E&P | NGI All News Access | NGI The Weekly Gas Market Report

Appalachian Midstream Build-Out Expands as Producers Fill More NGL Barrels

Stronger oil prices are again incentivizing natural gas liquids (NGL) development in Appalachia, and the midstream sector is keeping pace with a slew of gathering and processing projects in the works, as rigs shift back toward wetter portions of the Marcellus and Utica shales.

Since the end of last year, many of the basin’s leading operators have recorded double-digit gains in NGL production. In that time, Appalachian pure-play Antero Resources Corp. proclaimed that it was the nation’s largest NGL producer. Marcellus heavyweight Range Resources Corp. took a seat next to the throne, announcing months later that it too had become one of the nation’s largest NGL producers.

“I think with strong liquids pricing, that does support moving back into some of those wetter regions. That said, one thing that may kind of counterbalance that is wet gas wells generally have lower productivity rates, lower [initial production] rates than dry gas wells ” said senior analyst Marissa Anderson, of BTU Analytics, during a recent interview. “We do have a lot of new pipeline takeaway projects slated to come online. So, in the interim, there is that kind of trade off with producers needing to fill that gas takeaway capacity.”

In the years after oil prices crashed in 2014, many of Appalachia’s producers retreated almost exclusively to their dry natural gas acreage, where low breakeven prices and gushing wells were used to defend against the downturn.

To be sure, natural gas is still king in the Northeast. The Energy Information Administration expects the Appalachian Basin to lead all other major onshore plays this month with an estimated 28.15 Bcf/d of production, while expectations for the region to drive the bulk of the nation’s gas growth over the next decade have not waned.

But with oil recently coming off three year highs and with key infrastructure projects, such as Mariner East (ME) 2, on tap to move more NGLs out of the basin, the outlook for liquids has improved for the first time in a long time. And as dry gas production continues its upward climb to fill the 6.3 Bcf/d of new Appalachian pipeline capacity scheduled for service in 2018, pricing pressure remains.

Anderson said that when her firm looked at breakevens earlier this year, “the relative economics between wet and dry gas wells were becoming as, or more attractive than dry gas wells in some cases.” Overall, BTU estimates that Appalachian NGL production will grow by 80,000 b/d in 2018 to reach an exit rate of 680,000 b/d.

The drilled but uncompleted well inventory that operators have relied on in recent years is also dwindling. With producers like Antero, Range, Southwestern Energy Co. and Eclipse Resources Corp., to name a few, guiding for significant increases in liquids production, new wells are also being drilled to meet those forecasts.

Little NGLs make their way east out of the basin via pipeline, leaving everything else a path to basically move west, or by rail or truck, said Andy Ptacek, who oversees research at East Daley Capital Advisors Inc. That makes Energy Transfer Partners LP’s (ETP) 275,000 b/d ME 2 pipeline, which has repeatedly been delayed, even more crucial.

“I think we’ve seen a lot of rigs move to that wetter acreage, mostly through last year in anticipation of ME 2 coming online,” Ptacek said.

Just In Time

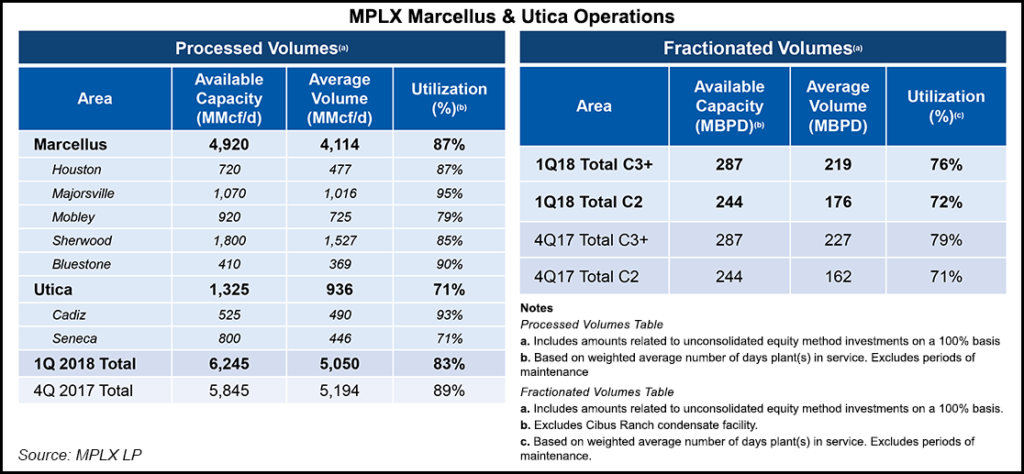

Appalachia’s largest processor and fractionator, MPLX LP, is seeing a similar pattern. It’s working to stay ahead of the projected growth with expansions planned this year in Ohio, Pennsylvania and West Virginia.

“We are seeing some movement from dry to wet as prices continue to increase, and you’re seeing” propane and butane prices “continually move back up with crude,” said Michael Hennigan, president of MPLX’s general partner, last month during a call with financial analysts to discuss first quarter results. “I think you’re seeing a little bit of both. We’re bullish. That’s why we’ve had the plans we’ve had in place that we’re going to progress a pretty good organic growth program up in the Northeast.”

MPLX has budgeted $2.2 billion in growth capital this year, with 65% of that slated to be spent in the Marcellus and Utica shales, where the bulk of its gathering, processing and fractionation business is located after it acquired subsidiary MarkWest Energy Partners LP in 2015.

Some of the company’s projects were on hold during the commodities downturn, such as its Harmon Creek facility, a new processing and fractionation plant in Washington County, PA, that’s expected to come online in the fourth quarter. MarkWest already has, or plans to bring online, another five processing plants by the end of the year and two more fractionation plants in the basin.

Those additions, spokesman Jamal Kheiry said, “are consistent with our strategy of constructing plants on a just-in-time basis to serve our producer/customer needs.”

A large part of MPLX’s growth is due to a 50/50 joint venture (JV) that Antero Midstream Partners LP and MarkWest entered early last year to expand the Sherwood Complex in Doddridge County, WV, and build a new facility about three miles west. In order to better serve Antero Resources’ needs, the JV contemplated the construction of up to 11 processing facilities. Three new processing trains have already been installed at Sherwood, one of the company’s largest facilities, while two more are under construction there and expected to be complete by the end of the year.

Kheiry said civil construction is just beginning at the company’s new Smithburg Complex, where up to six plants could be built as part of the JV.

All the activity in the area has been noticeable, especially since the rest of the oil and gas industry has been ramping its operations over the last year or so as the commodity outlook has improved, said Gregory Robinson, president of the Doddridge County Commission.

“Doddridge County has traditionally been a very rural county, with little or no industry. It’s in the process of being changed,” he told NGI’s Shale Daily. “I live about 13 miles outside of the county seat in the country, and at times, when I make that 13 mile trip in to town, I get stopped three, maybe four different places because of pipeline construction or construction on a compressor station and the other stuff that comes with this kind of activity.”

North to South

That’s true outside of Doddridge County too. MPLX is not the only one with expansions underway to meet the logistical demands of growing liquids and dry gas production. Williams spokesman Joe Horvath said the company’s Ohio River Supply Hub, which spans West Virginia, southwest Pennsylvania and a small portion of Ohio, is being expanded, particularly in response to rising liquids volumes.

The company is currently constructing two new processing trains at its Oak Grove facility in Marshall County, WV. The additions will triple the plant’s capacity to 600 MMcf/d, with room left to expand up to 2 Bcf/d. The projects, Horvath said, are expected to be complete next year and are “supported by long-term, fee-based agreements and volumetric commitments.”

He added that Williams is also constructing a new propane-plus pipeline from the Oak Grove complex to its jointly owned Utica East Ohio fractionator and Harrison Hub in Harrison County, OH, which is operated by Momentum Midstream LLC.

“This will improve natural gas liquids infrastructure flexibility and Oak Grove’s access to new and existing markets,” Horvath said, adding that the company’’s Susquehanna Supply Hub in northeast Pennsylvania has also been expanded to better accommodate its Atlantic Sunrise pipeline project.

Similarly, Blue Racer Midstream LLC, a joint venture between Caiman Energy II LLC and Dominion Energy Inc., has been growing. Spokeswoman Casey Nikoloric said the company recently completed its facilities to deliver propane and butane to ME 2.

At its Natrium Complex in Marshall County, WV, Blue Racer is building a third 200 MMcf/d cryogenic processing plant that would boost the facility’s capacity to about 650 MMcf/d. The company is also building five new compressor stations in the field to add supply and has several gathering projects underway to connect multiple well pads, Nikoloric said.

NGL Ceiling

How much NGL production grows between this year and next largely depends on the in-service date of ME 2, analysts said. The pipeline, which is now expected to be in-service in the third quarter, would move ethane, butane and propane from processing facilities in Ohio, Pennsylvania and West Virginia to the Marcus Hook Industrial Complex near Philadelphia for domestic and international distribution. Currently, the 70,000 b/d ME 1 pipeline is the only system moving ethane and propane east to Marcus Hook.

Complicating matters, however, was an order from Pennsylvania regulators last month that again halted ME 1 operations. The state granted an emergency order that requires ETP to fulfill a list of obligations before the pipeline can enter service. What’s more, construction on ME 2 and 2X was also partially suspended in response to the complaint filed by state Sen. Andrew Dinniman over safety concerns.

It’s unclear when the suspension might be lifted, raising questions about ME 2’s ultimate in-service and when ME 1 might begin moving NGLs again.

The suspension could create a ceiling for NGL production in the meantime, East Daley’s Ptacek said. Producers might not ramp liquids volumes as quickly before ME 2 comes online. He added that with few outlets for things like propane and less in-basin demand during the hotter summer months, prices could again slump.

But while a lack of available pipeline capacity could hike transportation costs and dent netbacks for some producers, Anderson simply said that higher NGL prices could ultimately trump those concerns and help sustain liquids production in the meantime.

“We’ve stated that we don’t see any impact throughout the remainder of the year if it were delayed,” Hennigan said of ME 2. “Obviously, at some point, if it continues to be delayed, we’d have to make additional plans, but right now, we’re assuming that Mariner will be coming up and it’ll be a major part of the NGL takeaway up in the Northeast.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |