Markets | NGI All News Access | NGI Data

Thoughts of Summer Heat Prop Up Natural Gas Futures as Weekly Spot Prices Climb

With the natural gas markets making the transition to summer after an unusually hot May, weekly spot prices strengthened across most regions for the week ended Friday, especially in the West; the NGI Weekly National Spot Gas Average gained 11 cents to $2.59/MMBtu.

Prices gained big on the week at points throughout the Rockies and California as El Paso Natural Gas declared a number of force majeure events restricting upstream throughput on its system. SoCal Citygate jumped 94 cents on the week to average $3.44, while El Paso S. Mainline/N. Baja added 68 cents to $2.69.

In West Texas, El Paso Permian added 8 cents to $1.87, while in the Rockies, Kern River climbed 38 cents to $2.26.

A few points in the Northeast and Appalachia gained double digits as some hotter temperatures along the I-95 corridor late in the week helped lift day-ahead averages. Algonquin Citygate strengthened 24 cents to average $2.59, while further upstream in Appalachia, Dominion South climbed 29 cents to $2.47.

In Canada, NOVA/AECO C finished C23 cents lower on the week at C$1.33/GJ.

“We continue to see the AECO market as undersupplied through 2018 and 2019, in large part due to strong demand from the power sector,” analysts with Tudor, Pickering, Holt & Co. (TPH) said in a recent note. “We estimate baseload (weather neutral) demand is up 18% year/year (y/y), as mothballing of coal fire plants is leading to gas fire capturing a greater share of the power stack.

“Year-to-date, the gas share of power generation sits at 39%, up from 30% last year and nearly double 2014 levels (20%),” the TPH analysts said. “Combined with oilsands demand, we estimate baseload demand is up 0.67 Bcf/d y/y, which, coupled with stronger exports, is more than offsetting higher production levels. We expect the tightness in the market to result in weekly inventory builds being roughly half of normal levels, leaving storage at a five-year seasonal low entering winter.”

TPH analysts pushed their estimated start-up date for the recently approved North Montney Mainlineconversion from June 2019 to November 2019, “which extends the undersupply through 2019 and should support strong pricing for the next 12-18 months.”

Natural gas futures inched higher Friday in a range-bound session following a rally Thursday, with hotter June temperatures and a leaner-than-expected weekly storage report lending support to prices. The July contract settled at $2.962, up 1.0 cents on the day, though prices were working higher after the settle as afternoon weather data trended hotter. Week/week (w/w) the front month added a couple cents, with the expired June contract settling at $2.939 the Friday before.

“It was about as slow a day as expected in the natural gas market following an active Thursday, though prices into and post settle did catch a bid with afternoon model guidance confirming long-range hot trends,” Bespoke Weather Services said. The winter months leading the gains Friday “is extremely supportive on a technical basis, and coming in a period of seasonal strength could potentially put $3.05 in play” to start this coming week “should long-range heat trend even more intense into the medium-range.”

That said, a foray to the $3.05 area “would likely be a gift to those seeking short exposure, as we see prices struggle to sustain above the $3 level for any significant amount of time unless we are able to continue seeing near-record cooling demand through the month,” Bespoke said.

In the lead-up to Thursday’s 6.7 cent rally for the front month, weather models added an estimated 8.4 Bcf of demand to EBW Analytics Group’s Week 3 outlook period, CEO Andy Weissman told clients Friday.

The hotter temperature outlook, combined with a bullish storage report for the week, “could provide the most serious test yet of whether resistance can be broken,” Weissman said. After the Energy Information Administration’s weekly storage report came in lower-than-expected Thursday “the July contract made a serious run at breaking resistance at $2.98.

“This effort ultimately failed,” he said. “The combination of hotter weather in Week 3 and a bullish storage miss reignited bullish sentiment. A renewed challenge to resistance at $2.98” could occur early in the week ahead, though “the most likely scenario is that resistance will hold at $3 or lower.”

The Energy Information Administration (EIA) reported a weekly storage injection that came in lower than most estimates and the five-year average, giving further momentum to a natural gas futures market already higher overnight on hotter weather trends.

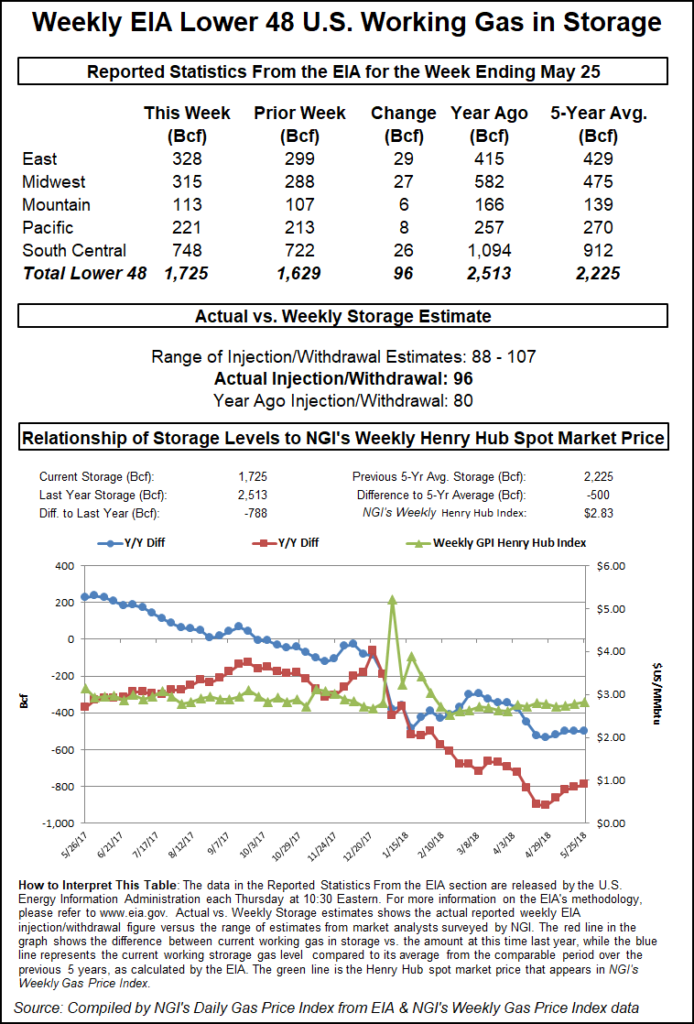

EIA reported a net 96 Bcf injection into Lower 48 gas stocks for the week ending May 25, more than the 80 Bcf build recorded last year but less than the five-year average 97 Bcf injection.

As the figure crossed trading desks at 10:30 a.m. ET Thursday, the July contract — already up more than a nickel overnight with forecasters pointing to a more supportive long-range temperature outlook — jumped another 3.5 cents to just under $2.990. By 11 a.m. ET, July was trading around $2.977, up about 9.2 cents from Wednesday’s settle.

Prior to the report, consensus estimates showed the market looking for a build notably larger than the actual figure.

A Reuters survey of traders and analysts on average had predicted a 102 Bcf injection, with responses ranging from 88 Bcf to 107 Bcf. A Bloomberg survey had produced a median 102 Bcf injection, with responses from 96 Bcf to 107 Bcf. ION Energy had called for a 105 Bcf build, while Price Futures Group had estimated a build of 101 Bcf. The Intercontinental Exchange EIA Financial Weekly Index settled Wednesday at an injection of 104 Bcf.

Bespoke Weather Services said the week’s build came in 6 Bcf below its estimate.

“We see this print as slightly bullish, with both noisy production and burn estimates indicating either burns were a bit more impressive or production recovered less than expected,” Bespoke said following the report’s release. “…We do note that we are still solidly loose to the five-year average, and this print was a touch looser to even 2018 on balance, so with average weather the market has far to fall, but this print confirms we can run on heat.”

Total working gas in underground storage as of May 25 stood at 1,725 Bcf, versus 2,513 Bcf a year ago and five-year average inventories of 2,225 Bcf, according to EIA. Week/week, the year-on-year storage deficit shrank from 804 Bcf to 788 Bcf, while the year-on-five-year deficit increased slightly from 499 Bcf to 500 Bcf, EIA data show.

By region, 29 Bcf was injected in the East, followed by the Midwest, which saw a 27 Bcf build for the week. In the South Central, 26 Bcf was injected, with EIA recording a 9 Bcf build into salt and 18 Bcf into nonsalt. The Pacific saw a build of 8 Bcf, while 6 Bcf was refilled in the Mountain region, according to EIA.

Early indications are that the upcoming EIA report for the week ending June 1 will again see injections fail to eclipse the triple-digit mark, potentially growing deficits in the process.

The Desk’s Early View natural gas storage survey showed respondents on average expecting a 91.5 Bcf build for the period, with a median of 91 Bcf. That’s versus 103 Bcf recorded last year and a five-year average 104 Bcf injection.

As for Thursday’s bullish storage miss, “compared to degree days and normal seasonality a 96 Bcf build appears very slightly tight versus the prior five years by 0.2 Bcf/d,” Genscape Inc. analyst Margaret Jones told clients Friday. “Relative to the previous week, total power generation was up 2 average GWh though thermal generation dropped 1 average GWh.

“Nuclear generation was up almost 3 average GWh, while wind was down 1 average GWh and hydro was up 1 average GWh relative to the previous week,” Jones said. “Gas generation was close to flat w/w with a slight increase of 584 average GWh or an estimated plus-0.1 Bcf/d gas burn w/w.”

Analysts with Tudor, Pickering, Holt & Co. (TPH) noted Friday that warmer-than-normal temperatures have continued to prevent triple-digit storage injections “before new supply comes online.” However, cooling degree days (CDD) surpassing heating degree days (HDD) “at the end of May is consistent with norms.”

While liquefied natural gas exports “remain depressed at around 2.8 Bcf/d, Mexican exports migrated marginally higher w/w and U.S. natural gas production finally breached 80 Bcf/d,” the TPH analysts said. With the Rover Pipeline’s Mainline B cleared for service Thursday “the aforementioned supply ramp (in the Northeast) is imminent.”

In fact, flows on Rover were already starting to increase Friday following FERC’s order, according to Genscape analysts Colette Breshears and Vanessa Witte.

“However, FERC did not authorize Rover to operate the Burgettstown or Majorsville supply laterals, which restricts the addition of new supply to the mainline section,” Breshears and Witte said. “It is not clear if these new supply points are necessary to sustain a higher level of throughput on the pipeline, which Rover had said would increase by an incremental 0.85 Bcf/d if they were authorized in conjunction with the other facilities, or if currently operational receipt points will be able to increase volumes to take advantage of the extra capacity.”

The spot market Friday saw mostly small adjustments heading into the weekend, with notable exceptions being steep declines in the Northeast and some double-digit gains in the West; the NGI National Spot Gas Average eased 3 cents to $2.57/MMBtu.

Three-day deals in the Northeast saw sharp discounts Friday as hotter temperatures to end the week were expected to cool off over the weekend.

Radiant Solutions was calling for above-normal conditions in the region — including highs in the 80s and low-90s from Boston to Washington, DC, Friday — to flip to below-normal by Sunday and Monday, with temperatures averaging in the 50s and 60s.

Algonquin Citygate tumbled 23 cents to $2.48 Friday, while Transco Zone 6 New York fell 50 cents to $2.47. Further upstream in Appalachia, Texas Eastern M2 30 Receipt dropped 11 cents to $2.41.

Deliveries from Columbia Gas (TCO) to Texas Eastern (Tetco) at the Waynesburg interconnect were to be unavailable due to maintenance starting Monday and continuing until Saturday, according to Genscape’s Witte.

“Scheduled deliveries at this location have averaged 266 MMcf/d for the past 14 days,” Witte said. “TCO notified customers in an additional notice that due to this maintenance, the total firm service reduction through ”Clendenin to Waynesburg’ and ”Lone Oak A MA41’ is estimate at around 120 MMcf/d for the duration of the event.”

In the West, a number of points across the Rockies, California and Arizona/Nevada regions gained heading into the weekend amid upstream restrictions from a series of force majeures on the El Paso Natural Gas (EPNG) system.

In California, SoCal Border Average surged 19 cents to $2.64, while in Arizona/Nevada El Paso S. Mainline/N. Baja added 35 cents to $2.86.

EPNG declared force majeures Friday due to issues discovered at its Puckett and Wink compressor stations (CS) in West Texas. At the Puckett CS, the operator said it was “experiencing a failure of equipment associated with Unit 1” that would require capacity through the point to be reduced to zero starting Friday and continuing until further notice.

At the Wink CS, EPNG said it identified an equipment failure “due to purchase power transformer failure” requiring capacity through Wink to be reduced to 200,000 Dth/d until further notice.

These latest restrictions come as an earlier force majeure event has been limiting capacity through EPNG’s Cimarron point to zero due to an anomaly identified on its Line 2000. EPNG told shippers Friday that it tentatively plans to resolve that restriction by Tuesday (June 5).

Further upstream in West Texas, El Paso Permian averaged $1.88, up 2 cents on the day after dropping 17 cents the day before.

A number of Rockies points strengthened Friday. Opal tacked on 9 cents to $2.31, while Kern River added 9 cents to $2.30.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |