Regulatory | Infrastructure | NGI All News Access | NGI Mexico GPI

Nueva Era Cross-Border Pipeline Begins Flow; In Service Later this Month

Impulsora Pipeline LLC began injecting natural gas into its Nueva Era pipeline last week, according to a filing at FERC by the company’s operator, Howard Midstream Energy Partners LLC.

Natural gas began flowing May 30 through the pipeline, which was built to transport gas produced in the Eagle Ford Shale to markets in northern Mexico, according to a letter from Impulsora posted at the Federal Energy Regulatory Commission Tuesday.

The pipeline is not yet in service, a company spokeswoman told NGI.

“This filing and the initial injection of natural gas is simply part of the broader start-up activities,” spokeswoman Meredith Hargrove Howard said. “The Nueva Era system as a whole is expected to be in service later this month.”

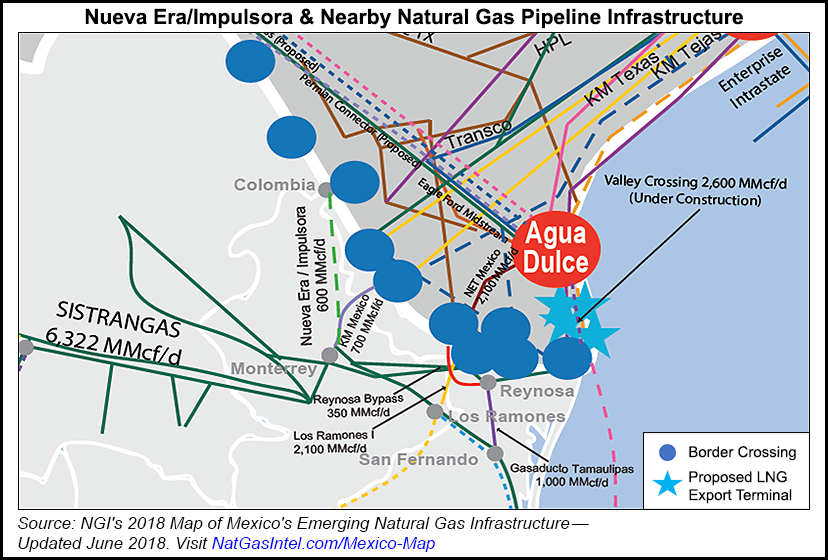

Nueva Era Pipeline LLC, a joint venture between HEP and Mexico’s Grupo Clisa, developed the pipeline to have 600 MMcf/d of transport capacity. The minimum 30-inch diameter, 190-mile pipeline was designed to directly connect a natural gas hub in Webb County, TX, to power plants in the Monterrey, Mexico area. The system is anchored by a 504 MMcf/d contract with the Comision Federal de Electricidad (CFE), Mexico’s state power company.

Construction of the pipeline began in early 2016 and was originally scheduled to enter service in the second half of 2017. Start-up was delayed based on “the needs of downstream off takers, adjustments required by a developing regulatory framework, and general force majeures related to some of last year’s extreme weather,” a Howard spokeswoman said in January.

The role of liquefied natural gas (LNG) in the Mexican supply balance is set to evolve after several pending pipelines, including Nueva Era, come in-service, experts say.

A handful of delayed projects that would connect gas consumers in northwest and central Mexico to U.S. producers in the Permian basin are due to wrap up by early next year. The 2.6 Bcf/d Sur de Texas-Tuxpan marine pipeline, running from South Texas to the Mexican port of Tuxpan, is also scheduled to come in-service later this year.

Social protests and legal challenges have held up several of the northwest Mexico pipelines located downstream from the U.S. border. Those projects would mainly supply power plants operated by state electricity company CFE and its independent power producers. Once those pipelines are completed, however, cheaper land imports are expected to further displace LNG in the Mexican gas market.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2577-9966 |