Infrastructure | E&P | NGI All News Access

Marcellus, Permian Rig Counts Down as BHI’s U.S. Tally Falls by Three

A drop in natural gas-directed drilling, included a net declines in the Marcellus and Utica shales, drove the U.S. rig count lower for the week ended Friday, according to data from Baker Hughes Inc. (BHI).

The domestic tally fell by three week/week (w/w) to 1,059 from 933 active units a year ago. Four natural gas rigs exited the patch to offset a net gain of one oil-directed unit. Directional units finished flat w/w, while two horizontal units and one vertical unit packed up, according to BHI.

All of the week’s U.S. net declines occurred on land, as Gulf of Mexico activity held steady at 19 rigs and one rig returned to inland waters.

In Canada, 27 rigs returned for the week, including 18 oil-directed rigs and nine gas-directed, leaving the Canadian tally at 139, down from 159 a year ago.

The North American rig count climbed by 24 w/w to end at 1,198 units from 1,092 rigs at this time last year.

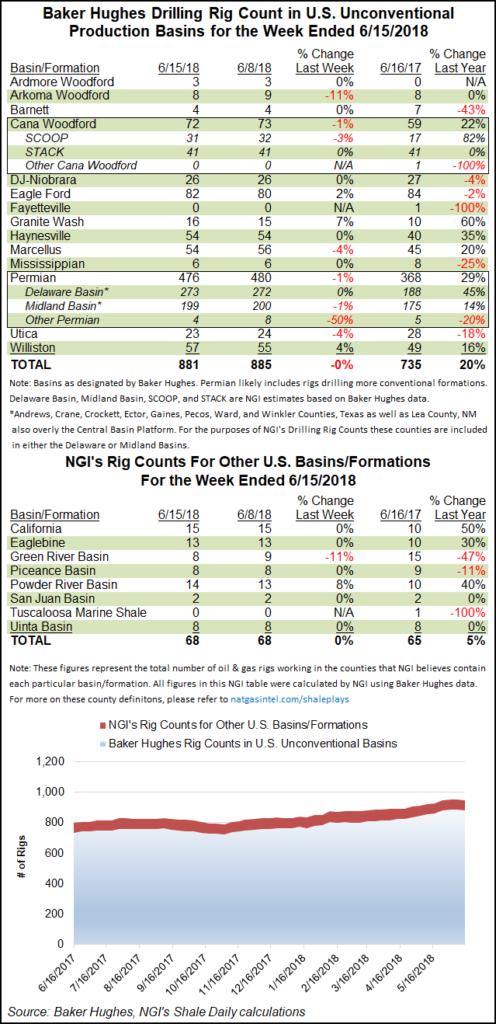

Among plays, the Permian Basin saw the largest net change for the week, dropping four units to finish at 476 (368 a year ago). A more detailed breakdown of BHI data by NGI’s Shale Daily shows the declines focused in the “Other” portion of the Permian, with the Midland sub-basin dropping one unit w/w as the Delaware sub-basin added one.

Meanwhile, the Marcellus Shale saw two rigs dropped for the week to finish at 54, putting it even with its gas-focused competitor in the Gulf Coast region, the Haynesville Shale. Other declines were in the Arkoma Woodford, the Cana Woodford and the Utica Shale, which each dropped one rig.

Gainers among plays included the Williston Basin and the Eagle Ford Shale, which each added two units, while one rig returned in the Granite Wash, according to BHI.

Among states, North Dakota and New Mexico each added three rigs for the week, while Louisiana picked up a rig to end at 60 active units.

Texas posted the largest weekly net decline among states, dropping four units to finish at 534. Alaska dropped two rigs overall, while Colorado, Ohio, Pennsylvania and West Virginia dropped a rig a piece.

Haynesville natural gas production is up 0.9 Bcf/d year-to-date, with output from the legacy play topping 9 Bcf/d for the first time since December 2012, analysts with Jefferies LLC said in a note earlier in the week.

“Although the majority of Haynesville activity is in Louisiana (60% of active rigs), there has been a recent increase in activity in the East Texas portion of the play,” the Jefferies team told clients. BP plc and ExxonMobil Corp. “have been two of the most active operators in this portion of the play, both currently operating seven rigs, up from only two combined rigs in June 2017.

“Recent well results in the play have improved versus older wells as enhanced completion techniques have been implemented, but we still estimate that East Texas Haynesville wells are only marginally economic.”

Meanwhile, Permian crude oil production is forecast to reach 5.4 million b/d in 2023, more than current production from any single member of the Organization of the Petroleum Exporting Countries (OPEC) except for Saudi Arabia, according to a recent analysis from IHS Markit.

Natural gas also is expected to double from 2017-2023 — up 116% — to 15 Bcf/d, while natural gas liquids should climb 105% to 1.7 million b/d.

“In the past 24 months, production from just this one region — the Permian — has grown far more than any other entire country in the world,” said IHS Markit Chairman Daniel Yergin. “Add an additional 3 million b/d by 2023 — more than the total present-day production of Kuwait — and you have a level of production that exceeds the current production of every OPEC nation except for Saudi Arabia.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |