Weekly Natural Gas Spot Prices Mixed as Heat Lifts East Coast; Production Weighs on Futures

Hot temperatures helped boost natural gas spot prices across the Mid-Atlantic and Northeast for the last week of June, though declines in Texas and the West left the NGI Weekly National Spot Gas Average a penny lower at $2.62/MMBtu.

With cities like Boston, New York and Washington, DC, seeing forecast highs in the 90s during the week, locations along the I-95 corridor saw gains on the week. Algonquin Citygate added 23 cents to average $2.85, while Transco Zone 6 New York climbed 18 cents to $2.97.

In West Texas, where constraints on El Paso Natural Gas disrupted takeaway capacity out of the Permian Basin during the week, prices declined. Waha dropped 16 cents to $1.78, while El Paso Permian gave up 17 cents to $1.75.

Further downstream, weekly prices in California were mixed, with SoCal Citygate adding 27 cents to average $3.51 as other points in the region moved the opposite direction. Malin dropped 28 cents to $1.96.

Rockies points also fell on the week. Cheyenne Hub tumbled 26 cents to $1.95.

Natural gas futures lost ground during an uneventful session Friday as strong production limited the impact of sizzling temperatures forecast for key demand markets into the first week of July. Nymex August Henry Hub futures settled at $2.924 Friday, down from a $2.945 settlement a week earlier.

“Natural gas prices traded within a narrow range as expected” Friday, “sitting lower through the day as dry production continued to hit record levels,” Bespoke Weather Services told clients. “Prices sit near the bottom of a long-term rising channel, yet the winter strip lagged into the settle and prices struggled to show many signs of firming up.

“Weather through the short-term will be very hot, and we expect forecasts for next week to stay about equally as hot over the weekend, yet even so cash prices struggled to rally significantly on the day,” the firm said.

Potentially weighing on prices, forecasts Friday showed heat in the short- and medium-term easing off by mid-July, Bespoke said.

“Production may dip to start July, but any dip will not be sustained,” according to the firm. “Meanwhile, burns appeared to loosen again Friday, and they should loosen” during the upcoming week “as well with the Fourth of July holiday. This has pushed prices significantly lower around the holiday, as seasonally this is a very weak period for natural gas, and with production near record highs and” the October/January spread flat Friday, “we would look for prices to move lower and potentially break through $2.87” in the week ahead.

Even with strong cooling demand, record-level production has kept natural gas on the wrong side of $3 from the bulls’ perspective. Government data released Friday corroborates the growth trends observed by traders and analysts.

The Energy Information Administration (EIA), in its monthly natural gas update Friday, said April 2018 dry gas production totaled 2.39 Tcf, or 79.7 Bcf/d, 8.0 Bcf/d (11%) higher year/year (y/y). That marks the eleventh straight month that production has surpassed the corresponding year-ago period, according to EIA.

“The average daily rate of dry natural gas production for April 2018 was the highest for the month since EIA began tracking monthly dry production in 1973,” the agency said.

EIA data shows consumption totaled 2.341 Tcf for April, a month that featured several spring storage withdrawals thanks to unseasonably cold weather. That averages out to 78 Bcf/d, a whopping 21.7% (13.9 Bcf/d) higher than the 1.924 Tcf consumed in April 2017, according to the agency’s tally.

“Natural gas consumption for April was the highest level for the month since 2001, when EIA began using the current definitions for consuming sectors,” EIA said, noting that residential, commercial, industrial and electric power consumption each increased y/y in April.

Looking at more recent production totals, Genscape Inc. said revisions to pipeline nomination data have pushed affiliate Spring Rock’s daily Lower 48 production estimate above the 80 Bcf/d mark for Thursday, reaching 80.05 Bcf/d, with Friday expected to roughly equal that total.

Crude oil prices have also swung higher over the past week or so, a potentially bearish development for natural gas given the prospect of more associated gas hitting the market. Nymex front-month crude oil futures settled at $74.15/bbl Friday, up 70 cents on the day and up more than $6 since Monday.

The recent surge has put West Texas Intermediate (WTI) prices at their highest level since late 2014, Genscape analyst Rick Margolin said.

“WTI and global prices have surged” due to a number of factors, including production increases announced by the Organization of the Petroleum Exporting Countries that fell short of market expectations, “cuts to Libyan exports with a civil war focusing on control of key export ports, foreign countries showing signs they’ll comply with U.S. demands to stop purchasing Iranian oil, and a larger-than-expected withdraw from U.S. domestic crude storage,” according to Margolin.

“Earlier this month, WTI had sunk to a 42-day low at $64.76/bbl. Since then the price has surged nearly $9,” he said. “The last time we saw a near-similar magnitude price gain was back in January. At that time, the WTI price had picked up more than $8 in a six-week span. That move (along with similar percentage gains in forward gas prices) added more than 0.3 Bcf/d of gas to our Summer 2018 forecast, and revised our Winter 2018/19 forecast up nearly 1.5 Bcf/d.”

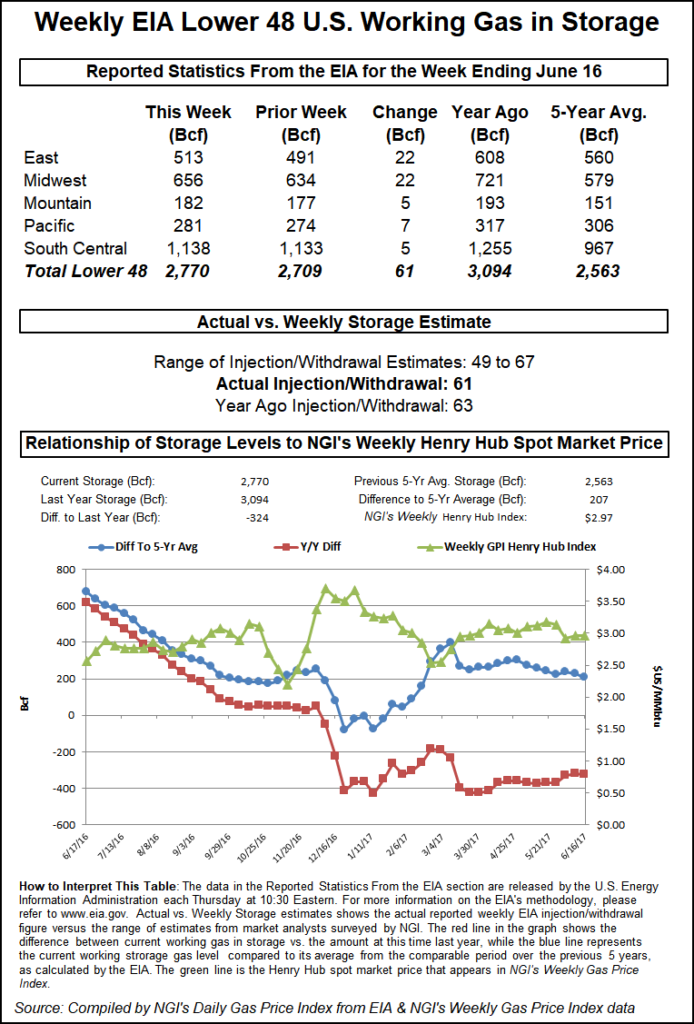

Meanwhile, the Energy Information Administration (EIA) on Thursday reported a below-consensus natural gas storage build for the week ended June 22, but prompt month futures pulled back a few cents as the market reacted to a revision that increased the prior week’s reported net build by 4 Bcf.

EIA reported a net 66 Bcf injection into Lower 48 gas stocks for the period, on the leaner side of market expectations leading up to the report. Last year, EIA recorded a 48 Bcf injection, and the five-year average is a build of 72 Bcf.

But the otherwise-bullish injection figure in this week’s report came with an asterisk. EIA said a reported revision “caused the stocks for June 15 to change from 2,004 Bcf to 2,008 Bcf. As a result, the implied net change” from June 8 to June 15 increased to 95 Bcf, higher than the 91 Bcf build the agency published in last week’s report.

Bespoke Weather Services said the revision effectively neutralized any bullish implications of the leaner-than-expected build.

“Storage levels are now estimated to sit at 70 Bcf above where they were estimated at this time last week,” Bespoke said. “The print over the past week is supportive, indicating significant weather-adjusted power burn tightening we had observed. Yet this reclassification indicates that previously, when heat was not as strong, we were even looser than expected, and on a two-week basis are not tight.

“This data is not yet bearish, as burns remain tight, but as they loosen” and long-range heat tapers off “downside arrives.”

Indeed, the report seemed to temper the market’s enthusiasm for the August contract, which had gained momentum earlier in the morning, climbing above $3.01 in the minutes leading up to EIA’s report.

But minutes after the EIA data crossed trading desks at 10:30 a.m. ET, August had dropped into the $2.980-2.985 area. Just after 11 a.m. ET, August was trading around $2.971, down about a penny from Wednesday’s settle.

Prior to the report, the market had been looking for a build in line with the five-year average. A Reuters poll of 25 industry traders and analysts had produced a tight 64 Bcf to 76 Bcf injection range with a 71 Bcf consensus expectation.

Working gas in underground storage stood at 2,074 Bcf as of June 22, versus 2,809 Bcf last year and five-year average inventories of 2,575 Bcf. Week/week, the year-on-year storage deficit shrank from 757 Bcf to 735 Bcf, while the year-on-five-year deficit increased slightly from 499 Bcf to 501 Bcf, EIA data show.

By region, the largest weekly builds were reported in the East and Midwest, which each returned 24 Bcf to the ground. In the Pacific, 5 Bcf was injected, while 6 Bcf was injected in the Mountain region. The South Central — where the revision to last week’s inventories was reported — saw a net build of 7 Bcf for the week ended June 22, with a 13 Bcf injection into nonsalt offsetting a withdrawal of 6 Bcf from salt.

The higher build following the revision “suggests a somewhat looser stat for” for the week ending June 15, “moving from plus 1.1 Bcf/d looseness versus degree days and normal seasonality to plus 1.6 Bcf/d,” Margolin said.

As for the report week ending June 22, analysts with Tudor, Pickering, Holt & Co. (TPH) calculated that the market was about 0.5 Bcf/d undersupplied even with U.S. production “closing in on 81 Bcf/d, up 800 MMcf/d week/week.

“The production ramp is more attributable to the reversal of processing downtime rather than new supply as Northeast volumes marginally increased,” the TPH team said. Liquefied natural gas “exports have appeared to stabilize at around 3.5 Bcf/d, but Mexican export weakness continues with exports down y/y.”

The Desk’s Early View natural gas storage survey on Friday showed 12 respondents on average expecting EIA to report a 72.8 Bcf build for the week ending June 29, with a median build of 75 Bcf and a range of 57 Bcf to 82 Bcf. Last year, EIA recorded a 60 Bcf build for the period, and the five-year average is a build of 70 Bcf.

In the spot market Friday, prices for weekend and Monday delivery slipped throughout the Gulf Coast, Midwest and East as traders in those regions apparently felt prepared to beat the heat; the NGI National Spot Gas Average fell 6 cents to $2.69/MMBtu.

The declines included a 7-cent drop at Henry Hub as the cash price pulled into better alignment with front-month futures.

Much of the Lower 48 has toasty temperatures to look forward to over the weekend and into next week’s holiday, according to NatGasWeather.

“Hot upper level high pressure continues to expand across the Midwest and Northeast with highs reaching the mid-90s from Chicago to New York City most days through next week,” the firm said. “With most of the central and southern U.S. also hot with 90s and 100s, national demand will be very strong, including the Fourth of July holiday where most of the country will see highs of 90s to 100s besides the Northwest.”

Despite the heat, after gains earlier in the week, most Mid-Atlantic and Northeast points pulled back on deals for weekend and Monday delivery. Algonquin Citygate shed 7 cents to $3.37, while Iroquois Zone 2 dropped 9 cents to $3.30.

Further south, Transco Zone 6 New York finished a penny lower at $3.38 as Transco Zone 5 gave up 13 cents to $3.26.

In West Texas, recent capacity restrictions on El Paso Natural Gas (EPNG) looked to be easing Friday, according to Genscape analyst Joe Bernardi.

“EPNG has restored a small amount of operational capacity through” the Guadalupe compressor station in West Texas, “although the relevant force majeure there remains in effect,” Bernardi said. For Thursday’s initial cycles, the flow point at the Guadalupe station “had its operating capacity reduced to 740 MMcf/d. However, EPNG announced Thursday that operating capacity would return to 838 MMcf/d” as of the Intraday 3 cycle.

“The overarching force majeure that is requiring the 838 MMcf/d operating capacity (instead of the normal capacity of around 1,120 MMcf/d) is still expected to end Tuesday.”

El Paso Permian added 3 cents to $1.79 Friday, while Transwestern added 9 cents to $1.95.

Further downstream, El Paso S. Mainline/N. Baja dropped 26 cents to $2.38.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |