Regulatory | NGI All News Access

Pemex Meets New Associated Gas Use Standards at 131 Oilfields, Regulator Says

Petroleos Mexicanos (Pemex) is complying with new associated gas utilization rules at 131 of its oilfields, according Mexico’s upstream regulator.

The Comision Nacional de Hidrocarburos (CNH) last week issued rulings on natural gas utilization programs presented for 167 oil-producing areas under the control of the state company. Pemex had submitted the plans last year to comply with rules issued by CNH in early 2016 to reduce flaring and increase oil recovery factors at Mexico’s oilfields.

The regulator determined that 131 of the 167 Pemex-controlled areas complied with the guidelines, which require that an operator use at least 98% of its annual associated gas output. The other 36 blocks did not comply “basically due to a lack of infrastructure,” said CNH’s León Daniel Mena Velazquez, head of the regulator’s technical unit for extraction.

“The majority of these areas are concentrated in Poza Rica,” in central Mexico, he added. “The wells are spread out and do not produce much, which is one reason why there’s no infrastructure at present and why it’s mainly the programs in this area that are not in compliance.”

The CNH asked Pemex to submit new plans for the outstanding 36 blocks within 30 days.

The associated gas utilization rules also apply to the private and foreign exploration and production (E&P) companies that have won blocks in Mexico’s oil and gas licensing auctions. E&Ps have three years to meet the 98% utilization target once they begin producing, so long as it is economically viable to do so within that timeframe.

“Fundamentally, what these rules seek is the rational exploitation of Mexico’s reservoirs,” CNH commissioner Nestor Martinez Romero said. “Some reservoirs in Mexico generate gas caps. And as those gas caps grow, the wells, depending on their position within the reservoir, start to see more gas flow,” which drives up crude output. “Common sense might say to continue producing since you are boosting oil output, but at the end of the day, wells with a high gas/oil ratio can lead to lower oil recovery factors.”

Mexican regulations require that operators set an upper limit for the gas/oil ratio of each oil-producing well in order to maximize its recovery factor.

The 167 programs presented by Pemex do not cover the company’s most productive asset, the Ku-Maloob-Zaap (KMZ) field in the Bay of Campeche, off the Gulf Coast in southern Mexico. KMZ currently contributes some 45% of Pemex’s 1.88 million b/d output.

KMZ is subject to a separate program resulting from a fine that CNH levied against Pemex in 2016 for violating gas flaring rules in place since 2009.

As part of that penalty, Pemex committed to investing some $3 billion to improve associated gas management at the KMZ. Those investments include a gas pipeline and electric submersible pumps, installed in 2017, as well as reinjection work this year and two new compression platforms due online in 2019 and 2020.

Gas flaring at KMZ averaged 90 MMcf/d in 2017, down by roughly 100 MMcf/d from 2016, according the latest data from the Mexican Energy Ministry (Sener). Pemex has said the KMZ investments, once completed, would allow the field to reach a utilization rate of 98% and supply an additional 160 MMcf/d to its petrochemical plants in the southeast, a region suffering from gas shortages.

Mexico has more than halved gas flaring at its oilfields to reach 213 MMcf/d in 2017, compared to 504 MMcf/d in 2016, according to Sener.

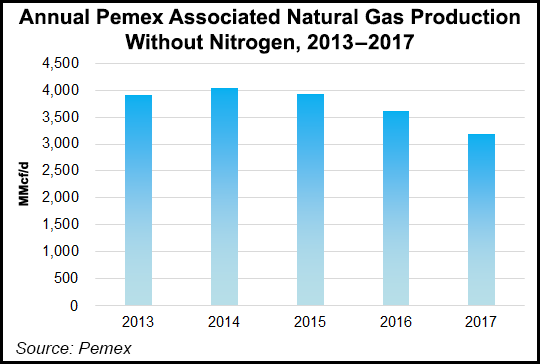

Excluding nitrogen content, Pemex’s associated gas production was 3.03 Bcf/d in May, down 8% compared to 3.29 Bcf/d in May 2017. Non-associated gas production was down 10% year/year to 0.9 Bcf/d.

Also last week, Mexican authorities unveiled the fiscal terms for Pemex’s upcoming farmout auction of seven onshore mature areas in southern Mexico.

The tender marks the debut of a revised bidding mechanism, in which companies commit to paying a fixed royalty to the Mexican government and a cash sum to Pemex. The cash payments, announced last week, range from $5 million for the Lacamango block to $146 million for Juspi-Teotleco. For the largest prospect in the auction, the Bedel-Gasifero area, companies must pay out $128 million.

Bidders would also offer an additional cash bonus for each block, which would determine the winner. Pemex would receive 80% of the bonus payment, while the remainder would go into Mexico’s sovereign oil fund, which also collects the royalty payments.

The blocks on offer currently produce a combined 43,000 b/d of crude and 228 MMcf/d of gas and hold 189 million bbl and 950 Bcf of proven, probable and possible reserves, according to Pemex.

To date, four companies have accessed the data room for the farmout areas. Three firms have initiated the prequalification process: Spain’s CEPSA, Canada-based explorer Gran Tierra and Argentine oil company Tecpetrol SA.

Bids for the farmouts are due Oct. 31, roughly one month after a joint licensing round for onshore conventional and unconventional areas on Sept. 27.

All three auctions are scheduled to occur after Mexico’s presidential elections on July 1, but before the next administration takes office in December.

Mexican officials on Wednesday signed E&P contracts with the winners of the offshore Round 3.1 tender in March. The auction awarded 16 of the 35 blocks on offer in the shallow water areas of three basins in the Gulf of Mexico. Pemex won seven of the blocks.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |