Nymex July Natural Gas Edges Higher as Heat Trumps Bearish Storage Data

July natural gas prices ended the day slightly higher Thursday as the battle between hot weather and another surprise in weekly storage data continued. The Nymex July gas futures contract swung as high as $3.012 and as low as $2.947 before eventually settling 1.1 cents higher at $2.975.

Spot gas prices, meanwhile, moved lower as comfortable weather patterns were expected across most of the country for the next several days. The NGI National Spot Gas Average slipped 4 cents to $2.64.

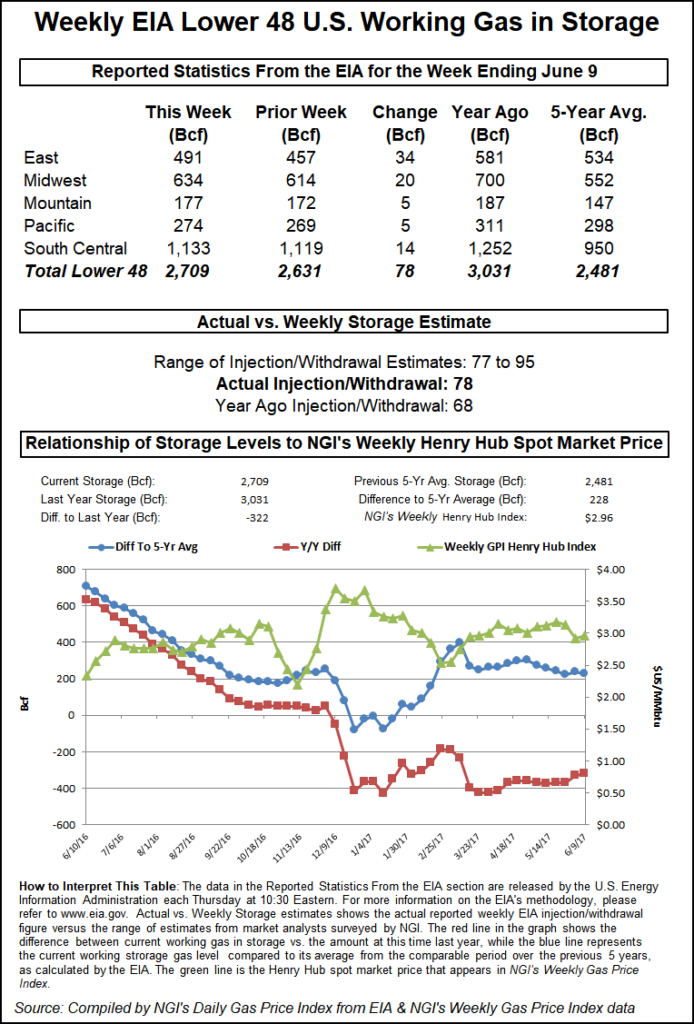

In its weekly storage inventory report, the Energy Information Administration (EIA) reported a 91 Bcf build into storage stocks for the week ending June 15, once again well above market consensus of an 85 Bcf build.

Working gas in storage climbed to 2,004 Bcf, which is still 757 Bcf below year-ago levels and 499 Bcf below the five-year average of 2,503 Bcf. The East and Midwest regions each injected 29 Bcf into storage, while the South Central injected 24 Bcf.

“Clearly, this is a rather bearish result, suggesting strong production is effectively countering above-normal cooling degree days (CDD). The result portends that as soon as the coming hot pattern cools back to normal, deficits will steadily recover,” NatGasWeather said.

Forecasters at Bespoke Weather Services agreed the larger-than-expected build reflected the impact of loosening power burns it had observed since June 15. Balances in the natural gas market continued to remain loose, especially as the past gas week included what were significant maintenance-related production declines.

Ahead of the report, market consensus had built around a storage injection in the mid-80s Bcf range. IAF Advisors’ Kyle Cooper projected an implied build of 86 Bcf and a headline build of 82 Bcf, while Bespoke estimated an 84 Bcf build. A Bloomberg survey had a range of 76-91 Bcf, with a median of 86 Bcf. A Reuters poll pointed to an 85 Bcf injection, with estimates ranging from 80-91 Bcf and a median build of 85 Bcf.

For the comparable week a year ago, EIA reported a 63 Bcf; the five-year average build stands at 83 Bcf for the corresponding period.

When news of the storage injection hit the market, Nymex July futures immediately pulled back 2.5 cents. Just before 11 a.m. ET, the prompt month was trading at $2.983, an increase of about 2 cents from Wednesday’s settle.

Despite Thursday’s relative inaction, natural gas prices have improved in line with Barclays Commodities Research forecasts. In an outlook released Wednesday, analysts led by Michael Cohen said the price move higher has occurred “despite increases in production and marginally lackluster power burn. Yet the market continues to focus on the storage deficit to the five-year range, which has improved only marginally.”

Given the upcoming summer cooling season, forecasts for warmer-than-normal weather helped raise market expectations to Barclays’ forecast range. Those forecasts were predicated on normal weather assumptions in order to replenish stocks, “so we expect even further appreciation in natural gas prices in the summer months ahead,” Cohen said.

For the next couple of weeks at least, the weather data appears to support higher prices as the late June and early July pattern keeps trending hotter over the eastern United States as high pressure sets up, with high temperatures in the 90s expected to gain ground, NatGasWeather said.

Forecasters called the weather pattern bullish overall, but cautioned that early July builds would need to come in lighter than five-year averages off the widespread heat, “or it will be problematic for the bullish case going forward.

“The pattern is certainly hot/bullish enough to threaten $3 if the markets wanted to weigh weather forecasts more heavily than strong production. But after such a bearish result on the EIA report, the markets are likely pausing to reconsider if $3 is warranted,” NatGasWeather said.

Meanwhile, production is expected to gain the upper hand in the long term, although it is not likely to cut into persistent storage deficits for at least another four to five weekly storage reports, the forecaster said. “We see the markets soon becoming fixated on how the coming July heat will be countered by strong production and whether builds will meaningfully print lighter than five-year averages.”

Genscape Inc. expects slight rebounds in production for the balance of this current week as a handful of Northeast and Rockies maintenance events wind down.

Meanwhile, demand related to liquefied natural gas (LNG) is expected to increase as delivery nominations to the Sabine Pass LNG export facility rebounded to 2.9 Bcf/d for Thursday’s gas day. Late Wednesday afternoon, Genscape monitors and LNG clients were alerted of the operational change at Train 1, which showed decreased nominated deliveries for Wednesday’s gas day. The alert was issued before evening cycle nominations data was published and confirmed its observations.

Spot Gas Softens, Heat Subsides

Spot gas prices across the country moved lower as a weather system tracked across the north-central United States with showers, thunderstorms and cooling, NatGasWeather said. Overall, the northern part of the country should remain mostly comfortable through this coming weekend, while most of the southern part of the country warms into the 90s and 100s, including the high demand states of California, Texas and Florida.

There still is a weather system likely to cut across the north-central United States early next week for regionally comfortable conditions, “although this has trended less impressive with most of the country still expected to reach the upper 80s to 100s, hottest over the southern and eastern U.S. where high pressure will be strongest,” the weather forecaster said.

In the Northeast, prices came off significantly in New England despite some maintenance that may limit flows on Algonquin Gas Transmission. The pipeline said the Burrillville compressor station will be restricted to 830 MMcf/d for a week, from Thursday (June 21) through June 29.

Scheduled capacity through the compressor has only averaged 329 MMcf/d month-to-date (or up to 432 MMcf/d using an imbalance west of Burrillville with no-notice). Meanwhile, Algonquin on Wednesday also lifted its operational flow order as the heat wave tailed off with only 1 CDD above normal forecast for Thursday. Current forecasts for end of month into July, however, show the possibility of more heat coming through with CDDs twice as high as average on some days, Genscape said.

Despite the pipeline restrictions, mild weather sent next-day gas at Algonquin Citygate down 25 cents to $2.47. Elsewhere, Iroquois zone 2 slipped 3 cents to $2.75, and Transco zone 6 non-NY dropped 15 cents to $2.65.

Appalachia prices posted smaller losses day over day. Dominion South slipped a penny to $2.30, while Tennessee zone 4 Marcellus dipped 3 cents to $2.16.

In the country’s midsection, Panhandle Eastern next-day gas fell 2 cents to $2.20, while NGPL Midcontinent tumbled 11 cents to $2.26. OGT, meanwhile, climbed 17 cents to $1.97. Midwest prices climbed slightly as well, with the Midwest Regional Average edging up a penny to $2.76.

In California, SoCal Citygate prices ended a three-day rally as earlier forecasts for hot weather to end the week failed to materialize. Instead of highs reaching the mid-80s as previously forecast, AccuWeather showed daytime temperatures topping out in the low 80s for Thursday and Friday, near normal for this time of year.

SoCal Citygate spot gas plunged 28 cents to $3.51, while Malin dropped 15 cents to $2.27.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |