July Natural Gas Ends Week Marginally Lower; Supply Points Increase as Rover Enters Service

In a week marked by volatile bidweek trading, a surprise bullish storage report and intense heat in parts of the country, natural gas forwards markets ended the May 25-31 time period a mere penny lower on average, according to NGI’s Forward Look.

It was a short week thanks to the Memorial Day holiday, and Tuesday’s return to trading action saw the Nymex June contract roll off the board some 6.4 cents lower at $2.875 as weak holiday demand and power losses resulting from Tropical Storm Alberto pressured the market. Despite the actual day/day loss for the expiring June contract, the prompt month’s closing price was 5.4 cents higher than May’s expiry, marking the fourth consecutive increase for a prompt month expiry.

Stronger production also factored into Tuesday’s sell-off, but as Mobius Risk Group analysts noted, month-end production data is almost always strong, and holiday weekend demand is almost always weak. “As such, neither factor should independently or collectively be extrapolated beyond mid-week.”

Wednesday’s trading session was largely a snoozefest before Thursday brought about a surprise storage report that provided market bulls enough adrenaline to push gas prices to within arm’s reach of $3. The July contract settled Thursday at $2.952, an increase of 6.7 cents day/day.

The Energy Information Administration reported a 96 Bcf build into storage inventories for the week ending May 25, notably lower than market expectations. A Reuters survey of traders and analysts on average had predicted a 102 Bcf injection, with responses ranging from 88 Bcf to 107 Bcf. A Bloomberg survey had produced a median 102 Bcf injection, with responses from 96 Bcf to 107 Bcf. ION Energy had called for a 105 Bcf build, while Price Futures Group had estimated a build of 101 Bcf. The Intercontinental Exchange EIA Financial Weekly Index settled Wednesday at an injection of 104 Bcf.

Bespoke Weather Services said the week’s build came in 6 Bcf below its estimate. “We see this print as slightly bullish, with both noisy production and burn estimates indicating either burns were a bit more impressive or production recovered less than expected,” Bespoke said following the report’s release.

The 96 Bcf build was more than the 80 Bcf build recorded last year but less than the five-year average 97 Bcf injection. Total working gas in underground storage as of May 25 stood at 1,725 Bcf, versus 2,513 Bcf a year ago and five-year average inventories of 2,225 Bcf, according to EIA. Week/week, the year-on-year storage deficit shrank from 804 Bcf to 788 Bcf, while the year-on-five-year deficit increased slightly from 499 Bcf to 500 Bcf.

Mobius noted that despite the tightening storage deficit to year-ago levels, there remains a sizable gap that could easily expand with a warmer-than-normal stretch of Southeastern U.S. temperatures. For reference, the Houston-based firm pointed to the first four days of June, during which temperatures are forecast well above normal along the Gulf Coast. Other than a brief three-day cooldown from June 5-7, “key power consuming markets near Henry Hub will likely see midsummer-like burn,” Mobius said.

With regional natural gas prices still favoring gas-fired power dispatch, it will be interesting to see how daily storage injection data compares to late May observations, Mobius said. “When temperatures break the triple-digit barrier it is often less efficient ”peakers’ that turn on to satisfy electric load, and thus, there is a non-linear change in natural gas consumption.”

Meanwhile, the latest weather models were mixed, with the European model hotter trending for the second week of June, according to NatGasWeather. The data still favors a hot and strong ridge over Texas and the southern Plains during the first full week of June, then expanding into the Midwest and Southeast the second week.

“Under this hot upper ridge, demand will be stronger than normal for the second week of June,” with highs of upper 80s to 100s dominating much of the United States besides the East and Northwest, the weather forecaster said. It’s likely the ridge weakens some around June 14-17, but should still cover a large portion of the country with very warm conditions, it said.

The sweltering conditions come as production continues to grow and is expected to increase further once pipeline additions like Energy Transfer Partners LP’s Rover are in full service. FERC on Thursday, partially granting urgent requests submitted by Rover Pipeline LLC over the past week, authorized full service on the 3.25 Bcf/d, 713-mile project’s Mainline B, along with its Supply Connector B.

The order paves the way for higher throughput on the highly anticipated Appalachian takeaway expansion, although Federal Energy Regulatory Commission staff said Thursday that they are still evaluating authorizations for a pair of completed supply laterals.

Genscape Inc. analyst Colette Breshears said it is not clear if these new supply points are necessary to sustain a higher level of throughput on the pipeline, which Rover had said would increase by an incremental .85 Bcf/d if they were authorized in conjunction with the other facilities, or if currently operational receipt points will be able to increase volumes to take advantage of the extra capacity.

But even with rampant production growth, NatGasWeather said it doesn’t expect to see signs of storage deficits being reduced for quite some time. Thus, hefty deficits will remain near or slightly more than -500 Bcf through the next three storage reports, then uncertain after, “but likely not improving much, if at all.”

But EBW Analytics’ Andy Weissman said the market is already signaling that lower storage targets are acceptable. During a webinar Thursday, the industry expert said that in early April, the market was projecting end-of-November storage inventories near 3.8 Tcf. Now, those projections are down to around 3.6 Tcf, and Weissman expects projections to fall even further. EBW is forecasting the most likely scenario for mid-November storage is for inventories to be around 3,450 Bcf.

Supply Points Gain As Rover Enters Service

A look at overall market behavior reflects most pricing hubs corresponding closely with Nymex futures, which saw the July contract slip a penny from May 25-31 to reach $2.952, August drop 2 cents to $2.965, the balance of summer (August-October) shed 2 cents to $2.95 and the winter 2018-2019 fall 2 cents to $3.08.

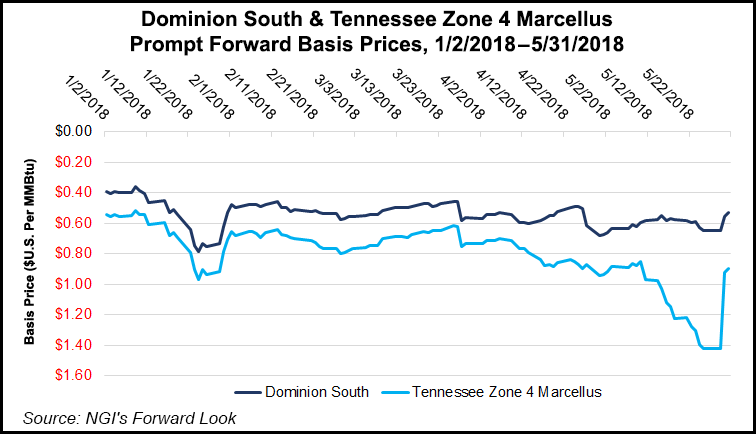

A couple of notable exceptions were supply area points that put up increases at the front of the curve through the remainder of summer, according to Forward Look. At Dominion South, July rose 7 cents to $2.424, August climbed a nickel to $2.445 and the balance of summer (August-October) edged up 2 cents to $2.38. The winter 2018-2019 strip was down a penny to $2.64.

At Tennessee zone 4 Marcellus, July climbed 7 cents to $2.05, August jumped 13 cents to $2.151 and the balance of summer (August-October) picked up 5 cents to hit $2.16. The winter 2018-2019 slipped a penny to $2.43.

The boost in supply region points comes as evening cycle nominations show Rover receipts topping at 2,050 MMcf/d, a 390 MMcf/d day/day increase, while deliveries are 407 MMcf/d below normal at 1,228 MMcf/d into ANR and Panhandle Eastern pipelines in Defiance, OH, according to Genscape. This difference has been made up with nominations to Vector’s new Rover location, which is showing Vector receiving 737 MMcf/d.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |