Nymex July Futures Brush Off Surprising Storage Miss; Spot Gas Mixed

July natural gas prices were on somewhat of a “rollercoaster ride” Thursday after a surprising storage miss and hotter weather trends for later this month showed up in weather data. The Nymex July contract settled at $2.965, up two-tenths of a cent on the day.

Spot gas prices were mixed as spring pipeline maintenance remained in effect, leading to swings for some pricing hubs. The NGI National Spot Gas Average slipped 3 cents to $2.60.

Nymex July gas futures were in the red before the market’s open as overnight weather guidance trended cooler for late next week. A cool shot focused across the center of the country into the Ohio River Valley was seen as potentially pulling cooling demand below seasonal averages for a brief period, according to Bespoke Weather Services.

Then, the Energy Information Administration’s (EIA) weekly storage inventory report came out, reflecting a 96 Bcf build that was considerably higher than even the most bearish of expectations. Nymex July natural gas futures initially appeared to take the surprise build in stride as the prompt month barely budged after the storage report’s 10:30 a.m. release.

“Prices didn’t fall that much. We were at $2.97 when the number came out, then we dropped a penny,” INTL FCStone’s Tom Saal said. By 11 a.m. ET, the Nymex July contract had dropped to its low of the day at $2.93 before regaining some ground to trade relatively flat compared to Wednesday’s settle.

Market consensus was around a build in the upper-80 Bcf range. EBW Analytics favored a slightly smaller build, while Bespoke Weather Services projected a 90 Bcf injection. Kyle Cooper of ION Energy Services expected a 93 Bcf build, and a Bloomberg survey had a range of 82-95 Bcf, with a median expectation of 90 Bcf. A Reuters poll also had a range of 82-95 Bcf, with a median expectation of 90 Bcf.

Saal said Thursday’s late-morning trading action was likely due to high-frequency traders that don’t necessarily care about such a large discrepancy in storage estimates versus the actual reported build. “The market is groping along now. There’s only so many things it can react to,” he said.

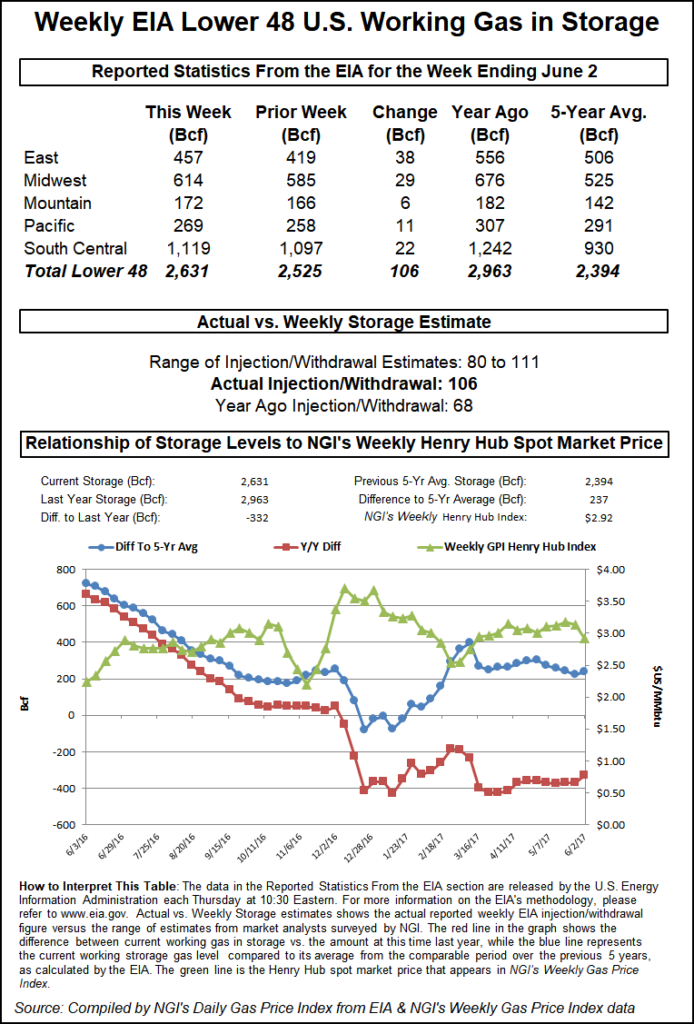

With storage inventories rising to 1,913 Bcf, those inventories are 785 Bcf less than last year at this time and 507 Bcf below the five-year average of 2,420 Bcf.

“This indicates that much of the looseness last week was not holiday demand destruction but rather loosening in power burns we have been observing, a trend that has continued even into this week,” Bespoke chief meteorologist Jacob Meisel said.

Last year, the EIA reported an injection of 82 Bcf, while the five-year average build stands at 91 Bcf. The East region injected 26 Bcf into storage, while the Midwest injected 31 Bcf. Inventories in the South Central region rose by 27 Bcf.

With storage deficits to historic levels remaining, and this week’s storage report only trimming the deficit to the five-year average by a mere 4 Bcf, Mobius Risk Group said an average injection of 73 Bcf per week would be needed in order for storage to reach the 3.5 Tcf mark ahead of the winter withdrawal season. Over the 23-week period from June 8-Nov. 2 last year, weekly injections averaged 53 Bcf.

A simplistic view suggests each week would need to be 3 Bcf/d loose to the prior year’s comparable injection to reach the 3.5 Tcf threshold. As a result, Thursday’s storage report would not be considered a bearish indicator unless the injection was larger than 103 Bcf.

But Bespoke said with average weather, the print is loose enough to put 3.6 Tcf in play, and though its current end-of-October estimate sits at 3.56 Tcf with a hot July, “we do not see the print as indicating much of a reason to rally, especially given cooler forecasts,” Meisel said.

With forecasts likely to trend hotter to close out June and with production limited, however, the weather forecaster said “$2.87-2.90 should hold and be a strong long entry, but the print is clearly bearish.”

Indeed, the market remains in waiting mode for Lower 48 production growth to take off as so many industry experts had predicted it would. Instead, maintenance season has yet to wind down and production has failed to get out of its recent high-70 Bcf/d range.

The EIA said earlier this week that dry natural gas production, which averaged 73.6 Bcf/d last year, will average a record 81.2 Bcf/d in 2018 and will increase again in 2019 to 83.8 Bcf/d.

“The big question remains: When will record production meaningfully reduce deficits since the coming pattern looks warm/hot enough to keep them near or greater than -500 Bcf for many weeks to come,” NatGasWeather said.

Indeed, midday weather data turned a touch cooler for next week into the following June 23-24 weekend, but then slightly hotter June 26-28 as the models continue to struggle on where the core of a hot upper ridge will set up to end June, forecasters said.

Wednesday night, models shifted the late June hot ridge a touch further west, while midday models turned it back a little further eastward, but still not quite hot enough over the Midwest and East. “A very warm overall pattern, but is it hot enough to take out $3?” NatGasWeather said.

Seasonal Maintenance Leading to Spot Gas Swings

While several pricing hubs posted wild swings on the day, benchmark Henry Hub spot gas prices were up a more modest 2 cents to $2.96, while Tennessee Line 500 slipped 2 cents to $2.86. Columbia Gulf Mainline was flat at $2.82.

Over in East Texas, forecasts for increasing cloud coverage during the next several days softened prices in the region. Houston Ship Channel slipped 2 cents to $2.98, and Katy was down 4 cents to $2.96.

In the Permian Basin of west Texas/southeastern New Mexico, next-day gas fell again amid ongoing pipeline maintenance-related constraints in the region. El Paso-Permian traded at $1.88, down 9 cents on the day. Waha was down 4 cents to $1.88.

Midcontinent prices were mixed, with NGPL Midcontinent next-day gas tumbling 12 cents to $2.37, Southern Star falling 8 cents to $2.39 and OGT sliding 7 cents to $1.83. Northern Natural Ventura, meanwhile, rose 4 cents to $2.68.

Rockies production has been impacted by a decrease in receipts of over 200 MMcf/d from the Echo Springs processing plant in southwestern Wyoming, according to Genscape.

This decrease was not alluded to in any of the affected pipelines’ advance maintenance schedules or notices, but fits into an annual pattern that could indicate planned maintenance at the plant, the company said.

Combined receipts onto the Colorado Interstate Gas, Rockies Express, Southern Star and Wyoming Interstate Company pipelines averaged 326 MMcf/d in May and 358 MMcf/d in the first 11 days of June, but have fallen off since then to only 115 MMcf/d, Genscape natural gas analyst Joe Bernardi said.

Meanwhile, another maintenance event was set to restrict flows to the Midwest. Natural Gas Pipeline Co. of America declared a force majeure Wednesday on Segment 11 restricting operational capacity by 520 MMcf/d.

Utilization through Segment 11 has averaged 95% for the prior 30 days, however, scheduled volumes as of evening cycle for Thursday haven’t reflected a similar drop in operating capacity, Genscape analyst Vanessa Witte said. Scheduled capacity is 990 MMcf/d, which is only a 37 MMcf/d decrease from Wednesday’s 1.02 Bcf/d.

There was no announced end date for the force majeure.

Genscape meteorologists are forecasting cooling degree days to climb above 15 from June 16-28 in the Midwest area, “which could put pressure on NGPL to deliver enough gas into the market,” Witte said.

NGPL Amarillo Mainline spot gas jumped 10 cents to $2.65, while Chicago Citygate rose a nickel to $2.78.

Meanwhile, Pacific Gas & Electric Co. will be performing planned maintenance beginning Friday that will cut into around 200 MMcf/d of Redwood Path flows, Genscape said. Maintenance at the Gerber Station will necessitate an operating capacity limit of 1,745 MMcf/d. The previous 30-day average flow is 1,935 MMcf/d, with more than 80% of those volumes coming via the interconnect with Gas Transmission Northwest.

PG&E currently expects this maintenance will last through the end of the month. A maintenance event last month with a similar operating capacity but shorter duration corresponded with a brief spike in PG&E Citygate spot basis and a slight decrease in PG&E’S injections to storage.

PG&E Citygate spot gas rose a nickel to $3.05, while Malin plunged a dime to $2.33. SoCal Citygate tumbled 40 cents to $2.96.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |