DJ Basin E&Ps Not Backing Down as Midstream Opportunities Expand

Like Mark Twain once said of false news reports about himself, the “demise” of the Denver-Julesburg (DJ) Basin in Colorado may be greatly exaggerated. Despite concerns that environmental protests and more restrictive regulations are driving operators to other states, it remains one of the nation’s top producing basins.

Industry sources told NGI’s Shale Daily that the DJ’s future is bright. But off the record, some expressed concerns and uncertainty about the next governor and the future regulatory environment. Gov. John Hickenlooper, a Democrat who has been supportive of the industry, will soon step down after two terms in office.

A spokesperson at the Colorado Oil and Gas Conservation Commission (COGCC) said regulators have no information that supports speculation that exploration and production (E&P) companies are leaving the DJ based on the regulatory environment.

A Denver-based spokesperson for Extraction Oil & Gas Corp., a pure-play DJ E&P, told NGI’s Shale Daily the company is not going anywhere.

“We bring more innovation to the table and we partner with communities to find ways to develop that work out for everyone,” he said, citing an agreement reached last year with Broomfield, CO, as a model.

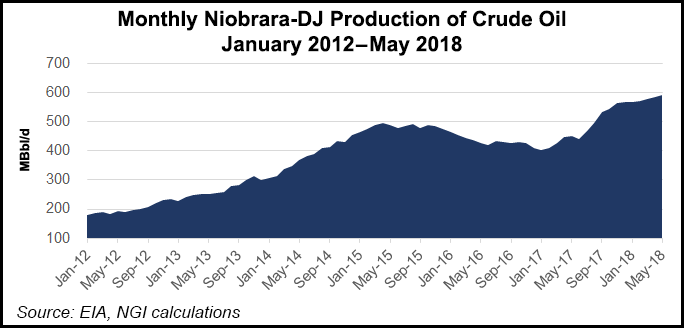

The Colorado Oil and Gas Association (COGA) pointed to expectations for all-time DJ production records this year in light of permit applications to the COGCC as an indication that concerns about the DJ are misplaced. Anadarko and other DJ-focused E&Ps, including PDC Energy Inc., continue putting a lot of their focus on the DJ.

COGA CEO Dan Haley said 94% of the COGCC applications are to drill in the DJ. “And according to the COGCC, they are on pace to surpass record drilling application numbers for the year. Colorado has among the toughest regulations in the country, is blessed with a phenomenal resource [base], and right now business is good,” he said.

Some of the recent clamor to the contrary came from comments by Whiting Petroleum Corp. CEO Brad Holly at the recent Williston Basin Petroleum Conference. While he talked bullishly about opportunities in the Bakken Shale and North Dakota’s favorable regulatory environment, he suggested Whiting was ready to sell its considerable stake in Colorado.

Whiting’s Ashley McNamee, director of corporate and government relations, said she was unsure about Holly’s comments, but “we have a $750 million dollar capital budget for 2018 — $600 million is being spent in the Williston Basin and $75 million in Colorado — and both assets continue to add value to Whiting.”

PDC holds 100,000 net acres in the Wattenberg field and it is planning more robust development this year and beyond, according to a spokesperson.

Echoing this optimism, Anadarko Petroleum Corp., the largest producer in Colorado, considers the DJ and the Permian Basin to be its two most important U.S. onshore operating areas.

“DJ is the key to Colorado’s economy,” said Anadarko spokesperson John Christiansen. Anadarko holds net resources in the DJ totaling more than 2 billion boe and more than 10 years of new drilling activity, he said.

Anadarko recently permanently took out of service its Third Creek midstream gathering system, which serviced about 30 natural gas producers. However, the system only gathered “very small volumes,” a spokesperson said, totaling about 6 MMcf/d, which is less than 0.5% of Anadarko’s total gathering capacity in the DJ. The producer still averaged more than 260,000 boe/d from the DJ during the first quarter, an 8% increase from a year ago.

Meanwhile, additional natural gas liquids (NGL) processing capacity is slated to be added this year, with DCP Midstream LP opening its 10th gas processing plant in August. Processing plants separately underway by Discovery Midstream Partners LLC and RimRock Energy Partners LLC are expected to come online by 2020.

In addition, SemGroup Corp., majority owner of the White Cliffs Pipeline, is converting part of the system to move NGLs from Colorado to the Gulf Coast. DCP plans to construct a 25-mile pipeline in the DJ to connect its system to White Cliffs.

And Denver-based Sterling Energy Investments LLC is planning to expand processing capacity of the Centennial System in the northeastern DJ to 220 MMcf/d from 120 MMcf/d to accommodate growing producer demand.

Sources close to some of the E&P’s in Colorado off-the-record will acknowledge that there are concerns because of the tough regulatory environment. There is added uncertainty about the November elections, with the crowded gubernatorial race in both the Republican and Democratic parties with candidates offering widely varying outlooks on the industry and regulation.

One source said “over-regulation” continues to be a concern in Colorado. “Oil and gas is Colorado’s most regulated industry, and those regulations come with a cost,” the source said. Many think the industry has done an admirable job in managing the stiff requirements and think E&Ps should be rewarded for it. In addition, the source said DJ operators provide many high paying jobs and operate in a responsible fashion.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |