Myanmar.

The office of U.S. Trade Representative Robert Lighthizer on June 15 issued two lists of tariff lines covering Chinese products — including check valves, pressure-reducing valves, and safety or release valves used for pipes and tanks, among others — deemed detrimental to the oil and gas industry.

That’s on top of the tariffs placed on Chinese steel and aluminum that went into effect on May 1 and in addition to tariffs on those products coming from the European Union (EU), Mexico and Canada.

Both Brussels and Mexico City have since filed complaints with the World Trade Organization over the tariffs. Canadian Prime Minister Justin Trudeau and Foreign Affairs Minister Chrystia Freeland announced plans to levy up to C$16.6 billion ($12.8 billion) in tariffs on a host of American-made products. Ottawa planned to solicit public comments about the proposed tariffs and potentially enact them on July 1.

While recent developments regarding steel tariffs could have an impact on the U.S. LNG industry, the full extent of these impacts is still under evaluation, said Schatzman. “The impacts will not be known until final legislative and/or regulatory frameworks are in place.”

Societe Generale (SocGen) added that it is notable that while crude oil, gasoline and coal were included in China’s list of tariffs, natural gas was excluded. “We believe it highlights the need of both the U.S. and China for growth in U.S. LNG exports in order to achieve their respective long-term goals (decarbonization for China and increased energy exports for the U.S.),” SocGen natural gas analyst Breanne Dougherty said.

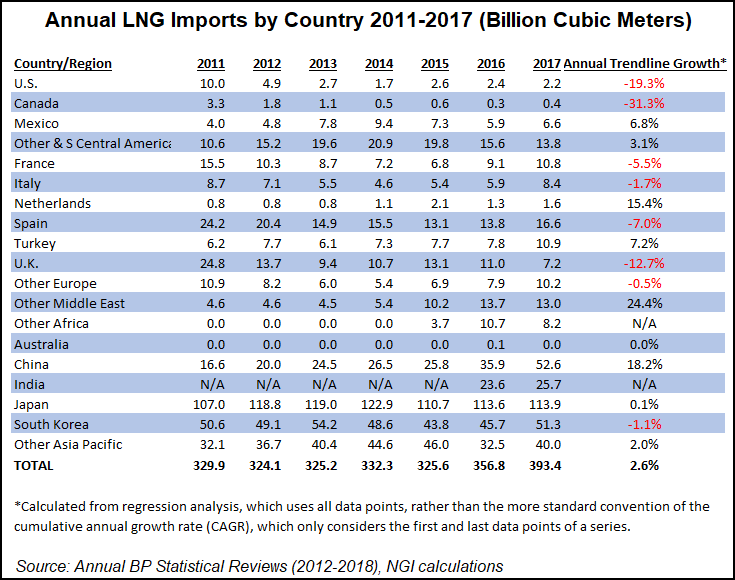

Thus far in 2018, the United States has represented 8% of the LNG imported by China. China has represented 16% of U.S. LNG exports. Given that the United States is only still in nascent stages of its LNG export program, its relatively large representation in China’s LNG supply mix is notable, the investment bank said.

China is expected to lead in global LNG demand growth between 2017 and 2022, and on the supply side, it is the United States that dominates growth through 2022, according to SocGen. “With all of this in mind, it is not surprising that any potential inclusion of natural gas in a tit-for-tat tariff situation between China and the U.S. could have repercussions on the evolution of the global gas market over the next five years. It is also not surprising, however, that both China and the U.S. have motivation to keep natural gas out of any tariff conversation,” Dougherty said.

Projects including the Alaska LNG Project are counting on China to be a major export customer.

Regarding the Chinese tariffs, Alaska Gov. Bill Walker on June 18 expressed confidence that leaders would “embrace the opportunity for mutual economic growth that we can achieve by working together.”

U.S. and Chinese officials signed a joint development agreement last November to help get the gas export project off the ground. FERC in March said it planned to conduct an environmental review of a proposed $43 billion project. The state-owned Alaska Gasline Development Corp. (AGDC) filed an application with the Federal Energy Regulatory Commission in April 2017 to commercialize North Slope gas; a notice of application was issued shortly thereafter.

In May, the AGDC and BP plc’s Alaska unit agreed to key terms of a gas sales agreement, with both parties planning to finalize an agreement this year for AGDC to purchase BP Alaska’s share of 30 Tcf of gas from the Prudhoe Bay and Point Thomson units.

“Alaska has abundant resources, from natural gas and seafood to beer and baby food,” Walker said. “These resources enable our state to dramatically reduce the trade deficit between the United States and China, if we can finalize agreements to increase exports of our products.

Walker indicated he was heading to Washington, DC, this month to meet with leaders “who have been at the table leading the efforts to avoid an unnecessary trade war. I will continue to work directly with both sides to make sure Alaska’s interests are protected.”

LNG Export Projects Waiting in the Wings

China is set to bring online three new LNG import terminals in 2018, increasing the total number of its facilities to 20 as it seeks to shift toward cleaner energy.

Meanwhile, U.S. lawmakers continue to push FERC to approve the proposed Jordan Cove LNG export project in Oregon. Earlier in June, Rep. Scott Tipton (R-CO), whose district includes the natural gas-rich Piceance Basin, issued a call for federal regulators to approve the project to tap supplies from Western Slope producers.

Colorado gas producers are counting on Jordan Cove to move supply to Asian markets, he said. If approved, the project would be the first on the U.S. West Coast. The Federal Energy Regulatory Commission, which rejected the project two years ago, is now reviewing a revised application.

Canada, meanwhile, has LNG export plans of its own, although the proposals have been sharply whittled down — and are long delayed. Malaysia’s state-owned energy conglomerate Petroliam Nasional Berhad, aka Petronas, in May took a 25% stake in the LNG Canada project led by Royal Dutch Shell plc.

A decision to start the estimated C$14 billion ($11 billion) construction project “remains pending,” according to the consortium that also includes Mitsubishi Corp., PetroChina and Korea Gas Corp. The Kitimat project, if sanctioned, would be built in stages to export up to 3.7 Bcf/d.

Wood Mackenzie analysts earlier in June said they expect the global LNG market “to tighten post 2022, and this bodes well for the project. But activity has returned to the LNG space” with a number of projects expecting to take final investment decision (FID) ahead of 2019. “A new wave of project sanctions and rising oil prices could push up project costs and dampen the economics.”

While the United States expects to be a major supplier to Asia’s surge in demand, so far only Cheniere Energy Inc.’s Sabine Pass export terminal in Louisiana and Dominion Energy’s Cove Point facility in Maryland have begun exporting LNG. Elba Island in Georgia is expected to begin commercial operations later this year.

In the next three years, trains are expected to come online at Cameron LNG in Louisiana and at two Texas projects, Freeport LNG and Corpus Christi LNG. Freeport LNG has delayed startup for its three-train project, with commercial operations beginning sequentially for the trains in the second half of 2019 into the first half of 2020. Cheniere sanctioned Corpus LNG in May.

Some LNG developers have indicated that while they welcome Chinese partners and LNG buyers, they are not relying on them for their projects to move forward. With LNG being a fungible commodity, its ultimate destination doesn’t really matter.

As for NextDecade’s Rio Grande project, Schatzman said he believes the project’s key competitive advantages — namely its low-cost, lower risk and optimal location — are “extremely compelling to our customers around the world.” He expects an FID by mid-2019.

Meanwhile, other second-wave LNG export developers are looking to start construction soon. Tellurian Inc. is targeting 2019 for the start of construction at its Driftwood LNG export facility near Lake Charles, LA. Driftwood, to be sited on 1,000 acres in Calcasieu Parish, LA, would require up to 4 Bcf/d of feed gas and have up to 20 trains, three storage tanks and three marine berths. It is looking worldwide to market its supply.

Even without China as a customer, however, U.S. LNG developers need China’s heavier-grade steel to build the infrastructure needed to support projects since U.S. steel companies find it too costly to produce. CEO Don Santa of the Interstate Natural Gas Association of America has called the administration’s decision to impose the tariffs “very troubling to the U.S. pipeline industry,” and counter to the president’s oft-stated goal of achieving energy dominance.

“The large-diameter, thick-walled steel used to construct natural gas transmission pipelines is a niche product with unique technical specifications,” Santa said. “Pipelines require specialty steel products not always available in sufficient quantities and specifications from domestic manufacturers. For certain steel products used in pipelines, no domestic product is available today.”

Furthermore, as soon as the Trump administration announced that tariffs were being considered U.S. steel companies began raising their prices, sources told NGI. Facing “increases of 3-9% on raw materials,” steel companies found a loophole as the tariff was only on raw materials. “If you had a plant in another country that could fabricate the materials and ship into the states, that bypassed the tariff,” a person with steel pricing knowledge told NGI.

Aside from the potential cost increase to build LNG projects, the tariffs also are a concern “from the view of retaliation from other countries,” said Center for LNG Executive Director Charles Reidl.

Overcapacity in the steel sector remains at the center of the trade dispute, but European Commission President Jean-Claude Juncker said the European Union was not the source of the problem, and that the trade bloc was, in fact, “equally hurt by it. That is why we are determined to work toward structural solutions together with our partners…”

Despite complaints and retaliatory moves by foreign governments, U.S. Commerce Secretary Wilbur Ross predicted that any retribution on trade would be ineffectual and lead to only “trivial” cost increases for American consumers.

In response to the most recent tariffs, Beijing retaliated by designating $50 billion worth of U.S. goods for matching tariffs. In a translated statement, China’s Commerce Ministry said that despite several rounds of trade negotiations, the United States “has disregarded the consensus it has formed and is fickle, provoking a trade war.” The ministry added that China “does not want to fight a trade war…”

Trump, meanwhile, has warned that the United States “will pursue additional tariffs if China engages in retaliatory measures, such as imposing new tariffs on United States goods, services, or agricultural products; raising non-tariff barriers; or taking punitive actions against American exporters or American companies operating in China.”

Despite the ongoing tariff saga, NextDecade’s Schatzman said he believes LNG exports can ultimately strengthen international relations while at the same time reducing the U.S. trade deficit, particularly with Japan, China and Korea. “These are the largest LNG markets in the world, and also happen to be tied to about 90% of the U.S. trade deficit.”

Reidl, however, had a different take: “…these tariffs will place over $100 billion of investment in U.S. LNG in jeopardy, kill jobs and damage valuable trade relationships with allies.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |