Eagle Ford Shale | E&P | NGI All News Access

KKR-Backed Partnership Acquires More Eagle Ford Assets

Affiliates of Venado Oil and Gas LLC and Kohlberg Kravis Roberts & Co. LP (KKR) have again scooped up assets in the Eagle Ford Shale of South Texas from an undisclosed seller.

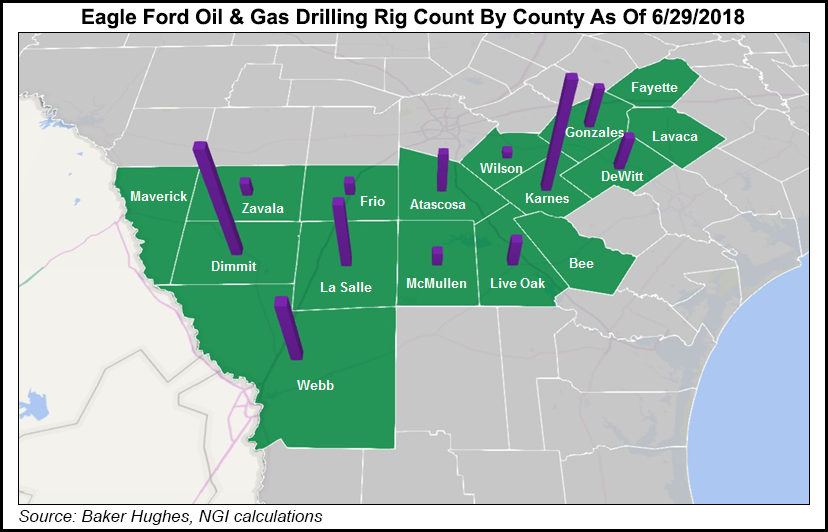

The producer and private equity giant formed a partnership in 2016 to consolidate assets in the play. The companies said this week they closed on the acquisition of 22 producing wells and 23,000 net acres in the Eagle Ford oil window that are adjacent to assets they already own in Atascosa and Frio counties. Terms of the transaction were not disclosed.

“These assets are a natural addition to our existing operated assets and considerably increase our future drilling inventory,” Venado CEO Scott Garrick said.

The properties produced 4,500 boe/d in 2Q2018, consisting of 74% oil, 11% natural gas and 15% natural gas liquids. KKR’s David Rockecharlie, who oversees the firm’s energy assets, said the latest investment marks the partnership’s third acquisition in less than 18 months, “underlining our commitment to capitalizing on the attractive market opportunity we see in the U.S. oil and gas sector at this point in the cycle.”

Since forming the partnership about two years ago, the companies have acquired acreage in South Texas from SM Energy Co. and Cabot Oil & Gas Corp. Venado has operated in the Eagle Ford since the play’s inception, while KKR has invested in unconventional oil and gas resources for roughly a decade.

The partnership, which is primarily funded by KKR’s Energy Income and Growth Fund I, manages 136,000 net acres and 43,000 boe/d of production from the Eagle Ford.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |